TO CREATE SUSTAINABLE VALUE FOR ALL STAKEHOLDERS, WE, AT AIRTEL MANAGE OUR FINANCIAL CAPITAL IN AN ASTUTE, OPTIMUM AND DILIGENT MANNER, THEREBY HARNESSING OPPORTUNITIES FOR LONG-TERM VALUE CREATION.

Source

Financial capital (includes shareholders’ equity and debt) is a critical input in executing our business activities and in generating, accessing and deploying other forms of capital.

Inputs

Our financial strength is based on the primary sources of financial capital such as shareholders equity, internally generated cash flows and debt raised from capital market. These resources serve us to maintain our network, functional units, fund expansion and modernization & pay dividends to our shareholders. The components of the debt portfolio are determined by the Company’s senior management in a manner which enables the Company to achieve an optimum debt-mix basis its overall objectives and future market expectations.

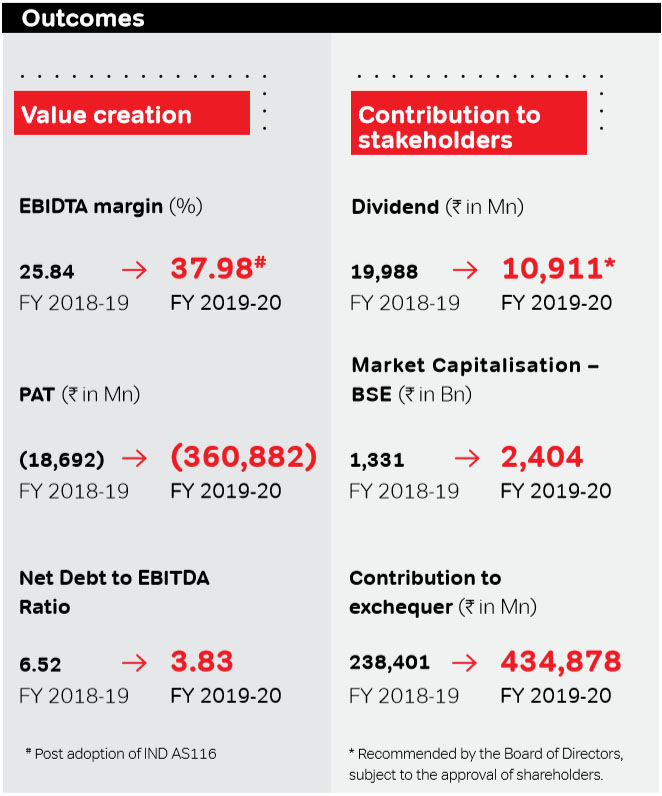

The year saw phenomenal confidence from the shareholders & investors and the Company witnessed fund raising of ~ USD 6.6 Bn through a combination of Rights issue, QIP and FCCBs. This confidence is also reflected in our market capitalization which reached an all time high during the year.

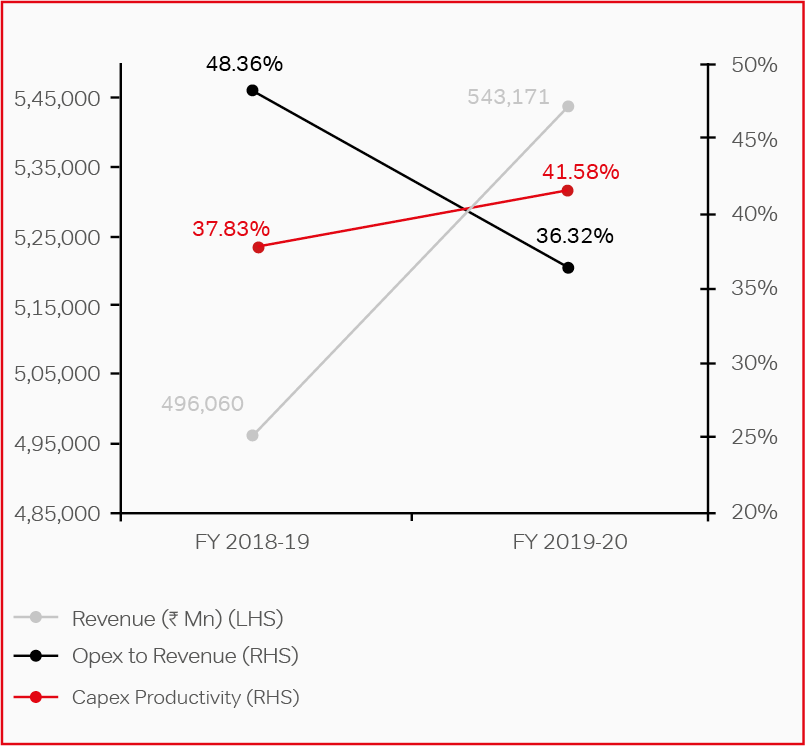

Airtel’s three line graph – Key enabler for driving value creation

At the core of the value creation process is Airtel's three line graph which measures:

Operating expenses / revenues

Revenue/ cummulative capex