Economic Overview

Global Review

Global economic activity in 2015 remained largely subdued.

Global growth is projected at 3.4% in 2016 and 3.6% in 2017.

Gradual slowdown and rebalancing of economic activity

in China, lower prices for energy and other commodities,

and gradual tightening of monetary policy in United States

influenced the global outlook. Growth in emerging and

developing economies contributed to 70% of global growth

in 2015.

Economic adjustments on the back of global slowdown will

have material impact on economic recovery. While deflation

and revitalisation of European Union and Japan has led to

central banks undergoing quantitative easing programmes,

United States is looking at rate hikes this year on the back

of strengthening economy and wage escalations. Some

improved data releases like firming of oil prices, support by

major central banks, and lower capital outflows from China

are resulting in improved investor sentiments.

GDP Growth Trend (%)

Key Snapshot

- The US economy grew by 2.4% in CY 2015, just as

it did in CY 2014. The challenges were weaker than

expected domestic demand, lacklustre performance

of the manufacturing sector, declining exports due to

stronger dollar and adverse external trade environment.

- The Euro Area as a whole grew by 1.6% in CY 2015,

faster than CY 2014. The economy received robust

support from three tailwinds: a) lower oil prices

(bolstering consumer expenditure / domestic demand);

b) expansionary fiscal policies; and c) an accommodative

ECB. The challenges, however, were: sub-zero inflation,

high non-performing loans and debt trajectories, low

investment and eroding skills of the working population

due to long-term high unemployment in the region.

- Economic growth for China was 6.9% in CY 2015. The

slowdown and rebalancing of the economy led to a

decline in investment in real estate, manufacturing and

allied industries.

- The economic performance of many African economies

was lower than expectations. Resource-rich countries in

Africa suffered owing to a decline in commodity prices

and also because their frontier markets were adversely

affected by tighter global financing conditions.

Indian Economy

India’s economic growth for 2015-16 was 7.6%, overtaking

its formidable economic rival China (Source: CSO). The

decline in oil price, while affecting large parts of the world,

has helped the economy lower its huge import bill. The

Government of India has also ushered in a series of reforms

in agriculture, manufacturing, infrastructure and services

sectors to bolster economic performance and make growth

more inclusive. Declining fiscal deficit, moderating inflation

and a comfortable interest rate trajectory were definite

positives as well. India stands out as one of the rising stars in

a world characterised by volatility and financial turbulence on

account of its economic stability, favourable demographics,

proactive Central Bank and a Government focused on

consistent reforms.

Key Snapshot

- The Union Budget 2016-17 focused on enhancing

farm output and welfare of farmers.

- Consistent fiscal consolidation has reduced

Government’s fiscal deficit to close to 4% of GDP (on

a 12-month rolling basis), down from a peak of 7.6% in

2009.

- The Government’s Make in India initiative has been

a resounding success. It has encouraged domestic

entrepreneurship and even attracted FDI to the country

significantly. In the period of 17 months (October 2014

to February 2016) after the launch of Make in India,

FDI inflows increased by 37% (Source: Ministry of

Commerce and Industry).

- Digital India will have a transformational impact on

Indian society. It represents a connected society, where

every citizen will be connected to the internet. This will

help enhance education, employment, efficiencies,

governance and controls.

- Internet penetration is around 30% in India; and is

projected to touch around 35% next year (Source:

IAMAI).

- The Government’s Smart Cities Mission is a revolutionary

concept in terms of overall infrastructure, sustainable

real estate, communications and market viability. There

are many technological platforms involved, including

but not limited to automated sensor networks and data

centres

African Economy

Africa’s economy as a whole remained more resilient

to global volatilities, compared to many other emerging

and developing regions. The continent’s growth enablers

comprise: the vastly improved macroeconomic environment,

benefiting businesses; reduction of external debt and social

conflicts; improved political and economic governance;

growing domestic demand; buoyant services sector; financial

services growth in line with an upswing in information and

communications technology; and rapid internet penetration.

Poverty in the continent is also seeing a declining trend.

Africa’s young and aspirational population is acting as

an agent of change in largely conservative societies. The

continent’s youth bulge will drive the next era of growth and

transformation.

Key Snapshot

- A large African middle-class is emerging, over

350 Mn people, driving the culture of innovation and

policymaking.

- Africa is the world’s second fastest growing FDI

destination, just behind Asia Pacific.

- Sustainable policies for urbanisation, manufacturing

growth, agricultural output, along with education and

empowerment can act as key catalysts.

- Less focus on oil exports and other commodities will

augur well for the economy, going forward.

South Asian Economies

Bangladesh shows significant potential in South Asia. It

has a stable democracy with focus on empowerment from

grassroots. The economy’s key growth enablers comprise:

growing manufacturing and construction sector, robust

service sector and higher private consumption bolstered

by remittances. These pivots have resulted in sustainable

economic growth for the nation.

Sri Lanka is also a stable, democratic society with focus on

inclusive growth. The island nation’s economic potential

is considerable. The country has a strong base of human

capital and reliable infrastructure. It also occupies a strategic

position in Asia, the fastest growing region in the world; and

investments over the last decade (especially in ports and

other transport-related facilities) can take advantage of this

opportunity.

Key Snapshot

- Bangladesh’s GDP grew by 6.6% in 2015 vis-à-vis 6.1%

in 2014.

- Growth is expected to further inch up to 6.7% in 2016,

led by strong garments exports and rising private

consumption as government employees get wage

increase.

- Real GDP growth for Sri Lanka was 4.8% in 2015

(broadly unchanged from 2014), driven by robust

growth in services and agriculture, as well as a positive

contribution from manufacturing.

- Sri Lanka’s economy is expected to grow by 5.3%

and 5.8% in 2016 and 2017, respectively on back of

strong domestic demand, and higher private and public

investments.

Megatrends that drive the Company’s business

- Internet users in India have risen from 50 Mn in 2007 to

100 Mn in 2010; and more than 300 Mn in 2015. Of the

306 Mn internet users as on December 2015, 219 Mn

users are from urban India. The urban user base grew

by 71% year-on-year. On the other hand, the rural user

base went up by 93% from December 2014 to reach

87 Mn at the end of December 2015.

- India is a lucrative market for global and domestic

smartphone manufacturers. Smartphone shipments

increased by 55% between 2014 and 2015 (Source –

IDC). The country has an established base of 184 Mn

users. Enhanced focus on manufacturing affordable

handsets with indigenous technology will further spur

mobile telephony.

- With rise in affordable smartphones and more users

preferring 3G / 4G, data usage is likely to grow by 12

times from 2015 to 2020. Mobile data traffic increased

by 89% between 2014 and 2015; and mobile data

traffic grew by 2.4 times faster than India’s fixed IP traffic

(Source: Cisco VNI forecasts). Network migration from

2G to 3G / 4G is driving a change in data consumption

from low bandwidth to high-bandwidth applications,

along with more availability of relevant content.

- India is in a sweet spot to leverage market opportunities

emerging through Internet of Things (IoT). A strong

ecosystem of IT organisations, renewed focus on

manufacturing, significant opportunities in education,

healthcare and agriculture; and enormous growth

in mobile internet usage will act as key catalysts in

supporting investments in IoT. The Government of

India’s initiative of smart cities requires seamless digital

and physical infrastructure to be shared efficiently

across devices and applications; IoT will play a critical

role in fulfilling this vision.

- Convergence is a global trend for the telecom

business of the future. It enables a user to have a

uniform experience, both at home and on the move.

