Management Discussion

and Analysis

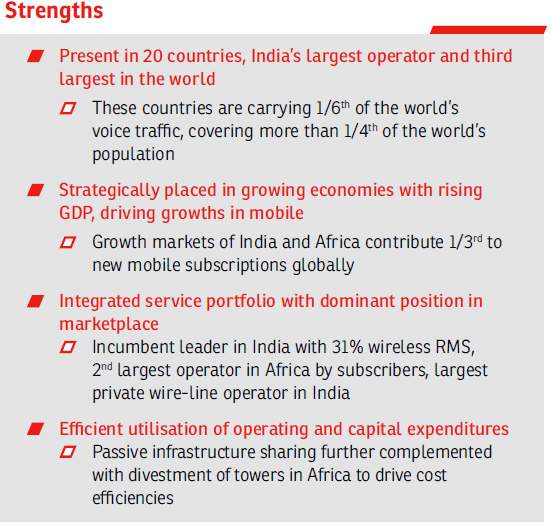

At Bharti Airtel, our journey so far has been exciting. In July, 2014, we crossed the important milestone of 300 Mn customers. The last 100 Mn additions happened in less than two years. We are committed to further bolster our market leadership across geographies. Telecom is transforming, and data-centricity is playing a critical role in it. We launched several industry-first innovations to drive data uptake during the year through various offerings and partnerships. We have steadily enhanced our investments in Africa, and continue to believe in the continent’s tremendous growth potential. We are well positioned to derive benefits from increasing tele-density in many countries, which have low mobile and data penetration.

Our endeavour is to maintain the optimum capital structure at all times and maintain and solidify our balance sheet’s strength. Despite being at very comfortable levels of leverage, deleveraging remains on track following initiatives, such as equity infusion, value unlocking through our investee companies and cash-generation through hiving off of our African tower infrastructure assets. The investment grade ratings awarded and reaffirmed by international credit rating agencies reflect the inherent strengths of our business model, its robustness and scalability. We continue to be committed to creating value for all stakeholders, while ensuring highest standards of corporate governance.

Our brand leadership, strong financial performance and sound governance will translate into enhanced stakeholder confidence. This, in turn, will ensure long-term sustainability and value generation for your business.

Global Review

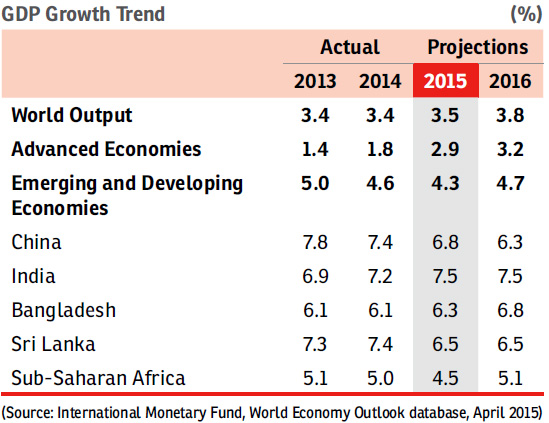

Financial year 2014-15 was marked by the collapse in crude prices and other commodities, while legacy risks continued to play their part in slow global growth.

Many economic adjustments that these events have triggered will continue to materialise in the quarters ahead. On the one hand, there is visible expansion in the US economy, while on the other, we are witnessing weak and uneven acceleration in some pockets of Europe, though largely macro-economic indicators continue to remain sluggish. There has been a decoupling in global growth – while the US is talking about starting monetary tightening, in markets of Europe and even China – which contributed largely to global growth – are continuing to talk about easing. The collapse in oil prices will effectively provide a tax cut for consumers globally. Growth in China has been sluggish, amid slowdown in the construction and manufacturing sectors. The world’s second largest economy is now rebalancing itself from an investment and export-led model to a consumption-led growth model.

In the near term, cheap oil adds to deflationary pressures, enabling central banks to maintain their ultra-supportive stance. However, the divergent global growth dynamics will be mirrored in central bank policy. Persistent concerns over low inflation in the Eurozone and Japan may see the European Central Bank (ECB) and Bank of Japan (BoJ) continue to ease policy. In contrast, the Fed, buoyed by a strengthening economy and rising wages, may raise rates. Monetary policy will, however, remain accommodative, with rates remaining low relative to previous cycles. For the emerging economies, inflation levels have also broadly trended lower with a few exceptions, and a fall in commodity prices will support this trajectory. The softening of commodity prices, which is likely to sustain for some time, is expected to weigh on traditional commodity exporters as opposed to net importers. Net energy importers, such as India, Turkey, the Philippines are expected to gain at the expense of countries, such as Brazil, Indonesia, Russia and the Gulf countries.

Indian Economy

India is back on track as an emerging powerhouse of Asia and the world. Inflation has largely been range bound during the course of the year, building a strong case for a more balanced monetary policy stance. The collapse of the global commodity prices has reduced stress on twin deficits and inflation, boosting consumer demand at the same time. These macro tailwinds are facilitating a gradual recovery with stable exchange rates, resulting in increased investor appetite and capital flows into the country. Asset prices are thus buoyant, with Indian equity indices near all-time highs and among the best performing in the world.

Certain lead indicators, also suggest that the headwinds buffeting India’s economy seem to be easing at the margin, as some of the bottlenecks in key industries are being removed. Noteworthy is the Government’s focus on infrastructure investments, and this is expected to strengthen India’s economic growth, going forward. Telecom is also expected to play a significant role in implementing the Government’s Digital India vision.

India’s GDP growth during FY 2014-15 is estimated at 7.4% under the new method of computing national accounts [Source: CSO]. The economic growth rate has the potential to overtake that of China in the foreseeable future, if legacy risks do not derail growth. A key driver of India’s macro-economic growth will be the digital consumer as the country’s total internet user base is expected to exceed 350 Mn in the near future. Thus India’s future growth story will be driven by two important trajectories: the positive macro-economic development and the acceleration provided by the internet to the aspiring young population.

Prospects in Africa

Africa is now widely considered as the sweet spot of opportunity, where investments in education, employment, healthcare and critical infrastructure can help elevate people’s lives. Not only is the region blessed with abundant and diverse resources, both natural and human, it has one of the world’s youngest populations brimming with aspirations for a better life. However, it still has a long way to go to realise its potential. Africa clearly can contribute significantly to global growth, provided Governments focus on sustained reforms to facilitate infrastructure creation, education and skill building, employment opportunities, entrepreneurships and socio-economic stability.

Real GDP growth in Sub-Saharan Africa has been projected by the IMF to hover around 5% annually for the next two years. Foreign direct investment into the region is targeting infrastructure sectors, as well as business services, transport and manufacturing. In 2014, the inflows into the region, excluding South Africa rose by 5% over the previous year to a projected USD 35 Bn. In fact, even the intra-Africa investments’ share of cross border Greenfield foreign direct investment rose to 18% from 10% from 2004 to 2009.

Over the last fiscal year, in the backdrop of falling oil and commodity prices, challenges with oil production, planned fiscal consolidation, resultant devaluation of most African currencies, along with security and Ebola outbreak concerns, there were downward revisions in growth forecasts. These challenges have led to adjustments in Government spends and customer wallets. However, following the period of economic adjustments, these countries are likely to elevate to a higher growth trajectory.

South Asian Economies

With regaining political stability and with a renewed focus on growth, Bangladesh is estimated to have grown its GDP by 6.1% in 2014. The country’s economy is expected to accelerate its growth to 6.3% in 2015. Remittances are expected to finance higher domestic consumption, while investments, especially in infrastructure will support strong long-term aggregate demand. Sri Lanka too seems to have recovered from the turmoil witnessed in the past few years, and has stepped up its efforts to attract foreign investments, improve infrastructure and promote all-round socio-economic development. The Sri Lankan economy is thus expected to continue its strong growth, at 6.5% in 2015, albeit marginally lower than the estimate of 7.4% in the past fiscal.

Megatrends that drive the Company’s Business

India’s internet users have risen considerably from 50 Mn in 2007 to 100 Mn in 2010 and more than 300 Mn in 2014, with close to 60% users accessing internet via mobile, making India the world’s second-largest internet market (Source: The Internet & Mobile Association of India (IAMAI)). Increasingly, first-time users are coming online via mobiles, leapfrogging the desktop era. The time taken to add incremental 100 Mn internet users has shrunk from 10 years in the previous cycle to under two now.

India enjoys favourable demographics for internet penetration than many countries of the world; around 75% of its online population are aged between 15 and 34.

India is a lucrative market for global and domestic smartphone manufacturers. Smartphone shipments have doubled year-on-year, which led the total established base to reach 150 Mn in 2014. Enhanced focus on manufacturing affordable handsets with indigenous technology will further spur mobile telephony. At the same time, it will widen and deepen the internet user base.

Growth in smartphones, therefore, would lead to a significant rise in mobile data usage, which, as per estimates is likely to grow 13 fold in the next five years. As per these estimates, mobile data traffic will grow thrice as fast as fixed IP traffic between 2014 and 2019 and therefore, is expected to account for 28% of the total internet traffic by 2019, up from 9% in 2014 (Source: Cisco- VNI Global data traffic forecast).

Demographic dividend and interest penetration including internet of things are transforming the lives of 1.25 Bn of people as they rely on it for various purposes from online shopping, entertainment, education to healthcare, payment mechanisms and so on. Such a scenario is driving mobile commerce.

Hence, a converged opportunity exists through voice secularity, data uptake and new services in the country across technologies as consumer needs are diversified across the spectrum of offerings. Different consumers have widely varying consumption patterns from being first-time users to affluent data-hungry consumers – providing telecom companies a well balanced portfolio.