Combination of conveniences, freedom of movement,

and personalised services, along with high quality and

speed of fixed communications will enable a seamless

network experience for the end user.

- India is on the cusp of a huge digital revolution. Digital

Literacy Mission will touch 60 Mn rural households as

per the Union Budget of India 2016. The Government of

India also plans to connect 550 farmer markets in the

country through the use of technology. The Digital India

drive will bring along a transformative impact on every

citizen through the medium of internet.

- The proposed policy environment through M&A rules,

spectrum sharing guidelines and 20-year spectrum

positions for telecom operators not only enhances

business certainty, but also encourages industry

consolidation and healthy growth. The gains in network

efficiency that sharing can provide will benefit operators

and customers alike. Upcoming auctions will further

help in building stronger networks.

- Mobile banking is on a rise in India and Africa. India’s

largest wallet company has around 120 Mn wallets

with other companies estimated to have 30 Mn+. This

is significantly more than the number of credit cards in

India. Additionally, mobile phone banking technology

is bringing more people in Sub-Saharan Africa into the

formal financial sector and the economy more broadly.

- Africa, with a median population of less than 20

years, is on the cusp of a mobile data revolution as

3G and 4G deployments gather scale with more

affordable handsets available. Mobile data is helping

people elevate their lives with a large proportion of

the population relying on the internet for education,

financial transactions, healthcare, and so on.

- E-commerce is at the epicentre of Africa’s thriving

economy. The continent’s digital evolution is a promising

prospect with the e-commerce market expected to be

worth approximately USD 50 Bn by 2018. India has

an exciting ecommerce story as well, with online retail

growing 4.5x in the last three years. India’s e-commerce

industry is likely to be worth USD 38 Bn by 2016, a 67%

surge over the USD 23 Bn revenues for 2015 (Source:

Deloitte).

Industry Overview

Indian Telecom Sector

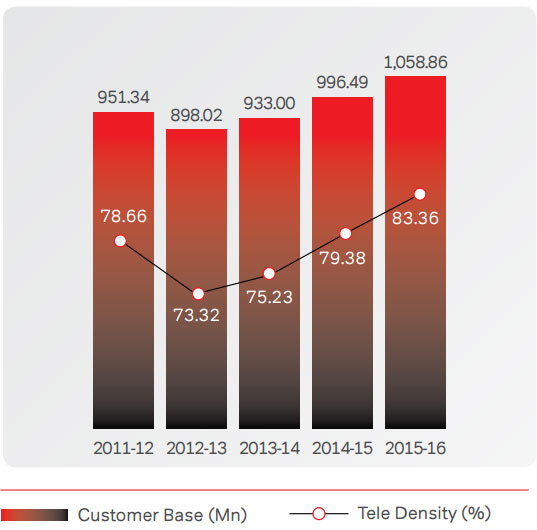

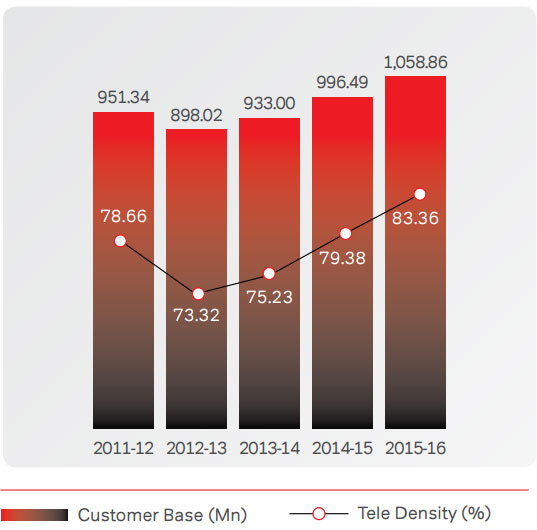

India’s total customer base stood at 1058.86 Mn with a teledensity

of 83.36%, as on March 31, 2016, having grown from

a base of 996.49 Mn and tele-density of 79.38% last year.

The urban tele-density stood at 154.01%, whereas the rural

tele-density stood at 51.37%, as on March 31, 2016. India’s

telecom market is witnessing a strong growth of internet

users; and now has the world’s second highest number of

internet users. The wire-line customer base is 25.22 Mn at

the end of March 31, 2016 vis-à-vis 26.59 Mn at the end of

March 31, 2015.

Among the service areas excluding metros, Himachal

Pradesh has the highest tele-density (127.41%) followed

by Tamil Nadu (118.12%), Punjab (106.09%), Kerala

(102.27%), Karnataka (101.88%), Gujarat (100.05%) and

Maharashtra (98.98%). Among the three metros, Delhi tops

with 236.30% tele-density. On the other hand, the service

areas, such as Bihar (54.31%), Assam (57.55%), Madhya

Pradesh (64.18%), Uttar Pradesh (65.83%) and Odisha

(69.09%) have comparatively low tele-density.

Rural penetration (low at nearly 50%) represents huge

headroom for growth. With urban tele-density crossing

150%, internet penetration and experience will be the key

drivers of growth in urban areas. With the government’s

favourable regulation and policies and the developing 4G

ecosystem, India’s telecommunication sector is expected to

witness an explosive data growth in the next few years.

Tele Density: India (%)

During the year, the Company introduced a comprehensive

network transformation programme - Project Leap aimed

at delivering a world class network. This programme will

see an investment of ` 600,000 Mn in the next three years.

The programme will help Airtel build a smart and dynamic

network that will significantly improve the quality of both

voice and data services across India. The programme aims

to deliver a truly differentiated customer experience and

reinforce its commitment to build a future-ready network.

Airtel has acquired rights to use 2x5 MHz spectrum in

the 1800 MHz Band from Videocon Telecommunications

Limited (VTL) which was allotted to VTL by the Department

of Telecommunication (DoT) on April 05, 2013 for six

circles, namely, Bihar, Haryana, Madhya Pradesh, UP (East),

UP (West) and Gujarat at an aggregate consideration of

` 44,280 Mn.

Bharti Airtel Limited and its subsidiary, Bharti Hexacom

Limited entered into definitive agreements with Aircel

Limited and its subsidiaries Dishnet Wireless Limited and

Aircel Cellular Limited to acquire rights to use 20 MHz 2300

Band 4G TD spectrum for eight circles namely, Tamil Nadu

(including Chennai), Bihar, Jammu & Kashmir, West Bengal,

Assam, North East, Andhra Pradesh; and Odisha at an

aggregate consideration of ` 35,000 Mn. The closing of the

said transaction is subject to certain customary regulatory

approvals and other closing conditions.

During the year, the Company had launched 3G services

in its gap circles and the high-speed 4G services were also

commercially launched across India.

With the proposed spectrum acquisitions from Videocon

and Aircel, the Company is set to become a pan-India 4G

operator.

African Telecom Sector

Africa is among the fastest growing regions, but had faced

significant headwinds in the last year as a result of global

trends and region specific issues. The global commodity

super-cycle has come to an end, sharply lowering the price of

oil, gas, metals and minerals. As a net commodities exporter,

Africa is deeply affected by falling commodity prices, putting

pressure on the current account and fiscal balances.

The revenue-weighted currency depreciation vis-à-vis the US

Dollar across 17 countries in Africa over the last 12 months

(exit March 31 rates) has been 5.7%, primarily caused by

depreciation in Malawi Kwacha by 54.9%, Zambian Kwacha

by 45.1% and Tanzanian Shilling by 17.3%. In terms of

the 12-month average rates, the revenue-weighted Y-o-Y

currency depreciation has been 18.3%, mainly caused by

depreciation in Zambian Kwacha by 51.8%, Malawi Kwacha

by 32.1%, Ugandan Shilling by 25.1%, Nigerian Naira by

18.0% and CFA by 14.2%.