Moreover, India’s Government is committed to usher in a ‘Digital India’ and bring along a transformative impact on every citizen through the internet across nine principal areas. These are: broadband highways, universal access to mobile connectivity, public internet access programme, e-governance, e-delivery of services, information for all, electronics manufacturing, IT for jobs and early harvest programme. Your Company is committed towards assisting in furthering this agenda of the Government in a manner that creates a win-win for all stakeholders.

The proposed telecom policy environment through M&A rules, spectrum sharing guidelines and 20-year spectrum positions for the telecom operators emerging post the recently concluded auctions not only provide for business certainty, but also encourage industry consolidation and robust growth.

Africa, with a median population of less than 20 years, is on the cusp of a mobile data boom as 3G and 4G deployments gather scale with more affordable handsets available.

There exists significant headroom for Sub-Saharan Region to further its mobile penetration with another 300 Mn subscribers additions predicted between 2014 and 2019, as per Ericsson.

Mobile money services are revolutionising the payments landscape across Africa. It has provided consumers with cheaper access to finances due to a reduced need to travel and lower overall cost of mobile phone for financial transactions. Co-ordinated efforts by mobile operators, telecom regulators, central banks, commercial banks, merchants and application developers are expected to drive rapid growth of mobile money usage in the region.

Wordwide digital literacy is considered a key aspect of contemporary citizenship to enable individuals to fully participate in ordinary societal and economic activities, besides being part of the democratic process. In fact, the need for digital literacy has triggered an urgent need for communities to close gaps in literacy rates. On the one hand, mobile habits and digital familiarity are leading to enhanced literacy; on the other hand, the younger generation with more command over digital tools has become the ambassador for literacy in the relatively under-developed parts of the world. This ‘reverse mentoring’ is indeed a unique phenomenon in the history of mankind.

Indian Telecom Sector

India’s total customer base stood at 996.49 Mn with a tele-density of 79.38%, as on March 31, 2015, having grown from a base of 933 Mn and tele-density of 75.23% last year. The urban tele-density stood at 148.61%, whereas the rural tele-density stood at 48.37%, as on March 2015. India’s telecom sector has grown phenomenally, with the country’s total customer base second only to China.

The wire-line customer base continued to decline from 28.49 Mn, as at the end of March 31, 2014, to 26.59 Mn at the end of March 31, 2015, representing a penetration of just 2.12%. The scale of the mobile opportunity in India is therefore immense.

Among the service areas excluding metros, Tamil Nadu has the highest tele-density (117.52%), followed by Himachal Pradesh (114.52%), Punjab (103.78%), Karnataka (97.52%), Gujarat (95.61%), Kerala (95.57%) and Maharashtra (93.41%). Among the three metros, Delhi tops with 237.94% teledensity. On the other hand, the service areas, such as Bihar (51.17%), Assam (53.95%), Madhya Pradesh (60.36%), Uttar Pradesh (60.51%) and Odisha (66.85%) have comparatively low tele-density.

Rural penetration has been increasing and with penetration levels still below 50%, it represents an opportunity for driving higher growth, as there is still a significant untapped market potential. With urban tele-density nearing 150%, internet penetration and experience will be the key drivers of growth in urban areas.

During the year, the Company continued to work towards improving data connectivity, and launched several industry-first initiatives to contribute to nation’s digital inclusion agenda. Lowering smartphone prices, coupled with the proliferation of 2.5G EDGE/ 3G/ 4G services in India, are likely to reduce connectivity costs and overcome the challenge of limited fixed-line connections.

The Company is privileged to play a lead role in the ‘Digital India’ programme announced by the Government of India. There are nine pillars of this programme, split across three clusters – creation of digital infrastructure, delivering services digitally and digital literacy. This programme will benefit all the citizens of India, as well as the administration. A time-bound plan for the completion in 2019 is in place, and its progress will be monitored by an inter-ministerial ‘Digital India Advisory Group’. It is, however, significant to note that for a successful implementation of this programme, there is a need for several enablers – additional wireless spectrum, level-playing field for telecom service providers and OTT players, state government and local authority support and telecom policy stability. The Company commits itself to capex investments, technology upgradation, servicing capability improvements and a deep rural thrust. These strategies will provide an impetus to the ‘Digital India’ programme.

With the recent acquisition of spectrum, Airtel is well positioned to enable data growth, and has secured a clear roadmap for the next 20 years. Cumulatively, since 2010 the Company has invested ` 681 Bn in spectrum through the auctions route. These investments will exert a downward pressure on the return on capital employed, which is already in single digits, hence it is imperative to generate healthy revenue growth. This scenario will enable the Company to sustain capex investments and support its growing customer base and usage.

African Telecom Sector

The economy of the continent faced headwinds in the past year, which impacted the growth of various countries in Africa. The year saw a sharp decline in crude oil and other commodity prices, impacting several African economies, such as Nigeria, Tchad, Congo B, Gabon, DRC and Zambia. Africa being a commodity-heavy continent, witnessed sharp depreciation in currencies across various countries. This has also caused some changes in regulations, such as a change in the Nigerian regulation requiring dollars to be purchased in the open market for import payments at higher rates than the Central Bank auction rates available earlier. The revenue-weighted currency depreciation versus the US Dollar across 17 countries in Africa over the last 12 months (exit March 31 rates) has been 22.3%, primarily caused by depreciation in Ghana Cedi by 42.3%, Nigerian Naira by 28.4% and CFA by 28.3%. In terms of the 12-month average rates, the revenue-weighted Y-o-Y currency depreciation has been 8.2%, primarily caused by depreciation in Ghana Cedi by 49.1%, Zambian Kwacha by 16.8%, Malawi Kwacha by 12.3%, Nigerian Naira by 8.5% and CFA by 6.0%. Further, events such as the outbreak of Ebola in West Africa presented significant challenges to some countries; however, with support from the UN and developed countries, the situation has since returned to near normalcy.

However, the African continent continues to present great opportunities for growth in the Telecom sector and connecting the billion-plus population in the continent. Data and mobile money present significant opportunities for explosive growth in the continent and with the increasing adoption of smartphones, this trend is set to continue. The launch of 4G/ LTE technologies also provides a great boost for data uptake.

Development in Regulations

The year saw several regulatory changes and developments for both the industry and the Company. The significant regulatory changes are as follows:

India

- Spectrum Auction: In March, 2015, the Department of

Telecommunications concluded the auction process for

800 MHz, 900 MHz, 1800 MHz and 2100 MHz spectrum.

Of the 470.75 MHz that was put up for auction in 22

circles, 418.05 MHz was sold for a consideration of

` 1,098,749 Mn. The licences would be valid for a period of 20 years from the date of allotment. Airtel won 111.6 MHz spectrum for a consideration of ` 291,291 Mn. It may be recalled that in the previous year, Airtel won 115 MHz spectrum for a consideration of ` 184,386 Mn. Cumulative spectrum investments made by the Company since 2010 are ` 681 Bn. - New Interconnect Usage Charges: In February 2015, the

sector regulator, Telecom Regulatory Authority of India

(TRAI) came out with final regulation on termination

rates for the industry effective from March 1, 2015. Mobile

termination charge has been reduced from

` 0.20 per min to ` 0.14 per min. Fixed line termination rates have been reduced from ` 0.20 per min to zero. Termination charge on international incoming calls has been increased from ` 0.40 per min to ` 0.53 per min. The cap on carriage charge has been reduced from ` 0.65 per min to ` 0.35 per min. - TRAI proposes new ceiling for roaming tariff: TRAI has reduced ceiling tariffs for national roaming calls by 20% to 40% and SMS by 75%, effective from May 1, 2015. The ceiling for outgoing local voice call has been reduced from ` 1 per min to ` 0.80 per min. Outgoing STD ceiling has been reduced from ` 1.5 per min to ` 1.15 per min. Incoming call ceiling has been reduced from ` 0.75 per min to ` 0.45 per min. Local SMS ceiling has been reduced from ` 1 per sms to ` 0.25 per sms. Revised national SMS ceiling is ` 0.38 per sms, compared to existing ceiling of ` 1.5 per sms. There will be a reduction of roaming prices in the near future, which should encourage more roaming usage, since the travelling population is growing.

- TRAI recommendations on ’Definition of Revenue Base (AGR) for the reckoning of License Fee and SUC’: On January 6, 2015, TRAI issued its recommendations on Definition of Revenue Base (AGR) for the reckoning of Licence Fee (LF) and SUC. LF and Spectrum Usage Charges (SUC) should continue to be computed, based on the Adjusted Gross Revenue (AGR), with clearly defined inclusions and exclusions. A new concept of Applicable Gross Revenue (ApGR) has been introduced. TRAI has also recommended that the share of USO levy in LF should be reduced from the present 5% to 3% of AGR. With this reduction, the applicable uniform rate of LF would become 6% (from the present 8%) of AGR. Intra-circle roaming charges should not be allowed as deduction for the purpose of computation of LF and SUC. The above recommendations are under the consideration of the DoT.

- TRAI amendment to Quality of Service (QoS) of Broadband Service Regulations: On June 25, 2014, TRAI notified the QoS of Broadband Service Regulations, and effectively increased the minimum speed, qualifying an internet connection as a ‘broadband connection’. As per the notification, ’Broadband is a data connection that is able to support interactive services including Internet Access and has the capability of the minimum download speed of 512 kbps to an individual subscriber from the point of presence (POP) of the service provider intending to provide Broadband Service‘. This definition now overrides the previously defined minimum download speed of 256 kbps.