However, Africa’s market with a billion-plus population

promises considerable opportunities for African telecom

sector. Data and mobile money have a significant potential

for sustained growth; and with increasing adoption of

smartphones this trend is set to continue.

Development in Regulations

The year saw several regulatory changes and developments.

The significant regulatory changes were:

India

- Sharing of Active Infrastructure: In February 2016, the

Department of Telecommunications issued Guidelines

for Sharing of Active Infrastructure among service

providers, based on mutual agreements. As per the

guidelines, active infrastructure sharing will be limited

to antenna, feeder cable, Node B, Radio Access Network

(RAN) and transmission system only.

- Valuation and Reserve Price of Spectrum: In January

2016, TRAI issued its recommendation on Valuation

and Reserve price of Spectrum in 700 MHz, 800 MHz,

900 MHz, 1800 MHz, 2100 MHz, 2300 MHz and 2500

MHz Bands. As per the recommendation, auction in all

the bands should be conducted simultaneously. DoT

should carry out carrier re-assignment exercise in the

800 MHz band at the earliest; and ensure that the entire

spectrum that is available for commercial use is put to

auction and it should be in contiguous blocks. Spectrum

in 700 MHz band should be offered in the block size of 5

MHz (paired). In case a TSP is able to win more than one

block of spectrum in the upcoming auctions, it should be

allocated spectrum in contiguous blocks.

- Liberalisation of Spectrum: On November 05, 2015,

the Department of Telecommunications issued the

Guidelines on Liberalisation of Administratively allotted

spectrum in 800 MHz and 1800 MHz band in a service

area for the balance validity period of right to use of

spectrum, after payment of auction determined price,

prorated for the balance validity period. The entry fee

paid will be pro-rated for the balance validity period of

the right to use spectrum; and will be deducted from the

total amount to be paid by the TSP for liberalising the

spectrum. In case the spectrum gets liberalised, the One

Time Spectrum Charges (OTSC) will be charged and the

same has to be paid by the licensee.

- DoT guidelines on Spectrum Trading: In October 2015,

the DoT issued the guidelines on Spectrum Trading.

Spectrum Trading shall be allowed between two access

service providers, holding Cellular Mobile Telephone

Service (CMTS) / Unified Access Service License (UASL)

/ Unified License (Access Services) (UL(AS)) / Unified

License (UL) with authorisation of Access service in

a licensed service area. All access spectrum bands

earmarked for Access Services by the Licensor will be

treated as tradable spectrum bands. Only that spectrum

can be traded that has been assigned through an auction

in 2010 or afterwards, or on which TSP has already paid

the prescribed market price.

- TRAI releases Telecom Consumers Protection (Ninth

Amendment) Regulations, 2015 on Call Drop: On

October 16, 2015 TRAI releases Telecom Consumers

Protection (Ninth Amendment) Regulations, 2015 on Call

Drop, which mandates the originating service provider

providing Cellular Mobile Telephone Service, for each call

drop within its own network compensate the consumer

by crediting the account of the calling consumer by

1 rupee subject to a maximum of 3 dropped calls in a

day; and inform the consumer within four hours of the

occurrence of a call drop. The Supreme Court ruled in

favour of Telco’s where it struck down TRAI’s directive.

- Spectrum Sharing: On September 24, 2015 the

Department of Telecommunications issued the

guidelines on Spectrum Sharing. Spectrum sharing will

be allowed only for the access service providers holding

CMTS license, UASL, UL (AS) and UL with authorisation

of Access Service in a Licensed Service Area (LSA),

where both the licensees are having spectrum in the

same band. Both the licensees shall ensure that they

fulfill the specified roll-out obligations and specified

Quality of Service norms.

- TRAI’s recommendations on ‘Introducing Virtual

Network Operators in Telecom Sector’: In May 2015,

TRAI made its recommendations on Introducing Virtual

Network Operators in telecom sector to DoT. Virtual

Network Operators (VNO) to be introduced through a

proper licensing framework. The terms and conditions of

sharing of infrastructure between the Network Services

Operator (NSO) and VNO should be left to the market i.e.

on the basis of mutually accepted terms and conditions

between the NSO and the VNO. An NSO shall allocate

a numbering range to their VNO(s) from the numbering

range allocated to it by the licensor. VNOs shall also

utilise the LRN and network codes of the parent NSO for

the purpose of routing of calls.

Africa

- Zambia, Tanzania, Malawi and Other SADC

Countries: The Governments within the SADC region

have commenced bilateral arrangements to implement

the Roam Like at Home tariffs imposed by the SADC

governments.

- Burkina Faso and Congo B: The Regulator has

performed a cost study to determine the interconnect

rates that will be applicable in 2016. Basis that, the

Regulator has kept the rates unchanged.

- Rwanda: The interconnect rates glide path, which had

been set by the Regulator has come to the end of the

term. Operators are now awaiting new rates from the

Regulator.

- Uganda: The Regulator has indicated that it will review

the interconnect rates; and is in the process of recruiting

a consultant to handle the process.

- Burkina Faso: The Regulator is proposing the introduction

of a tax on incoming international traffic. The industry is

in discussion with the Regulator on this matter. So far no

decision has been taken for its implementation.

- Tanzania: The Government of Tanzania in October 2015

had passed a new regulation that requires Telco’s to list

on the Dar es Salaam Stock Exchange within 12 months,

failing which they have to make a contribution of 0.6% of

its annual gross revenues to the ICT development fund.

- Uganda, Kenya and Rwanda: The Governments in

these three countries are pushing forward the agenda

of the One Area Network. In the last quarter these

Governments have proposed to expand the scope of

services under the regulated tariff to SMS and Data.

- Nigeria: Nigerian Communications Commission (NCC)

has released the Information Memorandum for 2.6

GHz spectrum auction for LTE and has also shared the

consultation paper on Procedures and Guidelines for the

provision of Value Added Services in Nigeria.

- Ghana: The Regulator has proposed to license frequency

in the 800 MHz band. This comes with an obligation for

local shareholding of up to 40%. Consultations between

the industry and the Regulator have taken place and the

final decision is awaited.

- Zambia: The Regulator is proposing to introduce a

unified licensing regime. If this proposal is adopted, it

will affect the existing rights and obligations under the

current licensing. It will also affect our spectrum holding

and introduce new acquisition costs.

- Kenya: The Regulator has agreed to make available to

Airtel at least 10 MHz of the available 800 MHz spectrum

for LTE. The price for the same is under discussion with

the Regulator.

- Niger: The Government has put in place a new law

proposing the introduction of an exclusive international

gateway, which is in violation of the mobile operators’

license.

- DRC: There is a proposed new law that will if passed;

affect the terms and conditions of the license. Some of

the proposals include restrictions on license ownership,

nationalisation of infrastructure and tariff control.

Industry is in discussion with the Regulator to review the

proposed law.

- Malawi: There is a requirement in the license that

the Company should have a minimum of 20% local

shareholding. Airtel has received a written extension of

the 20% local shareholding obligation for another 1.5

years from February 2016.

SCOT Analysis

Strengths

- Spectrum: Strong and expanding network

– Pan India 4G spectrum and 3G spectrum

in 21 circles. Wide spectrum presence with

21.1% spectrum market share (post deals

with Videocon and Aircel); 4G and 3G carrier

aggregation available in 12 and 8 circles,

respectively.