- Judgement on TDSAT: Post migration to the revenue sharing regime since 1999, a large number of disputes between operators and the DoT arose on the issue of ‘Adjusted Gross Revenue’ (AGR) definition. In August 2007, the Telecom Disputes and Settlement Tribunal (TDSAT) ruled that license fees should be levied only on revenues arising out of telecom activities, and accordingly settle various heads of revenue, which shall be included or excluded in the AGR. The DoT appealed against this judgement before the Hon’ble Supreme Court, who held in October 2011, that TDSAT cannot decide on the terms and conditions of the license agreement, but can only decide on the interpretation of the license. Since then, several operators including the Company had approached TDSAT on the issue of AGR definition. The Company has also obtained stays from the Kerala and Tripura High Courts on DoT demands for additional licence fees under various heads. In its judgement dated April 23, 2015, TDSAT has once again settled various inclusions and exclusions in the definition of AGR, and also directed the DoT to rework on licence fees payable by the operators for the years in question.

Africa

- Burkina Faso: The Regulator is contemplating cost plus based pricing. This will negatively impact business freedom to price competitively. The Regulator is considering imposition of fixed-line obligations on operators; efforts to persuade the Regulator to accept wireless fixed services instead of wireline fixed services are being made, in view of the huge financial outlay that will be required for cabling and wiring.

- Gabon: The Regulator issued a regulation with higher floor prices applicable only to Airtel; this asymmetry was in place for three years till December 31, 2014. The Regulator has also asked all operators to comply with a new requirement of an analytical accounting system, which must be able to provide the cost of the network and the specific and non-specific cost of interconnect and leased lines. The Regulator has also contracted a consultant to develop an interconnect model specific to Gabon, using the World Bank template.

- Ghana: Telecom chamber has commissioned Pricewaterhouse Coopers (PwC) to undertake a study on total tax contribution of telecom operators to Ghana’s GDP. The Government announced a policy to grant four new types of licenses: Interconnect Clearing House, International Wholesale license, Unified Access Service License and Mobile Virtual Network Operations (MVNO) license. The Government also issued a directive prohibiting all off-net promotions priced below interconnect cost, effective from September 30, 2014.

- Kenya: Interconnect rates have dropped from KES 1.15 to KES 0.99 per minute. The Government has reduced tax payable by telecom companies from 33% to 30%. There is one player with a dominant share, and the rest of the industry is of the opinion that Government should declare it as dominant and encourage more competitive play among existing operators for the benefit of customers. The Competition Authority finalised a settlement with the dominant competitor, which includes unlocking exclusivity of mobile money outlets.

- Niger: The Government is enforcing a unique international gateway, which will have a detrimental impact on the industry.

- Nigeria: Licens es are coming up for renewal in August 2015, and the industry is of opinion that the automatic licence renewal period should be for a longer period of 10-20 years, instead of five years. The Nigerian Communications Commission (NCC) has approved retention of floor price at Nigerian Naira 6.40 per minute for both on-net and off-net mobile voice calls.

- Rwanda: 4G services were launched in Rwanda by single wholesale network consortium led by Korean Telecom. Operators can provide 4G/LTE services as MVNO to the consortium. Consequently, Airtel has commenced 4G/LTE services as a MVNO.

- Sierra Leone: The Government is contemplating an increase in license fee – which may increase the payout of operators by eight times. The justification of such increase is not yet clear and industry is working with the Government to annul this increase.

- Tanzania: Currently, the excise duty on Telecom Services is 17.5% and the industry has represented that it should be harmonised at 12% like other East African countries. As regards new entrants, the industry is of an opinion that there should be a level playing field with existing operators. The Regulator has prepared and distributed a Memorandum of Understanding (MoU) on implementation of MNP; operators have requested for a detailed discussion on the same. The Regulator has proposed new QoS requirements, which are under discussion by the industry. The industry is currently representing against a draft regulation issued in 2014 that requires operators to list a portion of their shares; the most contentious issue is a proposal in the draft regulation to have local shareholders own at least 35%.

- Tchad: The industry has been requesting the Government to improve the index of ‘ease of doing business’ in Tchad, especially following several unjustified and frivolous tax demands that were levied on the industry, which caused enormous pressure on operators, besides unnecessary burden of litigation.

- Zambia: The Government is conducting a consultation for introducing a 4th operator–the industry has represented that this would fragment the sector and affect scale and economies of existing operators. The Lusaka Stock Exchange’s (LUSE) enforcement of a minimum 10% local shareholding is being contested by the operators.

- East Africa: The East African Governments initiated a project to ease doing business, enhance regional integration and avoid bill shock of roamers, and decided the following during their meeting in Rwanda: (i) Originating and terminating between different member states in the EAC region is exempt from surcharges on International Incoming Traffic (SIIT) (ii) Regional roaming retail tariff is capped at USD 0.10 per minute on a per second billing arrangement (iii) Regional roaming retail rate inclusive of the Inter-Operator Tariffs (IOT) for the EAC region is capped at USD 0.07 per minute (iv) There shall be no charges for receiving calls, while roaming for traffic originating and terminating between different member states in the EAC region (v) The prevailing local tariff rates in the visited country shall apply to in-bound roamers (non-discrimination between in-bound roamers and subscribers of visited networks). Consequently, Kenya, Rwanda, Uganda and South Sudan have mutually agreed to adopt a regional telecommunications framework for ’One-Network-Area’.

- Others: Penalties on quality of service are inconsistent and many times frivolous. This is causing enormous burden on operators across countries. In addition, there are a lot of challenges with respect to KYC. The telecom industry is of opinion that the Governments need to act as an equal partner, especially since there are no Government issued ID cards in many countries.

- GSMA: At the Africa CEO Roundtable, the participants

suggested that the GSMA and the Task Force set out

a roadmap on digital inclusion/rural access, aimed at

developing a more positive narrative on rural coverage.

GSMA Africa team met with several Government

delegations in Barcelona. Several common themes were

identified including: (a) need for capacity building in the

African region

(b) challenges with meeting the Digital Migration deadline of June 17, 2015 and (c) Rural coverage and follow-up actions were agreed.

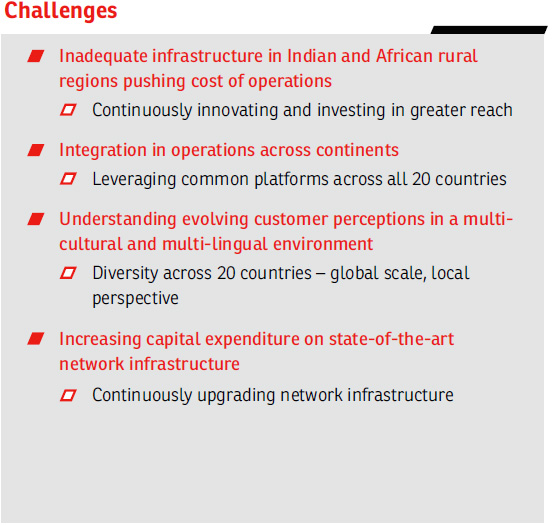

SCOT Analysis

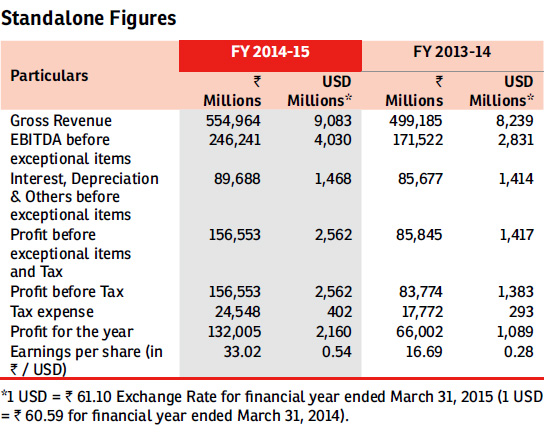

Consolidated Figures

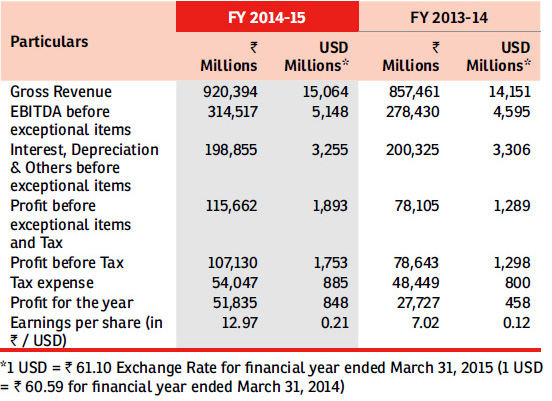

Consolidated revenues increased by 7.3% to ` 920,394 Mn for

the year ended March 31, 2015. Revenues in India for the year

ended March 31, 2015 stood at ` 645,295 Mn, representing

a growth of 12.1%, compared to that of the previous year.

Revenues in Africa reported at USD 4,407 Mn, representing

de-growth of 1.9%, compared to that of the previous year. In

constant currency terms the growth in revenues for Africa

was 6.2%. The Company incurred operating expenditure

(excluding access charges, cost of goods sold and license

fees) of ` 402,395 Mn, representing an increase of 3.8% over

the previous year. Consolidated EBITDA at ` 314,517 Mn

grew by 13.0% over the previous year primarily contributed

by India. EBITDA margin for the full year stood at 34.2%,

increased from 32.5% in the previous year, primarily due to

tighter opex controls. Depreciation and amortisation costs

for the year were lower by 0.8% to ` 155,311 Mn, partially due

to lower depreciation in Africa on account of assets held for

sale. Consequently, EBIT at

` 158,571 Mn increased by 30.0%,

resulting in an improved margin of 17.2%, up from 14.2% in

the previous year.

Net finance costs at ` 48,463 Mn were marginally higher by ` 82 Mn. The impact of higher forex and derivative losses for the full year at ` 21,530 Mn (PY: ` 12,423 Mn) was neutralised by higher investment income. Consequent to a conservative hedge accounting policy followed by the Company, net foreign exchange gains of ` 27,575 Mn on account of certain designated Euro and USD borrowings were taken directly to equity instead of the income statement. The consolidated profit before taxes and exceptional items at ` 115,662 Mn has significantly improved by 48.1% over the previous year.

The consolidated income tax expense (before the impact on exceptional items) for the full year ending March 31, 2015 is ` 52,928 Mn, compared to ` 44,478 Mn for the previous year. The effective tax rate in India for the full year came in at 26.5% (25.5% excluding dividend distribution tax), compared to 31.2% (29.1% excluding the impact of dividend distribution tax) for the full year ended March 31, 2014. The reduction in the underlying effective tax rate in India is due to improved performance in the loss making subsidiaries and lower forex losses in relation to borrowings. The tax charge in Africa for the full year at USD 203 Mn (full year 2013-14: USD 273 Mn) has been lower, primarily due to higher operating losses and reduction in withholding taxes due to lower upstreaming from subsidiaries.

Exceptional items, during the year, accounted for a net charge of ` 8,993 Mn. These included impact of several restructuring and integration activities, settlement of various disputes, tax settlements, gains / losses on disposal of towers and forex impact arising out of change in foreign exchange regulations in Nigeria, among others. After accounting for exceptional items, the resultant consolidated net income for the year ended March 31, 2015 touched ` 51,835 Mn, a significant 86.9% increase over the previous year. Net income before exceptional items for the full year came in at ` 60,828 Mn, an increase of 85.9% over the previous year.

The capital expenditure for the full year was ` 186,682 Mn, an increase of 76.4%, compared to the previous year. Consolidated operating free cash flow for the year reflected a decline of 25.9% from ` 172,587 Mn to ` 127,834 Mn, primarily on account of stepped up capex in India and Africa.

Liquidity and Funding

During the year, the Company undertook several initiatives to meet its long-term funding requirements, strategically using a diversified mix of debt and equity: a) In Q1, the Company’s subsidiary BAIN raised to USD 1,000 Mn through the issuance of 5.25%; Guaranteed Senior Notes due 2024 at an issue price of 99.916% and Euro 750 Mn through the issuance of 3.375% Guaranteed Senior Notes due 2021 at an issue price of 99.248%, b) In Q2, Airtel sold 85 Mn shares of Bharti Infratel Limited (Infratel) for ` 21,434 Mn, representing 4.5% shareholding in Infratel to comply with the requirement to maintain minimum public shareholding of 25%. Subsequent to this transaction, the shareholding in Infratel was reduced to 74.86%, and c) In Q4, the Company sold 55 Mn shares in Infratel for ` 19,255 Mn, representing 2.9% shareholding in Infratel. Subsequent to the transaction, the Company’s shareholding in Infratel has now reduced to 71.9 %.

As on March 31, 2015, the Company was rated ‘Investment Grade’ with a ‘Stable’ outlook by all three international credit rating agencies namely Fitch, Moody’s and S&P. It had cash and cash equivalents of ` 11,719 Mn and short-term investments of ` 92,840 Mn. During the year ended March 31, 2015, the Company generated operating free cash flow of ` 127,834 Mn. The Company’s consolidated net debt as on March 31, 2015 increased by USD 606 Mn to USD 10,679 Mn as compared to USD 10,074 Mn last year, mainly due to the DoT spectrum obligations. The net debt excluding the DoT spectrum obligations stood at USD 8,392 Mn as on March 31, 2015 (USD 10,056 Mn as at March 31, 2014). The Net Debt- EBITDA ratio (USD terms LTM) as on March 31, 2015 improved to 2.08 times as compared to 2.19 times in the previous year, mainly on account of strong operating performance and the proceeds from the Infratel stake sale and continuous deleveraging from cashflows. The Net Debt-Equity ratio marginally increased to 1.08 times as on March 31, 2015, compared to 1.01 times in the previous year.

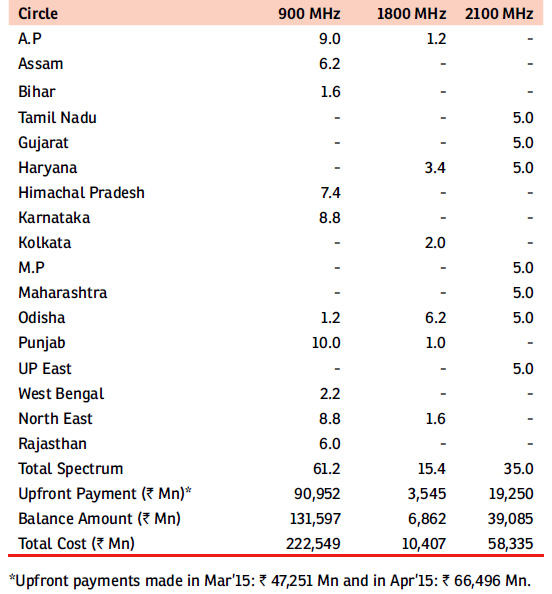

Auction of Spectrum in India

The Department of Telecommunications (DoT) commenced the auction process for 800 MHz, 900 MHz, 1800 MHz and 2100 MHz spectrum on March 4, 2015 that went on for 115 rounds till its conclusion on March 25, 2015.

A total of 470.75 MHz of spectrum was put to auction by DoT across bands, of which 52.70 MHz went unsold. Spectrum worth ` 1,098,749 Mn was bought by seven telecom operators. The Company successfully renewed 900 MHz spectrum in six circles, where the 20-year tenure of existing administered spectrum will end in various dates between December 11, 2015 and April 21, 2016. The Company also won additional 900 MHz spectrum in key leadership circles. This was in addition to its existing 1800 MHz and 2100 MHz spectrum in seven circles, and won 2100 MHz spectrum for 3G services in six new circles. Airtel acquired 111.6 MHz of prime spectrum across 900 MHz, 1800 MHz and 2100 MHz bands for a total consideration of ` 291,291 Mn in the spectrum auction conducted by the Government of India in March 2015. Of this, ` 176,176 Mn has been spent on the renewal of existing spectrum, while the balance ` 115,115 Mn has been spent on procuring new spectrum. The circle-wise quantum of spectrum secured in the auctions is summarised in the table below:

Since 2010, in five separate auctions, the Company has acquired spectrum valued at ` 681 Bn. This is in line with its long-term strategy to grow the internet user base, and emerge as a leading player in realising the national vision of a ‘Digital India’. The Company has secured its future and the roadmap for the next 20 years is now clear. The Company is committed to provide world-class voice and data services to its customers across 2G, 3G and 4G technologies.

Awards and Recognition

- Honoured with the Dun & Bradstreet (D&B) Corporate award in the Telecom Services sector at the D&B – Manappuram Finance Corporate Awards 2014 in Mumbai.

- B Srikanth, Global CFO, Bharti Airtel Ltd, has been honored with the ‘Best Performing CFO in the Telecom Sector’ award at the 8th edition of India’s most coveted awards for the finest CFOs - the CNBC-TV18 CFO Awards 2013.

- Bharti Airtel is the winner of ‘Top Treasury Team Asia 2014’ in Adam Smith Awards Asia 2014.

- The Company has scored 100% on a Composite Disclosure Index in a report by FTI Consulting Inc, a global advisory firm. This Index tracks mandatory and voluntary disclosure practices among listed companies. Along with two other listed companies, Airtel scored a perfect 10 out of 10 on disclosure practices. The average score for the BSE 100 companies came in at 6.7 / 10.

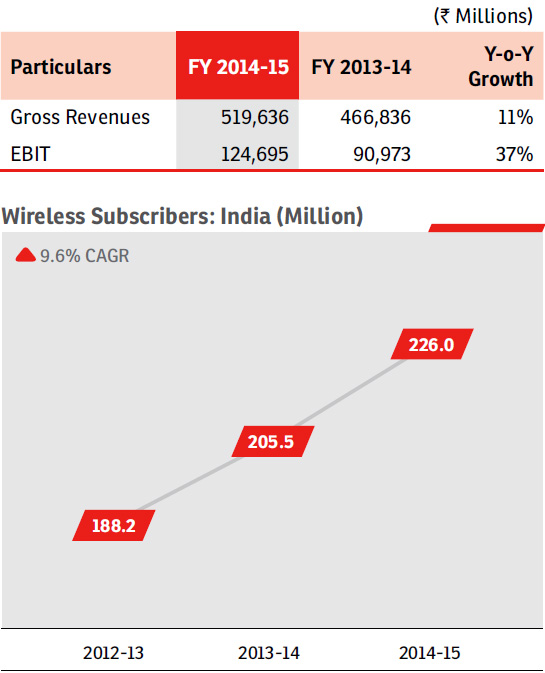

Overview

The year saw rapid growth in e-commerce and growing popularity of apps on smartphones, including OTT applications, which catalysed explosive growth in data usage over the past year. During the year, the Company continued to work towards improving data connectivity and launched several industry-first initiatives.

As on March 31, 2015, the Company had 226 Mn GSM customers. The Company’s customer acquisition and retention strategy is consistently yielding positive results in terms of reduced customer churn, from 2.9% last year to 2.7% in the current year. Data revenues, as a percentage to total revenues, increased from 9.9% to 15.2% in the current year. Of its total number of mobile subscribers, the Company had 46.4 Mn data customers (on the basis of the revised definition of ‘data customer’ as one who uses at least 1 MB per month) as on March 31, 2015, of which 19.4 Mn were subscribed to 3G data services.

The segment witnessed significant improvement in the EBITDA margin in the current year to 37.6%, compared to 33.8% in the last year. Improvement in margin is the combined effect of revenue growth and enhanced opex productivity. EBIT margins have improved significantly from 19.5% to 24.0% in the current year.