- Presence: #1 telecom player in India and #3

worldwide. The Company is present in 20

countries across South Asia and Africa.

- Scale: The Company’s revenue market share

is the highest in the industry. It also has the

highest subscriber market share with the

largest net additions this year.

- Diversified Portfolio: Vast product line, which

includes telecom services like DTH, Telemedia,

Airtel Business and Tower Infrastructure. The

portfolio also includes other bundled services

like Wynk music, movies, and mobile wallet.

Challenges

- Operations: Geographically varied presence,

integrating operations across India, South Asia

and Africa leveraging common platform.

- Customer Needs: Understanding changing

customer expectations and perceptions in a

fast evolving multi-cultural, multi-lingual, and

multi-technological environment.

- Technological: Harmonisation of multi-band

sub 5MHz of spectrum.

Opportunities

- Data Usage: Data explosion is at its cusp with

the proliferation of affordable smartphones.

Data uptake has also increased with usage

moving from low to high bandwidth content.

- Convergence: Newer and converged needs

across technologies and services targeted to

specific customer segments.

- Internet Space: Significant opportunities

thrown up by the internet across payment

mechanisms, e-commerce, m-commerce

and IoT.

- Investments: Large residual opportunity with

bulk investments in place. Best pan-India

spectrum assets with prime spectrum to yield

data uptake, largest optical fibre network

amongst private players.

Threats

- Competition: Competitor launches and its

impact on the overall industry structure and

profitability, especially data rates across

4G + 3G.

- OTT: Cannibalisation of traditional voice

and messaging – further aggravated by OTT

applications gaining scale.

- Regulatory: Political and economic

uncertainties in Africa and India due to

changes in policies.

- Currency Exposures: Volatility in currencies

due to global macro-economic uncertainties.

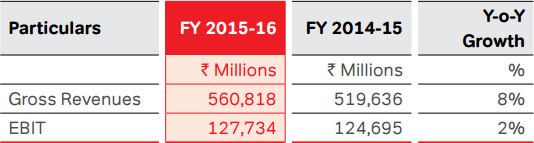

Financial Review

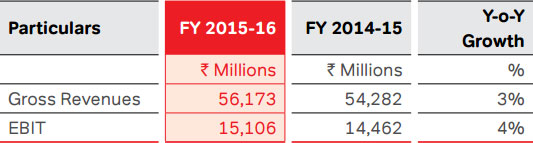

Consolidated Figures

Standalone Figures

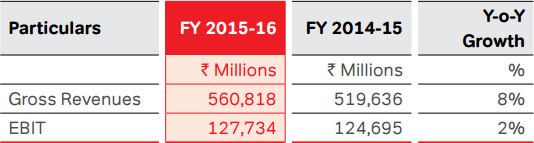

The Company’s consolidated revenues grew by 4.9% to

` 965,321 Mn for the year ended March 31, 2016 (growth of

6.9% after normalising for impact of IUC in India and impact

of divestment of tower assets in Africa). The revenues for

India and South Asia (` 723,881 Mn for the year ended

March 31, 2016) represented a growth of 9.6% compared to

that of previous year (growth of 12.2% after normalising for

impact of IUC in India). The revenues for Africa, in constant

currency terms, grew by 3.1% (growth of 4.2% adjusting for

the impact of divestment of tower assets).

The Company incurred operating expenditure (excluding

access charges, cost of goods sold, license fees and CSR

costs) of ` 413,886 Mn representing an increase of 2.9%

over the previous year. Consolidated EBITDA at ` 341,902

Mn grew by 8.7% over the previous year. The Company’s

EBITDA margin for the full year touched 35.4% vis-à-vis

34.2% in the previous year, primarily due to tighter opex

controls (after adjusting for the impact in reduction of

termination rates, EBITDA margin for the previous year was

34.6%). Depreciation and amortisation costs for the year

were higher by 12.4% to ` 174,498 Mn primarily on account

of spectrum related amortisation cost in India. Consequently,

EBIT at ` 166,434 Mn increased by 5.0%, resulting in a

flat margin of 17.2% vis-à-vis the previous year. The cash

profits from operations (before derivative and exchange

fluctuations) for the year ended March 31, 2016 stood at

` 289,152 Mn vis-à-vis ` 285,280 Mn in the previous year.

Net finance costs at ` 68,866 Mn were significantly higher

by ` 20,403 Mn, compared to that of previous year, primarily

on account of higher interest on borrowings due to spectrum

borrowing cost, higher interest on finance lease obligation

and lower investment income. The Forex and derivative

losses were lower at ` 18,108 Mn (PY: ` 21,530 Mn).

Consequently, the consolidated profit before taxes and

exceptional items at ` 106,200 Mn has declined by 8.2%

over the previous year.

The consolidated income tax expense (before the impact on

exceptional items) for the full year ending March 31, 2016

was almost flat at ` 53,180 Mn, compared to ` 52,928

Mn for the previous year. The effective tax rate in India for

the full year came in at 30.2% (28.8% excluding dividend

distribution tax) compared to 26.5% (25.5% excluding the

impact of dividend distribution tax) for the full year ended

March 31, 2015. The increase in the underlying effective tax

rate in India is primarily on account of expiry / reduction of

tax holiday benefits in select units. The tax charge in Africa

for the full year at USD 189 Mn (PY: USD 203 Mn) has been

lower, primarily due to change in profit mix of the countries.

Exceptional items during the year accounted for net gains

of ` 7,097 Mn. These included impact of gains / losses

on divestment of telecom towers, settlement of various

disputes, few restructuring and integration activities and

revisiting certain accounting positions. After accounting for

exceptional items, the resultant consolidated net income

for the year ended March 31, 2016 touched ` 54,842 Mn,

a 5.8% escalation over the previous year. Net income before

exceptional items for the full year touched ` 47,745 Mn, a

21.5% decline over the previous year.

The capital expenditure for the full year was ` 205,919 Mn

(USD 3.1 Bn), an increase of 10.3%, vis-à-vis the previous

year. Consolidated operating free cash flow for the year

reflected an increase of 6.4% to ` 135,982 Mn.

During the year, the Group has designated the USD

denominated finance lease obligations (‘FLO‘) resulting from

the sale and lease back of telecom tower assets in Africa,

as a hedge against the net investments in subsidiaries with

USD functional currency. The effective portion of the foreign

exchange movements on the hedging instrument has been

recognised in other comprehensive income, so as to offset

the foreign exchange movement on the net investments

being hedged. Accordingly, during the year, foreign exchange

loss of ` 708 Mn (net of tax and non-controlling interests)

has been recognised in other comprehensive income.

Liquidity and Funding

During the year, the Company undertook several initiatives

to meet and manage its long term funding. Primarily in Q1,

the Company raised USD 1,000 Mn through the issuance

of 4.375%, Guaranteed Senior Notes due 2025 at an issue

price of 99.304%.

As on March 31, 2016, the Company was rated ‘Investment

Grade’ with a ‘Stable’ outlook by all three international

credit rating agencies namely Fitch, Moody’s and S&P. It

had cash and cash equivalents of ` 37,087 Mn and short-term investments of ` 30,059 Mn. During the year ended

March 31, 2016, the Company generated operating free

cash flow of ` 135,981 Mn. The Company’s consolidated net

debt as on March 31, 2016 increased by USD 1,982 Mn to

USD 12,661 Mn as compared to USD 10,679 Mn last year,

mainly on account of deferred payment liabilities to the DoT

being included in debt. The Net Debt excluding the DoT

obligations stood at USD 7,508 Mn as on March 31, 2016

i.e. it decreased by USD 884 Mn over the previous year (USD

8,392 Mn as at March 31, 2015). The Net Debt - EBITDA

ratio (USD terms LTM) as on March 31, 2016 deteriorated to

2.47 times as compared to 2.08 times in the previous year,

mainly on account of increase in debt during the year. The

Net Debt-Equity ratio increased to 1.28 times as on March

31, 2016, compared to 1.08 times in the previous year.