The Company continued to invest in networks and spectrum to build capacity and improve the quality of coverage, especially in 3G and 4G technologies. The number of sites as on March 31, 2015 were 146,539, of which 48,825 were 3G sites.

Key Initiatives

- Bharti Airtel launched ‘Wynk Music’, a new music streaming service with an OTT app that is carrier agnostic. Wynk Music crossed its first milestone, thereby witnessing 1 Lakh downloads in just four days of its launch. Wynk also achieved a momentous feat of 5 Mn downloads within six months, making it one of the most popular destinations for the country’s music lovers.

- Launched ‘Platinum 3G’- India’s first 3G network in Mumbai and Kolkata. This service will enable customers to experience 34% faster speed than other 3G networks, 30% better indoor coverage and battery lasting for 17% longer than on other networks.

- Rolled out 4G services across India’s 16 cities, expanding its 4G footprint in the country. With this achievement, Airtel 4G is now present in India’s 17 cities.

- Launched ‘One Touch Internet’ – a first-of-its-kind initiative aimed at simplifying internet services for millions of first-time users in India. It is a portal designed with a simple, secure and intuitive interface that will allow users to discover internet easily. It works as a single-point destination for users to see-try-buy a host of popular services.

- Announced a strategic collaboration with China Mobile, under which the two companies will work towards the growth of the LTE ecosystem and evolving mobile technology standards. Airtel and China Mobile will also work towards shaping up a joint strategy for procurement of devices that include Mifi, smart-phones, data cards, LTE CPEs and USIM.

- Launched ‘The Smartphone Network’ campaign to augment the rapidly increasing uptake of data services. Airtel has made significant technology and network investments to ensure the best data experience for smartphone users in India.

- Organised ‘Each One Teach One’ day - an industry-first initiative, aimed at driving internet literacy in India and contributing to the nation’s digital inclusion agenda.

- Partnered with Mi India to launch its flagship 4G device – Redmi Note 4G.

- Introduced a series of relief initiatives to support those affected in Jammu & Kashmir floods, expediting restoration of communication services in the region. Facilities like free calling stations, free talk time and advance talk time were launched to facilitate easy communication.

- Introduced a series of relief packages to ensure restoration of communication services in cyclone affected regions of Andhra Pradesh. Free calling stations and local talk time of 10 minutes, along with Advance Talk time facility were provided to all Airtel customers in the affected areas to enable them to connect with their families.

- Introduced its ‘Smart SIM’ in the market, which provides customers the freedom to seamlessly work across multiple devices (including smartphones and tablets) without worrying about the compatibility of their SIM card.

- Launched a refreshed ‘my Airtel app’ to extend an enhanced digital experience to its customers across categories.

- Launched customer initiated instant SIM swap for its prepaid customers in all circles, enabling change or upgradation of SIM within 10 minutes.

- Became the first private telecom operator to launch 2G services in Bomdila, Jameri, Zero Point and Tenga Valley of Arunachal Pradesh.

- In collaboration with Kotak Mahindra Bank, Airtel has applied for a Payments Bank licence to be a partner in the national mission of financial inclusion.

- Ranked ‘No.1 Service Brand’ in the annual Brand Equity Most Trusted Brands Survey 2014.

- Won the DSCI Excellence Award for Security in Telecom at the NASSCOM-DSCI Annual Information Security Summit 2014.

- Won the ’Best Mobile Product‘ for Wynk Music under Telecom Service Providers Category and ’My Favourite Service Provider‘ award under the Public Poll Awards Category at the prestigious ET Telecom Awards 2014.

- Airtel’s WAP (Wireless Application Protocol) portal – ‘One Touch Internet’ was accredited as the ‘Best Mobile Service/ Application of the Year for consumers’ in the category of Best Mobile Services at the prestigious GSMA Global Mobile Awards 2015 in Barcelona.

- Won eight accolades at the Voice & Data Telecom Leadership Forum & Awards 2015, these included – Top Performance in Assam, Bihar, Himachal Pradesh, Karnataka, Odisha, Punjab and Rajasthan circles and for Wynk Music app in Product Innovation category.

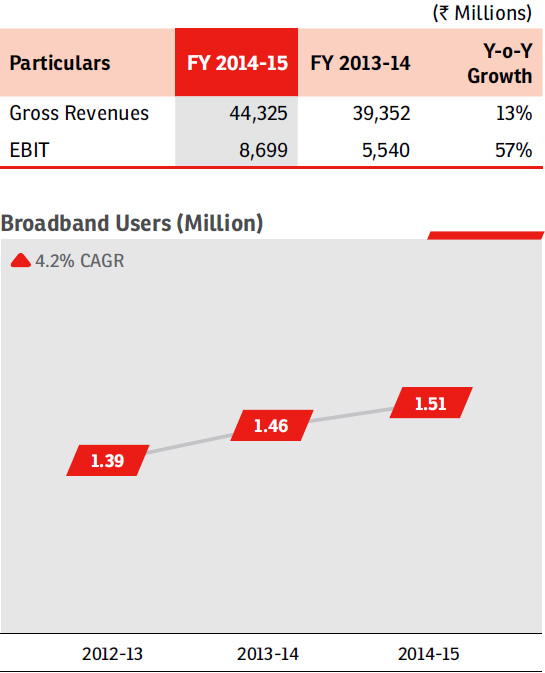

Awards and Recognition

The Company provides fixed-line telephone and broadband (DSL) services for homes, as well as offices in 90 cities across India. Airtel had 3.4 Mn customers, as on March 31, 2015. Of them, 1.5 Mn customers were subscribed to its broadband / internet services, representing 44.2%, compared to last year’s 43.6%. The higher proportion of DSL customers was primarily driven by improved speed offering and the Company’s focus on quality acquisitions. The higher number of broadband customers also resulted in a significant increase in ARPU to ` 1,026 during the year as compared to ` 946 in the previous year. Consequently, non-voice revenue as a percentage of total telemedia revenue also increased significantly, now representing 64.9%, compared to 59.8% last year.

The product offerings include high-speed broadband, rising up to the speed of 100 mbps for the home segment. Besides, the Company’s product portfolio also includes local, national and international long-distance voice connectivity. In the office segment, Airtel is a trusted solutions provider for fixed line voice (PRIs), MPLS, mobile, data and other connectivity solutions. Additionally, the Company offers solutions to businesses to improve employee productivity through collaborative solutions (audio, video and web conferencing). Cloud portfolio is integral to its office solutions suite, which offers storage, compute, Microsoft office 365, e-commerce package through shopify and CRM packages on a pay-as-you-go model.

Key Initiatives

On the home front, significant progress was made in the endeavour to pioneer high-speed broadband through FTTH and VDSL rollouts in the top markets. Another key intervention was improvement in the quality of acquisition through focused interventions, resulting in lower churn. Focus on high-speed internet during both - acquisition and base migration, resulted in high-speed base (defined as greater than or equal to 4 Mbps) moving to 46% at the end of the year as against 34% last year.

On the corporate business front, significant progress was made in ICT solutions, in terms of simplification of the products and processes through instant feasibility and faster implementation (implementation of ILP in one day). In Fixed Line, new segments were tapped with innovative products like call conferencing and call-back. Another focus area was increasing distribution in terms of geographic coverage and cluster-wise infrastructure mapping, among others. There was also a significant brand shift from product sales to solution sales. In addition, programmes like verticalisation simplified the sales ecosystem on a consultative selling approach.

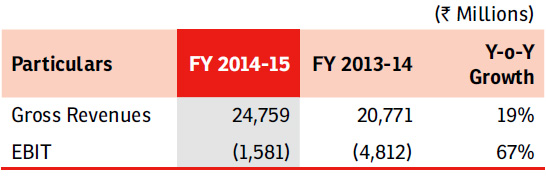

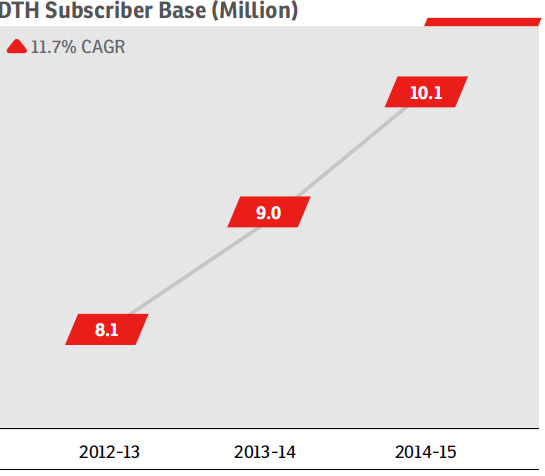

The Company served a customer base of 10.1 Mn on its Direct-to-Home platform (Airtel digital TV), as on March 31, 2015, adding 1.1 Mn customers during the year. From the third quarter, the Company harmonised the accounting of indirect taxes in line with other segments and industry practice; such taxes were part of opex earlier and are now netted off against revenues. On a like-to-like basis the growth in revenues was 24.6%, compared to previous year.

The Company currently offers both standard and high definition (HD) digital TV services with 3D capabilities and Dolby surround sound. The Company currently offers a total of 460 channels, including 27 HD channels, four international channels and three interactive services. Enriching its regional focus, Airtel Digital TV has added 29 vernacular channels across languages, such as Bengali, Tamil, Telugu and Oriya, among others. Enhanced transponder capacities, affordability of HD set-top boxes and upselling efforts led to ARPU increasing by ` 14 to ` 216. Consequently, this business reported positive EBIT in Q4 for the first time.

Key Initiatives

Airtel Digital TV launched ‘Pocket TV’ app on iOS, enabling its subscribers to view TV on their mobiles, tablets and other similar devices. Airtel is India’s first company to provide real-time integration of all three screens viz. television, mobile and computer, enabling its customers to record their favourite TV programmes through mobile and web. Airtel Digital TV launched a Self-Care App and a Wi-Fi dongle for its HD customers.

Airtel Digital TV, in partnership with Disney India launched its first English Subscription Video on Demand (SVOD) channel – ‘Disney Family Movies’ to showcase popular Disney movies, including Hollywood classics, popular animation movies and live action titles. In addition, Airtel Digital TV also tied up with Samsung TV for an exclusive launch with Samsung for IDTV: India’s first integrated TV with inbuilt HD STB. Customer can put an Airtel CAM card in the TV and enjoy Airtel digital TV services. No separate STB is required for availing the same facility.

Airtel Business is India’s leading and most trusted ICT services provider. Its diverse portfolio of services includes voice, data, video, network integration, data centre, managed services, enterprise mobility applications and digital media. Airtel Business consistently delivers cutting-edge integrated solutions, superior customer service and unmatched depth / reach to global markets, to enterprises, governments, carriers, and small and medium businesses.

Global Business, the international arm of Airtel Business, offers an integrated suite of global and local connectivity solutions, spanning across voice and data to the carriers, Telcos, OTTs, large multinationals and content owners globally.

Airtel’s international infrastructure includes ownership of i2i submarine cable system, connecting Chennai to Singapore and consortium ownership of SMEWE4 submarine cable system, which connects Chennai and Mumbai to Singapore and Europe. It also includes cable system investments like Asia America Gateway (AAG), India, the Middle East and Western Europe (IMEWE), Unity, Europe India Gateway (EIG) and East Africa Submarine System (EASSy). Along with these seven owned subsea cables, Airtel Business has a capacity on 13 other cables across various geographies.

It has significantly invested in creating state-of-the-art national and international long-distance infrastructure to serve the growing capacity demands of customers, especially in the emerging markets of the Middle East, Africa and APAC. Its global network runs across 225,000 Rkms with over 1000 customers, covering 50 countries and five continents. This is further interconnected to its domestic network and direct terrestrial cables to SAARC countries and China, accelerating India’s emergence as a preferred transit hub.

Leveraging the direct presence of Airtel in 20 countries across Asia and Africa, Global Business also offers VAS solutions (ITFS, signalling hubs, messaging), along with managed services and Satcom solutions.

Key Initiatives

Airtel Business continues to focus on the following areas to propel the business to greater heights:

- Driving deeper engagement and increasing revenue wallet share in large, multi-geography customers through Global Account Management programme.

- Acquiring new customers and enhancing global reach in unchartered geographies through Channel Partner programme.

- Leveraging strength of existing retail customers to enter into strategic business alliances like Chicago agreement with large Telcos and carriers.

- Moving from traditional revenue sources to VAS solutions by focusing on newer products and solutions, such as toll free services, SMS hub, Firewall, Satellite solutions and airtel talk, among others.

- Expanding footprint in the emerging markets with access, network, delivery and partnerships to further strengthen the position and revenue from such markets.

- Developing India as an IP Hub for neighbouring countries, including Nepal, Bhutan, Bangladesh, China, Myanmar, Sri Lanka and Maldives by on-boarding CDNs like google, facebook, and so on.

- Bharti Airtel Hong Kong Ltd. announced the launch of ‘airtel talk’ – an all-in-one communication application that facilitates easy and affordable calls into India.

- Airtel joined hands with Amazon Web Services to offer private network solutions for its global enterprise customers. The partnership will help Airtel’s customers to leverage the powerful and dedicated AWS network at reduced network costs to experience increased bandwidth and consistent connectivity.

- Signed an inter-provider connectivity agreement with Orange Business Services to enable inter-country video conferencing facility to enterprise customers in respective countries of operation.

- Applied for a Payments Bank licence, in collaboration with Kotak Mahindra Bank to be a partner in the national mission of financial inclusion.

- Won top honours at the prestigious 2014 Frost & Sullivan India Information & Communications Technology (ICT) Awards. Airtel won three awards: Enterprise Telecom Service Provider of the Year – Large Enterprise Segment, Enterprise Telecom Service Provider of the Year - SMB (Corporate) Segment, and Enterprise 3G Service Provider of the Year under the ‘Enterprise Telecom Services’ category for its exemplary growth and performance.

- Won the ‘Enterprise Mobile App 2014’ award for Airtel mGovernance solution and ‘Unified Communication Solution’ award for Biznet video solution at the Aegis Graham Bell Awards – the biggest innovation award in the field of telecom, internet, media and entertainment (TIME).

Awards and Recognition

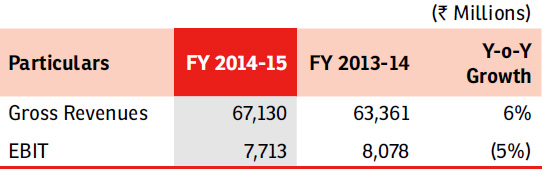

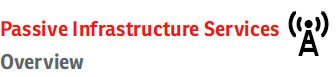

Bharti Infratel Limited, a subsidiary of Bharti Airtel, provides passive infrastructure services on non-discriminatory basis to all telecom operators in India. Bharti Infratel deploys, owns and manages telecom towers and communication structures in 11 circles of India. It also holds 42% share in Indus Towers (a joint venture between Bharti Infratel, Vodafone and Idea Cellular). Indus Towers operates in 15 circles (four common circles with Bharti Infratel, 11 circles on exclusive basis).

The Company enjoys nationwide presence with operations in India's all 22 telecommunications circles.

As on March 31, 2015, Bharti Infratel owned and operated 37,196 towers in 11 telecommunications circles, while Indus Towers operated 115,942 towers in 15 telecommunication circles. Bharti Infratel's towers, including installations in its 42% interest in Indus Towers, comprised an economic interest in the equivalent of 85,892 towers in India, as on March 31, 2015. Bharti Infratel is listed on the Indian Stock Exchanges, NSE and BSE.

Africa

Overview

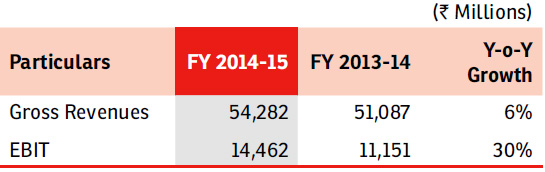

The year saw sharp decline in crude oil and other commodity prices impacting several African economies such as Nigeria, Tchad, Congo B, Gabon, DRC and Zambia. Africa being a commodity-heavy continent, witnessed sharp depreciation in currencies across various countries.

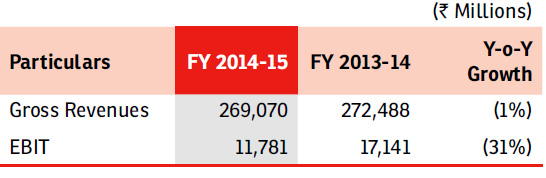

As on March 31, 2015, the Company had 76.3 Mn customers in Africa across 17 countries as compared to 69.4 Mn customers in the previous year, an increase of 9.8%. Total minutes on the network during the year increased by 7.6% to 118.6 Bn, compared to 110.2 Bn in the previous year. At the end of the year, 30.4 Mn data customers accounted for 39.8% of the total customer base, compared to 32.1% in the previous year. Data traffic increased by 87.4% from 18.9 Bn MBs in the previous year to 35.3 Bn MBs in the current year, with usage per customer increasing from 89 MBs to 114 MBs.

Voice realisation per minute, however, declined from 3.30 cents to 2.84 cents for the full year, due to competitive pressures and currency depreciation. Consequently, overall ARPU in Africa declined from USD 5.6 to USD 5.1. Total sites in Africa as on March 31, 2015 were 18,819, of which 10,011 were 3G sites, representing 53% of the total sites.

Full year reported revenues of Africa came in at USD 4,407 Mn (PY: USD 4,491 Mn). In constant currency terms, gross revenues increased by 6.2%, and net revenues by 7.5%. Reported EBITDA at USD 1,002 Mn (PY: USD 1,175 Mn) reflected a margin of 22.7%, a decline from 26.2% in the previous year due to investments in network and higher marketing spends. Reported EBIT at USD 193 Mn declined from USD 280 Mn in the previous year. After accounting for a full year capex of USD 1,073 Mn (PY: USD 635 Mn), the cash burn in Africa was USD 71 Mn, compared to operating free cash flow of USD 540 Mn in the previous year.

Key Initiatives

- During the year, the Company’s subsidiary, Bharti Airtel International (Netherlands) B.V. (BAIN) entered into agreements with Helios Towers Africa (HTA) for divestment of over 3,100 telecom towers in four countries across Africa. BAIN also entered into agreements with Eaton Towers Limited (Eaton) for divestment of over 3,500 telecom towers in six countries across Africa. The Company’s subsidiary in Nigeria and American Towers Corporation (ATC) have entered into an agreement for sale of over 4,800 telecom towers in Nigeria. The Company’s subsidiaries in Zambia and Rwanda have entered into agreements with IHS Zambia Ltd and IHS Rwanda Ltd, respectively, for sale of over 1,100 telecom towers in these two countries. The divestment of tower assets in one of the countries consummated during the year.

- Airtel and Kenya Airways have signed a Memorandum of Understanding (MoU) to deliver an MVNO service for the airline, subject to regulatory approvals.

- Airtel Kenya tied up a unique MVNO plan with Equity Bank, which will reduce Equity’s cost of delivering MVNO services and help Airtel to utilise its investment and grow revenues.

- Airtel Money signed an MoU with the United Bank of Africa (UBA) for cross-border money transfer in 24 countries across Africa, where either Airtel or UBA is present.

- Yu subscribers in Kenya were successfully migrated to Airtel on December 20, 2014 and Essar network was finally switched off on January 5, 2015.