Awards and Recognition

- Airtel is No. 1 Telecom Company in the ‘Best Telecom

companies to Work for in India’ survey conducted by

Business Today and No. 8 across all sectors.

- Airtel has won the ‘Golden Peacock Award for

Sustainability’ for 2015. It is indeed an honour to receive

this award as it recognises Airtel’s efforts in embedding

sustainability in the services we provide; and the way we

conduct our business. This award brings Airtel a step

closer to achieving our vision of becoming the most

loved brand.

- Airtel wins Innovation Award 2016 for excellence in

Internal Auditing by the Institute of Internal Auditors (IIA).

- Airtel has been honoured as the Firm of the year -

Telecommunication at the CNBC TV18 India Risk

Management Awards.

- Airtel Global Revenue Assurance & Fraud Management

team wins the Operator Excellence award in the category

of Business Innovation in Risk Management at Subex

user conference organised at Prague, Czech Republic.

Airtel wins Annual Cybermedia ICT Business Awards for

being ‘India’s Top Mobile Services Operator‘, Top Internet

Services Operator” & “Top Broadband Wireless Access

Operator” award for the year 2015.

Segment-wise Performance

B2C services

Mobile Services: India

Overview

The last year saw significant business and regulatory

developments, which also include the release of spectrum

sharing and trading guidelines by the Department of

Telecommunications. The Company launched 3G services in

its gap circles and was the first operator to launch high speed

4G services across India. With the spectrum acquisitions

from Videocon and the proposed spectrum acquisition

from Aircel, the Company is set to become a pan-India 4G

operator. It also widened its content portfolio by launching

Wynk Movies and Wynk Games mobile application.

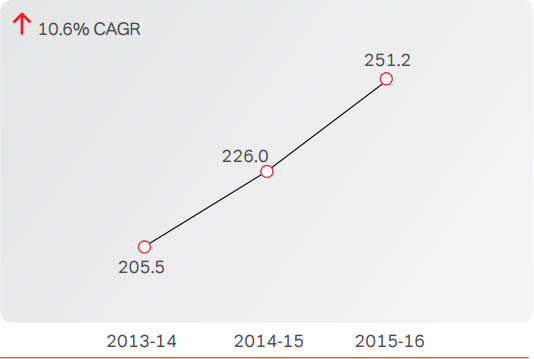

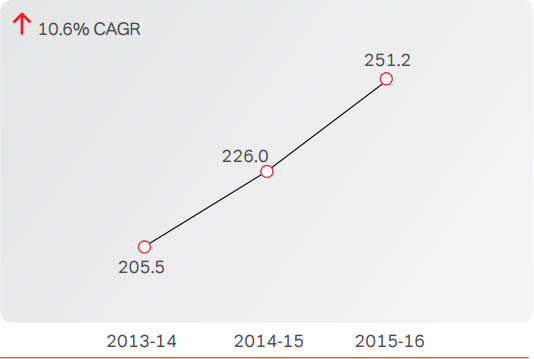

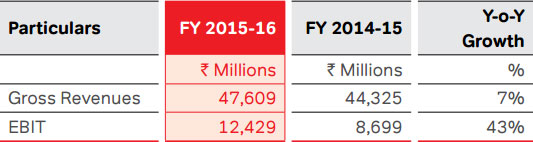

As on March 31, 2016, the Company had 251.2 Mn mobile

customers. The churn has increased to 3.4% for the current

year, compared to 2.7% during the previous year, primarily on

account of enhanced market intervention and competitive

pressure; however, it still remains the lowest in the

industry. Data revenues, as a percentage of total revenues,

significantly increased from 15.2% to 21.8% in the current

year. Of its total number of mobile subscribers, the Company

had 58.2 Mn data customers at the end of March 31, 2016,

of which 35.4 Mn were mobile broadband customers.

The segment witnessed significant improvement in the

EBITDA margin to 39.0% during the year, compared to

37.6% in the last year. Improvement in margin is primarily

due to the sustained top line growth and tighter control

over operating expenses. EBIT margin for the year declined

to 22.8%, compared to 24.0% in the last year, primarily on

account of incremental amortisation cost on new spectrum

acquired, which has an impact on EBIT margin of 2.3%.

Wireless Subscribers: India (Million)

During the year, the Company accelerated its spends on

capex, which were largely directed towards building data

capacities, increasing 3G / 4G coverage and improving the

all-round customer experience. During the year, the Company

rolled out over 63 K mobile broadband (MBB) base stations

in India. This is one of the largest global rollouts of MBB base

stations in a single year. The Company had 154,097 network

towers, compared to 146,539 network towers in the last year.

Mobile broadband (MBB) base stations were 118,197 at the

end of the year, compared to 54,381 at the end of last year.

Key Initiatives

- Airtel has introduced its new range of ‘Infinity Plans’ and

an industry first technology platform – Flexpage. While

the Infinity Plans represent an industry first plan to offer

unlimited voice calls on mobile, along with bundled

movies and music, the Flexpage is an automated

platform that allows customers to track their data usage

and get real-time usage alerts.

- Airtel launched ‘Wynk Movies’ – it’s an all new carrier

agnostic mobile application offering customers

thousands of movies and other video content. Launched

following the success of Wynk Music, the app is

India’s first curated video marketplace that offers an

exhaustive library of popular movies, TV shows and

other entertainment videos across genres. It also has a

comprehensive library of 5,000+ movies and 25,000+

videos.

- Airtel mobile moves all its prepaid mobile customers to

per second billing. Rolled out under the new Pay for What

You Use initiative as part of the Company’s Customer

First commitment, this will help ensure that customers

pay only for the time they use the Airtel network.

- Airtel revolutionised the smartphone experience for

every customer by offering irresistible data benefits

and surprises ranging from 50% daily Data ‘Cashback‘

offer, sharing of 3G / 4G packs in Family as well as

Smartphone Surprise offers; a pioneering initiative in

India. With this, Airtel has further established itself as an

undisputed preferred partner for data experience on any

smartphone.

- Airtel launched India’s first unrestricted-validity data

plan for its prepaid mobile customers. The Company

reinforced its commitment of Customers First by

enabling its prepaid users to enjoy unrestricted validity

towards consuming their data quota.

- Airtel expanded its content portfolio by launching

beta phase of ‘Wynk Games’ mobile application – the

Company’s latest OTT addition to the Wynk portfolio.

The app offers a library of over 2,000 global and local

games from across genres. ‘Wynk Games’ subscription

is free for Airtel users and at a promotional price of ` 29

for other customers in the current beta phase of the app.

- Airtel invited customers in its network modernisation

drive by, launching a microsite www.airtel.in/leap. It allows

the customers to know everything they want to know

about project leap; and get a transparent view of the

coverage of voice and high speed broadband services,

along with other details in their respective localities. This

is an industry first initiative.

- Airtel network transformation programme Project Leap

is now focusing on a series of fresh initiatives towards

creating a greener environment and building a sustainable

network for the future. The Company announced the

migration of 40,000 of its network sites across India to

green technology, while committing to bring down its

carbon emission footprint by 70% by 2018.

- Airtel became the first mobile operator in India to

commercially deploy LTE-Advanced (4G+) technology

on a live 4G network in Kerala. LTE-Advanced carrier

aggregation technology combines TD LTE (2300 MHz)

with FD LTE (1800 MHz) bandwidths to deliver mobile

data speeds up to 135 Mbps. This is also an industry first

initiative.

- Airtel announced the launch of its Platinum 3G network

for customers in the North East. Airtel’s Platinum 3G will

deliver faster internet speeds, enhance voice clarity and

offer a superior network experience for customers in the

circle.

Key Highlights

- RBI approved Payments Bank License to Airtel Payments

Bank Limited (APBL) (formerly known as Airtel Commerce

Services Limited (AMSL)). The Reserve Bank of India had

decided to grant an ‘in-principle’ approval to APBL to set

up a Payments Bank in India. APBL already offers Airtel’s

flagship semi-closed wallet under the brand name ‘Airtel

Money’.

- Airtel has acquired rights to use 2x5 MHz spectrum

in the 1800 MHz Band allotted to Videocon

Telecommunications Limited (VTL) by the Department of

Telecommunication (DoT) on April 05, 2013 for six circles,

namely, Bihar, Haryana, Madhya Pradesh, UP (East), UP

(West) and Gujarat at an aggregate consideration of

` 44,280 Mn.

- Bharti Airtel Limited and its subsidiary, Bharti Hexacom

Limited entered into a definitive agreement with Aircel

Limited and its subsidiaries Dishnet Wireless Limited and

Aircel Cellular Limited to acquire rights to use 20 MHz

2300 Band 4G TD spectrum for eight circles namely,

Tamil Nadu (including Chennai), Bihar, Jammu & Kashmir,

West Bengal, Assam, North East, Andhra Pradesh and

Odisha at an aggregate consideration of ` 35,000 Mn.

The closing of the said transaction is subject to certain

customary regulatory approvals and other closing

conditions.

- Airtel signed an agreement to acquire 100% equity stake

in Augere Wireless Broadband India, which holds 20

MHz of BWA spectrum in the telecom circle of Madhya

Pradesh and Chhattisgarh.

- Kotak Mahindra Bank Limited (KMBL) and Airtel

Payments Bank Limited signed the Share Subscription

and Shareholders Agreement, wherein, KMBL agreed to

acquire 19.90% of the paid-up capital of APBL.

Telemedia Services

Overview

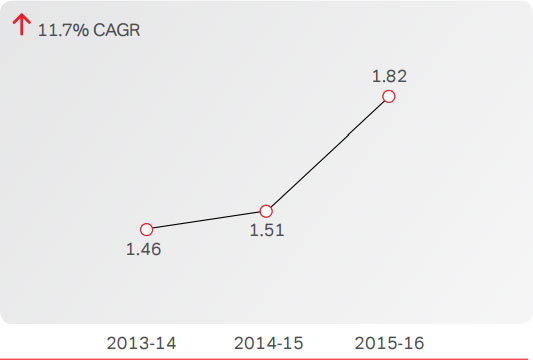

The Company provides fixed-line telephone and broadband

(DSL) services for homes, as well as offices in 87 cities across

India. The Telemedia business witnessed a record high DSL

net addition of 309 k, seven times compared to previous year,

primarily driven by launch of innovative pricing plans and an

aggressive Go-to-Market strategy. As on March 31, 2016,

Airtel had 3.7 Mn customers. Of these, 1.8 Mn customers

subscribed to its broadband / internet services, representing

49.6% compared to 44.2% last year. The higher number of

broadband customers also resulted in a significant increase

in ARPU to ` 1,063 during the year, compared to ` 1,026

in the previous year. Consequently, non-voice revenue as

a percentage of total Telemedia revenues now represents

68.2% as compared to 64.9% in the last year.

In the Homes segment, the offerings include high-speed

broadband on copper and fibre, up to the speeds of 100

Mbps. Besides, the product portfolio also includes local,

national and international long-distance voice connectivity,

IPTV and other VAS services. Majority of the DSL Net additions

as referred above has come in the Homes Segment.

In the Corporate Business segment, Airtel is a trusted ICT

solution provider for fixed-line voice (PRIs, SIP trunking), data

solutions (ILP, MPLS, NLD) and other connectivity solutions

like Enterprise Mobility (Resource Tracking, IOT / M2M).

Additionally, the Company offers solutions to businesses

to improve employee productivity through collaborative

solutions (Audio, Video and Web Conferencing). Cloud

portfolio is also an integral part of its business solutions

suite, which offers storage, compute & Microsoft Office 365

on a pay-as-you-go model.

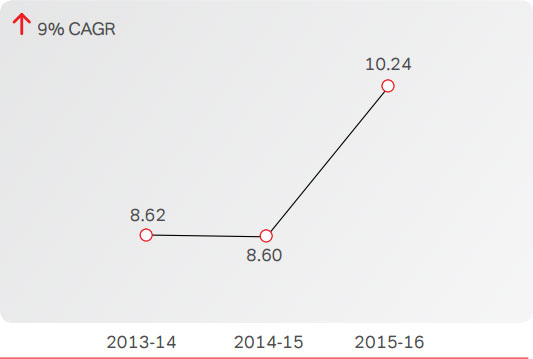

Broadband Users (Million)

Key Initiatives

- On the Homes front, significant progress was made

in the endeavour to pioneer high-speed broadband

through FTTH and VDSL rollouts in the top markets.

Another key intervention was improvement in the quality

of acquisition through focused interventions and plan

/ price rationalisation, resulting in lower churn. Focus

on high-speed internet during both - acquisition and

base migration, resulted in high-speed base (defined as

greater than or equal to 4 Mbps) moving to 59% at the

end of the year as against 46% last year.

- On the Corporate Business front, significant progress

was made in ICT solutions both in terms of increasing

geographic coverage - making all sites RF ready & faster

implementation with defined timelines. On product front,

layered internet offerings created for servicing customer

needs of all segments.

- Airtel rolled out irresistible offers on its home broadband

plans for existing as well as new customers, called as

“Airtel Surprises”. It enables the existing customers to

upgrade to higher speeds or additional data benefits on

their existing plans completely free of cost and enables

its new customers to avail the best possible internet

speed at their home at no extra cost.