- In Kenya, the existing licence was successfully renewed for 10 years. Following the successful acquisition of Yu Mobile’s customers and license in January 2015, the Regulator has now confirmed that Airtel Kenya license will be synchronised with Essar Yu to expire on June 30, 2024.

- Airtel Money launched cross-border person-to-person transfer between DRC, Zambia and Rwanda and also received regulatory approval from Banque Centrale des Etats de I’Afrique de I’Ouest (BCEAO) for launch of cross-border remittances in Niger.

- Facebook, in partnership with Airtel launched the internet.org app in Zambia, Kenya and Ghana

- The year has continued to see Airtel’s involvement in the community across Africa, such as:

- Pan-African partnership with VISA and MasterCard for the introduction of virtual and plastic companion cards for Airtel Money.

- Airtel Sierra Leone embarked on a Private Public Partnership with the Ministry of Health and Sanitation and UNFPA in the fight against the outbreak of the deadly EBOLA epidemic, where the staff donated a day’s salary for the cause.

- Service delivery and food stuff donation to flood victims by Airtel in Madagascar and Malawi.

- Support to pregnant women in Kenya through the ‘Beyond Zero’ marathon, donation of Mama kits in Uganda and baby packs for mothers in Sierra Leone.

- Airtel crossed the milestone of 75 Mn subscribers across 17 countries in Africa.

- Airtel continues to expand its 3G footprint across the continent with Airtel now present in all 17 countries.

- Airtel obtained trial authorisation from Regulator for providing 4G LTE services in Madagascar. Airtel’s licence will expire on the September 20, 2015 and renewal is already in process. The payment of the licence fee in Madagascar for renewal of 10 year licence will be done as soon as the terms and conditions are finalised.

- The Company successfully renewed its existing licenses in Niger. Airtel was also successful in obtaining 3G license for a period of 15 years.

- The Company was successful in obtaining 3G and 4G licences in Tchad. 3G services have also been launched.

- Airtel Money crossed the milestone of 5 Mn subscribers across Africa. As at the end of March 2015, Airtel Money had 6.2 Mn customers across Africa. Airtel Money celebrated 1 Mn REC milestone in DRC, making it the largest provider of financial services in DRC.

- Airtel Money was awarded the Best Mobile Money Service in Ghana at the Mobile World Ghana Telecoms Awards and also won the Best Mobile money solution at Africa Com Awards in South Africa.

- Airtel Ghana was awarded the best CSR Company and best Mobile Money Service of 2013.

- Airtel Ghana also won the Brand Activation Programme of the year for Airtel Rising Stars programme.

- Airtel Zambia won the overall award at Zambia Public Relations Association (ZAPRA) for its outstanding CSR initiatives like ‘Adopt a School Programme’ and ‘Staff Volunteer Programme’.

- Airtel Zambia also won the Green Award for sustained compliance and commitment to continuous environmental improvement; and recognised for outstanding telecommunications service, innovation and corporate citizenship at the PMR Africa Achievers Awards.

- Airtel Zambia also won the Most Creative Advert of 2014 for Airtel Money campaigns and Best Sponsorship Marketing Excellence award of 2014 for Airtel Rising Stars campaign.

- Airtel Uganda scooped the ‘Best Brand of the year 2014’ at the Annual Social Media Awards 2015. These awards sought to reward individuals and organisations that were at the front-line in using social media for change, engagements and talking to customers online.

- Airtel Kenya was rated as one of the top global brands on social media, making it to the category of socially devoted companies in the region. The report is based on Airtel Kenya’s high response rate on Facebook and Twitter in a report issued by Social Bakers, a leading global provider of social media analytic tools, statistics and metrics.

Key Highlights

Awards and Recognition

South Asia

Overview

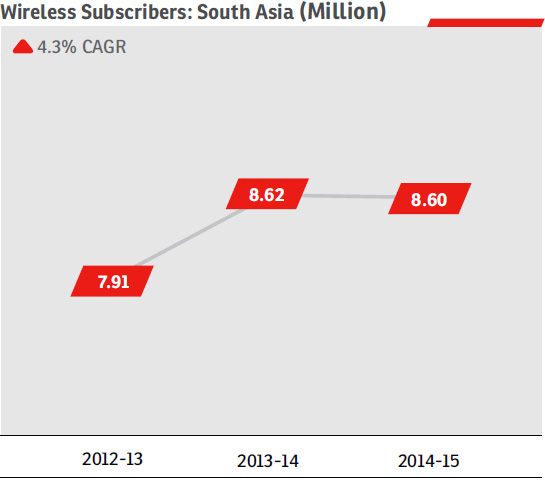

As on March 31, 2015, South Asia had 8.6 Mn mobile customers on its network. Data customers represented 40.4% of the total customer base as on March 2015, compared to 35.7% in the last year. As on March 2015, the Company had 6,867 sites on network, compared to 6,814 sites in the last year. Of the total number, 3G sites were 3,050 in number, representing 44.4% of the total.

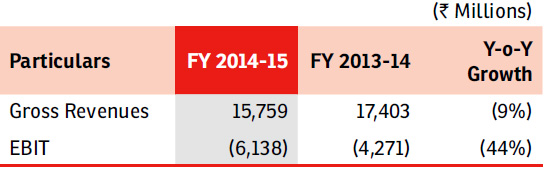

Full year revenues of South Asia declined by 9.4% to ` 15,759

Mn, compared to ` 17,403 Mn in the previous year. EBITDA

loss for the year at

` 196 Mn dropped by 118.9%, compared

to the previous year. EBIT losses for the year reported at ` 6,138 Mn, compared to a loss of ` 4,271 Mn in the previous

year. Capex for the year was ` 3,233 Mn, compared to ` 6,460

Mn in the previous year.

Key Highlights

- Airtel Sri Lanka launched its very own Airtel App Store - a one-stop online shop for all local and international apps.

- Airtel Sri Lanka completed Airtel Rising Stars programme, where 12 aspiring footballers were sent to Manchester United. This year, for the first time, two female players were chosen to represent Sri Lanka.

- Airtel Sri Lanka won a Gold award at the People Development Awards 2014. Airtel was the youngest organisation and the only telecom company to win the award for best practices in human resources.

- Airtel Bangladesh launched a new voice product called ‘shobaiek’, which offers the lowest flat rate of 1 paisa/ second to all customers.

- Airtel Bangladesh also launched ‘aircredit’ facilities to its customers.

This section discusses the various aspects of enterprise-wide risks. Readers are cautioned that risk-related information outlined here is not exhaustive and is for information purpose only.

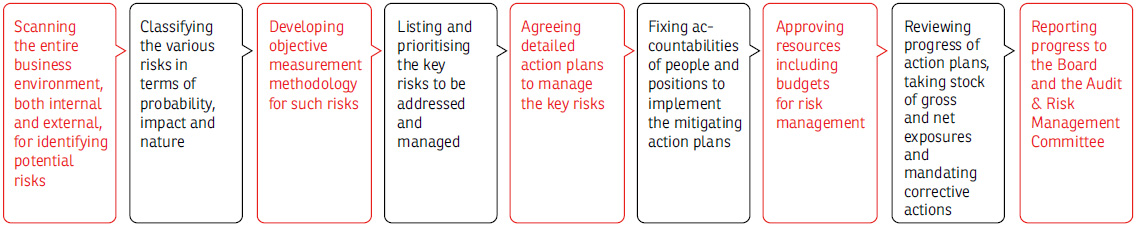

Risk management is embedded in the operating framework of Bharti Airtel. The Company believes that managing risks goes hand in hand with maximising returns. Risks are inherent in any business operation, especially in a multi-country organisation and in a regulated sector, where the Company serves millions of customers everyday. Proactively identifying risks and managing them in a systematic manner is an essential pre-requisite for effective corporate governance. Bharti Airtel has a sound practice to identify key risks across the Group and prioritise relevant action plans to mitigate these risks.

At the apex level, the Risk Management Framework is reviewed periodically by the Board and the Audit & Risk Management Committee. These apex reviews include: discussing the management submissions on risks, prioritising key risks and approving action plans to mitigate such risks. The Internal Audit function is responsible for assisting the Audit & Risk Management Committee on an independent basis with a full status of the risk assessments and management. Every quarter, the Audit & Risk Management Committee also obtains periodical updates on certain identified risks, depending upon the nature, quantum and likely impact on the business.

At the top level, the respective Management Boards (AMB and Africa Exco) are accountable for managing the risks across their respective businesses, viz., India & South Asia and Africa. The AMB / Africa Exco ensure that the environment – both external and internal – is scanned for all possible risks.

At the operating level, the Executive Committees (EC) of Circles in India and Operating Companies in the international operations are fully charged with the responsibilities of managing the risks at the ground level.

During the year, a Risk Management Policy has been placed before the Audit & Risk Management Committee and the Board and got approved. The objective of this Policy is to have a welldefined approach to risk. The Policy lays broad guidelines for the appropriate authority so as to be able to do timely identification, assessment, and prioritisation of risks affecting the Company in the short and foreseeable future. The Policy suggests framing an appropriate response action for the key risks identified, so as to make sure that risks are adequately compensated or mitigated.

The two CEOs, for India & South Asia and Africa, are responsible for the implementation of the agreed risk framework, including the detailed processes of:

The key risks that may impact the Company and the mitigating actions undertaken are:

1. Political Instability and Government Relations

Risk Statement: The Company operates in India, Bangladesh, Sri Lanka and 17 African countries. Some of these countries (or regions within countries) are affected by political instability, civil unrest and other social tensions. The political systems in a few countries are also fragile, resulting in regime uncertainties; hence, the risk of not enjoying Government support. Such conditions tend to affect the overall business climate, especially the telecom sector, which requires stable socio-economic conditions and policy stability.