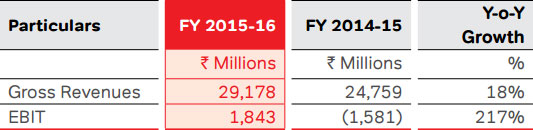

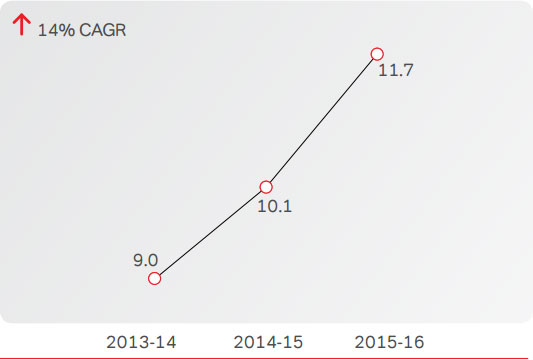

Digital TV Services

Overview

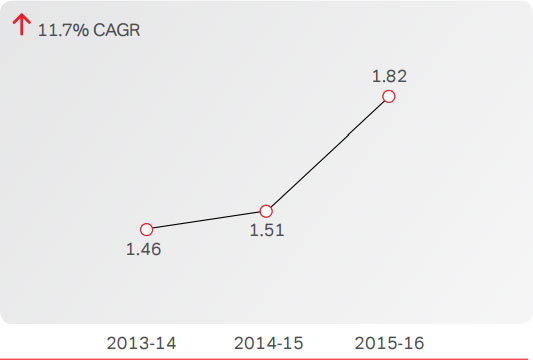

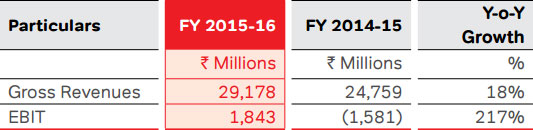

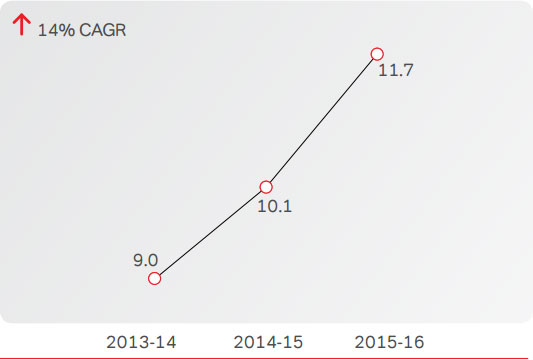

The Company served a customer base of 11.7 Mn on its

Direct-to-Home platform (Airtel digital TV), as on March 31,

2016, adding 1.7 Mn customers during the year. During

the year, the Company launched its first indigenously

manufactured set-top-boxes.

The Company currently offers both standard and high

definition (HD) digital TV services with 3D capabilities and

Dolby surround sound. The Company currently offer a total

of 504 channels including 42 HD channels, 4 international

channels and 5 interactive services. Affordability of HD set-top

boxes, demand for HD channels and upselling efforts led to

ARPU increasing by ` 19 to ` 226 as compared to previous

year on an underlying basis. Consequently, DTH business

turned EBIT positive on full year basis at ` 1,843 Mn compared

to EBIT losses of ` 1,581 Mn in the previous year.

Key Initiatives

- Airtel Digital TV launched its first 4K-Ultra HD (UHD)

channel. With the launch of UHD channel, Airtel enables

its customers to experience the 4 times superior picture

quality as compared to HD channels.

- Airtel Digital TV announced the launch of its first

indigenously manufactured set-top-boxes. The Made in

India set-top-boxes will be available in HD to begin with;

and soon all of Airtel Digital TV’s set-top-boxes will be

manufactured in India. With this, Airtel Digital TV has

become the latest corporate to join the Government’s

Make in India initiative, contributing to its growing

proliferation across sectors.

DTH Subscriber Base (Million)

B2B Services

Airtel Business

Overview

Airtel Business is India’s leading and most trusted ICT

services provider. Its diverse portfolio of services includes

voice, data, video, network integration, data centre, managed

services, enterprise mobility applications and digital media.

Airtel Business consistently delivers cutting-edge integrated

solutions, superior customer service and unmatched depth

/ reach to global markets, to enterprises, governments,

carriers, and small and medium businesses.

Revenues in this segment include those from: a) Enterprise

& Government Business (EGB), which is predominantly

Data, and b) Global Business which includes wholesale voice

and data. The EGB revenues (included in Airtel Business)

together with the Corporate Mobile revenues (included in

India Mobile) and Corporate Fixed Line revenues (included

in Telemedia) is ` 92,327 Mn in this year; this is now 13.0%

of the total India revenues, and has grown by 18.8% over

the last year.

Global Business, the international arm of Airtel Business,

offers an integrated suite of global and local connectivity

solutions, spanning voice and data to the carriers, Telcos,

OTTs, large multinationals and content owners globally.

Airtel’s international infrastructure includes the ownership of

i2i submarine cable system, connecting Chennai to Singapore

and consortium ownership of SMEWE4 submarine cable

system, which connects Chennai and Mumbai to Singapore

and Europe. It also includes cable system investments like

Asia America Gateway (AAG), India, the Middle East and

Western Europe (IMEWE), Unity, Europe India Gateway (EIG)

and East Africa Submarine System (EASSy). Along with

these seven owned subsea cables, Airtel Business has a

capacity on 20 other cables across various geographies.

Its global network runs across 225,000 Rkms with over

1,000 customers, covering 50 countries and five continents.

This is further interconnected to its domestic network and

direct terrestrial cables to SAARC countries and China,

helping accelerate India’s emergence as a preferred transit

hub. Global business now serves more than 60% of the

SAARC internet requirement.

Leveraging the direct presence of Airtel in 20 countries

across Asia and Africa, Global Business also offers mobile

solutions (ITFS, signalling hubs, messaging), along with

managed services and SatCom solutions.

Key Initiatives

- Airtel has launched Smart MPLS services, wherein

customers would be provided access to application

performance management in addition to network

performance management.

- Global Business has launched Direct Internet Access

(DIA) product in partnership with various global

carriers. The DIA product would enable global telecom

organisations to deal multiple providers, multiple billings

and different SLA when procuring local Internet for their

customers across multiple countries.

- Airtel launched a unique, one-of-a-kind gamut of corporate

applications known as EAS- Enterprise Application store,

which will empower an enterprise by providing the one

stop shop experience to achieve its mobility objectives,

provide completely online / touch free consumption and

self-care for enterprise application user.

- Airtel launched the digital engagement solutions with

long-term contracts in the government space. Main

pillars of the solutions, include IVR, USSD, Bulk SMS and

toll-free internet.

- Airtel continued its drive to localise the content, which

improves user experience, along with lowering the cost

of accessing content. Airtel now serves more than 50%

internet requirements from India and have partnered

with various global OTTs for content delivery service.

- Airtel has expanded its cloud service portfolio with the

launch of Connexion, which will ensure a more secure,

scalable and seamless private connection between

enterprises, cloud service providers, and data centre

partners. This will help customers seamlessly and

more securely connect to Microsoft Azure, by bringing

down their network cost substantially and improving

performance.

- Airtel has strategic tie-ups with various global operators for

satellite business. The objective is to reach destinations,

where we have limited or unreliable connectivity. Airtel is

focusing primarily on satellite communication, media and

broadcast solutions, along with managed solutions and

consulting projects.

- Airtel is adding new capacity in new and existing cables

assets in the Pacific and Atlantic routes to further expand

its footprint globally.

- Airtel has launched two new POP in Kenya and South

Africa for IP Transit and MPLS services.

Key Highlights

- Innovations like ‘Call me free’ and ‘Share credit with

friends’ in Airtel Talk helped in winning ‘Innovations

Award’ in the Consumer Services category at the Global

Telecom Awards 2016, London.

- Airtel Talk also won the Gold Stevie Award in the ‘Utility and

Services app’ category at the 12th annual International

Business Awards, 2015. Stevie’s is one of the world’s

most prestigious awards and celebrates distinguished

accomplishments of companies worldwide.

- Airtel Corporate Business won Frost & Sullivan ICT Award

for the second year in a row.

- Airtel Business has won the coveted Aegis Graham

Bell Award for its mHealth solution. mHealth solution

aims to improve the delivery of primary health services,

specifically for expecting mothers in rural India, by

leveraging technology. The application successfully

works in tandem with the National Rural Health Mission’s

(NRHM) initiatives to improve local health indices and

quality of life.

Passive Infrastructure Services

Overview

Bharti Infratel Limited, a subsidiary of Bharti Airtel, provides

passive infrastructure services on a non-discriminatory basis

to all telecom operators in India. Bharti Infratel deploys, owns

and manages telecom towers and communication structures

in 11 circles of India. It also holds 42% share in Indus Towers

(a joint venture between Bharti Infratel, Vodafone and Idea

Cellular). Indus Towers operates in 15 circles (four common

circles with Bharti Infratel, 11 circles on an exclusive basis).