Mitigation: As a responsible corporate citizen, the Company engages proactively with key stakeholders in the societies in which it operates, and continuously assesses the impact of the changing political scenario. The Company works hand-in-hand with other telecom operators in jointly representing the case for policy stability. It does its best to contribute to the socio-economic growth of the countries in which it operates through high quality services to its customers, improved connectivity, providing direct and indirect employment, and contributions to the exchequer. Through the Company's CSR activities, it contributes to the country's social and economic development, especially in the field of education.

2. Economic Uncertainties

Risk Statement: The Company's strategy is to focus on the growth opportunities in the emerging and developing markets. These markets are characterised by low to medium mobile penetration, low internet penetration and relatively lower per capita incomes, thus offering more growth potential. However, these countries are also more prone to economic uncertainties, such as capital controls, inflation, interest rates and currency fluctuations. Since the Company has borrowed in foreign currencies, and many loans are carrying floating interest terms, it is exposed to market risks, which impact its earnings, cash flow and balance sheet.

Mitigation: As a global player with presence across 20 countries, the Company has diversified its risks and opportunities across markets. Through a variety of services including voice, data, Airtel Money and value-added services, it has also spread its portfolio. To mitigate currency and interest rate risks, the Company follows a prudent risk management policy, including hedging mechanisms to protect its cash flow. A prudent cash management policy ensures that surplus cash is up-streamed regularly to minimise the risks of blockages at times of capital controls. Finally, the Company adopts a pricing strategy that is based on twin principles of profitability and affordability, which ensures that it protects margins at times of inflation, and market shares at times of market contraction.

3. Weaknesses in Infrastructure

Risk Statement: Several regions, particularly rural and the hinterland, are handicapped by poor quality infrastructure, such as lack of proper roads, transport, power supply, housing, labour availability, banking and security, among others. These could result in gaps, such as energy unavailability, fuel shortages, fuel theft, asset misappropriation and cash theft, among others, thereby impacting quality of its services.

Mitigation: The Company's philosophy is to share infrastructure with other operators, and enter into SLA-based outsourcing arrangements. The disposal of towers in Africa to independent and well-established tower companies and long-term lease arrangements with them will ensure high quality of assets and maintenance on the passive infrastructure. The Company proactively shares fibre assets with other telecom operators. It has also put in place redundancy plans for power outages, fibre cuts and VSAT breakdowns, among others, through appropriate back ups, such as generators, secondary links, and so on.

4. Unavailability or Poor Quality of Networks and IT Including Redundancies and Disaster Recoveries

Risk Statement: The Company's operations and assets are spread across wide geographies. Repeated outages and / or poor quality of networks cause disruption of services, resulting in revenue losses, customer attrition, market share losses and damage to brand image and Company reputation. Regulators are now levying stiff monetary penalties for poor quality of services.

Mitigation: Network Planning is increasingly being done in-house, to ensure that intellectual control on architecture is retained within the Company. The Company follows a conservative insurance cover policy that provides a value cover equal to the replacement values of assets against risks, such as fire, floods, and other natural disasters. The Company has been continuously investing in business continuity plans and disaster recovery initiatives to ensure minimum disruption and speedy restoration of services. The Company has recently revamped the IT resourcing strategy, and is now able to deploy a more balanced mix of in-house and outsourced capabilities to improve its IT capabilities.

5. Adverse Regulatory or Taxation Developments Including Risks Related to Tax Positions

Risk Statement: Several regulatory developments in India, South Asia and Africa have posed several challenges to the telecom sector. India's telecom sector is also a highly taxed sector with high revenue share-based license fees and spectrum charges, service taxes and corporate tax, besides the significant spectrum acquisition costs in the auctions. The telecom industry in Africa also operates in a high tax regime. The sim tax in Bangladesh has made customer acquisition an expensive proposition, and this affects smaller players. OTT operators may also take away a share of the revenue pie increasingly.

Mitigation: The Company has always stood for a fair, transparent and non-discriminatory Government policy on telecom regulation. It has represented to the Governments in all countries that sustainable regulatory regimes will lead to healthy growth of the telecom sector, leading to higher investments and modernisation, which in turn unleashes a growth cycle once again. The telecom industry has been making a case for regulation of OTT players, especially in matters such as security and lawful interception, among others. The Company stands for a regime that promotes healthy, competitive pricing, keeping two objectives in mind - customer interests and health of the telecom sector. As an industry, Airtel provides adequate facts and figures to prove how healthy telecom growth improves the overall economic growth of the country. Similarly, the Company has been at the forefront of industry co-operation to share infrastructure, to minimise impact on the environment, lower the costs of operations and make services more affordable.

6. Gaps in Internal Controls and / or Process Compliances

Risk Statement: The Company serves over 324 Mn customers globally with a daily average of 3,630 Mn minutes of voice and 1,074 terra bytes of data carried on the wireless networks. Gaps in internal controls and / or process compliances not only lead to wastages, frauds and losses, but can also adversely impact the Airtel brand.

Mitigation: Airtel's business philosophy is to ensure compliance with all-accounting, legal and regulatory requirements proactively. Compliance is regulated meticulously at all stages of operation. Substantial investments in IT systems and automated workflow processes help minimise human errors. Besides internal audits, the Company also has a process of self-validation of several checklists and compliances, as well as a 'maker-checker' division of duties to identify and rectify deviations early enough. Lately, the Company has implemented GRC systems (Governance, Risk and Compliance) to embed systemic controls.

7. Inadequate Quality of Customer Lifecycle Management in the Wake of Intense Competition

Risk Statement: Customer mindsets and habits are changing rapidly, reflected in their ever-rising expectations in terms of quality, variety, features and pricing. The competitive landscape is also changing dramatically, day by day, as operators view with one another to capture customer and revenue market shares. Failure to keep pace with customer expectations would result in customer churn, leading to erosion of revenues, profits and cash flows, and market share losses.

Mitigation: The Company constantly refreshes its ways of working, especially in customer service, innovation, marketing and distribution. These are now captured in the Company's integrated Customer Lifecycle Management approach, which ensures that every customer's behaviour is studied, classified and segmented, followed by segmented service and price offerings. Organisational effectiveness is enhanced through appropriate design and creation of leaner and multi-functional teams. Technologies and tools, such as Business Intelligence, Scientific Pricing Modelsa and Big Data Analytics, among others are deployed in managing the customer lifecycle. The Company has recently announced the theme of 'hunger to win customers for life' as its 'obsession', and this has energised all employees.

8. Poor Quality of Customer Acquisitions

Risk Statement: In a market dominated by prepaid customers, several inefficient processes have emerged in respect of customer acquisitions, e.g. unhealthy commission structure for agents and fraudulent practices by retailers, among others. Such practices lead to high rotational churn, high acquisition costs, trade frauds, and so on.

Mitigation: The Company led the way, bringing in healthier commission and incentive structures. In many countries, Government regulations have also been introduced to tighten new customer activation process, restriction on number of SIMs for the same customer and so on, making rotational churn more difficult. The Company tracks 'customer base decay' for the first six months after an acquisition to understand and mitigate this risk more effectively.

9. Non-compliance with Subscriber Verification and KYC Regulations

Risk Statement: In several countries including India, the Regulators have introduced more stringent subscriber verification and KYC guidelines. Non-compliance with these guidelines entails severe penalties, and repeated violation may even threaten the license itself. Weak internal processes for subscriber verification and KYC may also lead to uncompetitive market position especially if competitors have a much faster and well coordinated system for customer activation.

Mitigation: The Company is investing significant capex on IT assets and KYC tools to improve the quality of subscriber activation and documentation processes. Focus on quality of partners and IT systems, staff training, proactive makerchecker controls and internal audits, as well as robust internal MIS help achieve greater focus on compliances. The Company regularly benchmarks its 'first time activation' and quality with other operators.

10. Low Revenues and / or Low Utilisation of Sites

Risk Statement: While there is a robust process and criteria for choice of new site locations and the investment approval, often the Company is faced with the issue of low revenues and / or low utilisation of sites ('LRLU'), leading to recurring operating losses in such sites, not to mention the burden of sunk investment.

Mitigation: Mitigating actions include: making cross-functional teams responsible for the turnaround, improving brand presence in the specified location, increasing distributor coverage, adding new retail outlets for SIM selling and recharges, trade incentives, special introductory pricing and improving quality of networks, among others. Contingency actions include: closure of sites and redeployment of equipment, allowing another operator to roam, which will help share the costs, consolidation of sites, and so on. At a root cause level, the Company has introduced more science into the decision-making criteria for investments in new sites.

11. Issues Arising Out of Emerging Businesses and New Technologies

Risk Statement: Evolving technologies (2G, 3G, 4G) result in change in customer value propositions. The quality of internet experience, especially in a seamless manner and indoor environment has emerged as a key competitive parameter. Mobile money technologies, innovative mobile apps, Cloud, M2M, SaaS and other technology-based VAS products are also evolving. Such rapid technology evolution may impact the functionality of existing assets and accelerate obsolescence. Keeping pace with changing customer expectations is a big agenda for the telecom sector.

Mitigation: Airtel's strong strategic vendor relationships - especially in the areas of network technologies, IT, mobile money and a few other key VAS technologies help us keep pace with technology shifts and retain market leadership. The Company's own digital innovations, such as Wynk and My Airtel App, among others are few examples of its keeping pace with the changing landscape.

The potential risks of asset obsolescence are managed through leaner order pipelines, demand-based capacity sourcing and formal swap arrangements with vendors. In several countries, the Company is pro-actively leading the development of 3G, 4G, digital content partnerships and mobile money, among others ahead of the curve to leverage big opportunities.

12. Ineffective Partner Governance