Hence, the Company has a nationwide presence with

operations in India’s all the 22 telecommunications circles.

As on March 31, 2016, Bharti Infratel owned and operated

38,458 towers, while Indus Towers operated 119,881

towers. Bharti Infratel’s towers, including its 42% interest

in Indus Towers, comprised an economic interest in the

equivalent of 88,808 towers in India, as on March 31, 2016.

Bharti Infratel is listed on the Indian Stock Exchanges, NSE

and BSE.

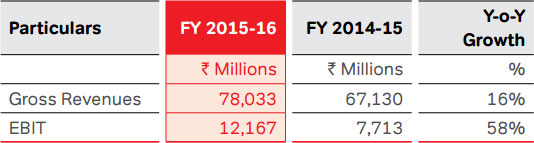

Africa

Overview

The revenue-weighted currency depreciation versus the US

Dollar across 17 countries in Africa over the last 12 months

(exit March 31 rates) has been 5.7%, primarily caused by

the depreciation in Malawi Kwacha, Zambian Kwacha and

Tanzanian Shilling. In terms of the 12-month average rates,

the revenue-weighted Y-o-Y currency depreciation has been

18.3%, primarily caused by the depreciation in Zambian

Kwacha, Nigerian Naira, CFA, Malawi Kwacha and Ugandan

Shilling. To enable comparison on an underlying basis, all

financials up to PBT and all operating metrics mentioned

below are in constant currency rates as on March 05, 2015

for all the periods. (PBT as mentioned below excludes any

realised / unrealised derivatives and exchange gain or loss

for the period).

During the year, sale and lease back of 8,740 towers in

seven countries was completed for a total consideration of

USD 1.8 Bn.

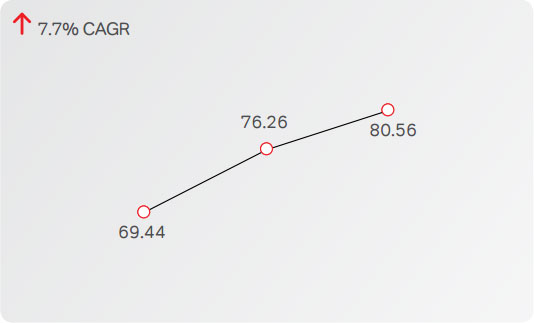

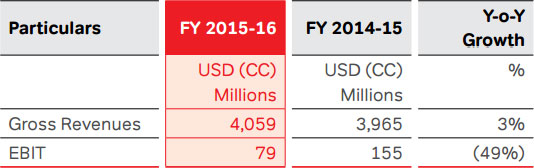

As on March 31, 2016, the Company had 80.6 Mn customers

in Africa across 17 countries, compared to 76.3 Mn customers

in the previous year, an increase of 5.6%. The total minutes

on the network during the year increased by 14.7% to 136.0

Bn, compared to 118.6 Bn in the previous year. At the end of

the year, 15.8 Mn data customers accounted for 19.6% of

the total customer base, compared to 16.1% in the previous

year (on the basis of revised definition of ‘data customer’ as

one who uses at least 1 MB in last 30 days). Data traffic had

been more than doubled to 74.0 Bn MBs from 35.3 Bn MBs

in the previous year with usage per customer increasing from

277 MBs to 435 MBs. Voice realisation per minute, however,

declined from 2.53 cents to 2.14 cents for the full year, due

to competitive pressures. Consequently, the overall ARPU in

Africa declined from USD 4.6 to USD 4.2. Total sites in Africa

as on March 31, 2016 were 20,196 (PY: 18,819), of which

13,128 (PY: 10,011) were 3G sites, representing 65% of the

total sites, compared to 53% for the previous year.

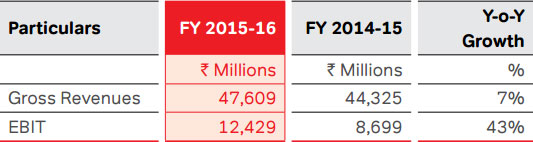

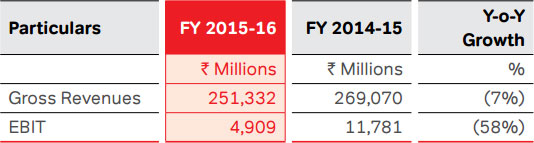

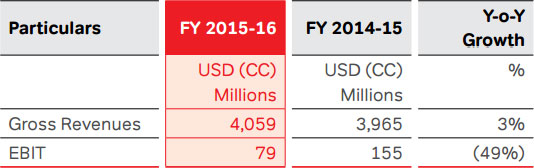

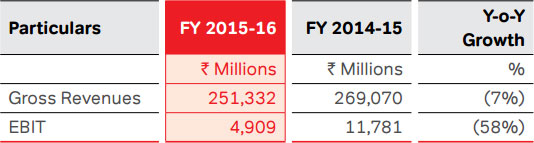

The revenues of Airtel Africa grew by 3.1% to USD 4,059

Mn, compared to USD 3,935 Mn in the last year (growth

of 4.2% adjusting for the impact of divestment of tower

assets). Underlying EBITDA at USD 906 Mn (PY: USD 869

Mn) reflected a similar margin of 22.1%, compared to the

previous year. EBIT at USD 79 Mn was lower in comparison

to USD 155 Mn in the previous year, primarily due to lower

EBITDA. After accounting for the full year capex of USD

771 Mn (PY: USD 1,066 Mn), operating free cash flow was

USD 81 Mn, compared to cash burn of USD 197 Mn in the

previous year.

Wireless Subscriber: Africa (Million)

Key Initiatives

- Airtel Kenya launched a new plan, which offers flat rate

for roaming across Africa. One Airtel provides flexible

and simple tariff within the Airtel Network footprint. The

customers of Airtel Kenya roaming in 16 Airtel Africa’s

countries will be treated as local customers on the visited

network in terms of pricing, including receiving calls free

of charge, while retaining their home SIM card.

- Airtel Ghana launched the first ever tap-and-pay mobile

money payment service in Ghana. The OpCo has

added another first to its credits, as it has rolled out an

innovative service through its Airtel Money that allows

a tap-and-pay, contactless payment, based on the Near

Field Communications (NFC) technology.

- Airtel signed a three-year global agreement with the

World Food Programme for cash and value voucher

distribution services in Madagascar, Malawi, Tanzania,

DRC, Congo B and Zambia.

- Airtel DRC and Korongo Airlines have signed an

agreement for air tickets purchase through Airtel

M-Falanga - Airtel Money.

- Airtel Africa partners with customer engagement

software provider IMImobile, to launch Airtel Artist

Management System. The Airtel Artist Management

System is a new service innovation, enabling upcoming

music artists to upload and make available their music to

potential audiences out of its 83 Mn subscribers.

- Airtel DRC & UBA officially launch ‘LIBIKI’, the new

microloan service through mobile phones. LIBIKI is the

new Airtel Money services, which offer small amount of

loans to the entrepreneurs or craftsmen, who have no

access to the bank credit system.

- Airtel and I&M Bank Ltd have announced a partnership

that enables I&M Bank customer’s access to their

accounts via Airtel Money free of charge. The Bank

account holders will now be able to pull money from their

bank accounts into their Airtel Money wallets or push

money from their Airtel Money wallets to their I&M Bank

accounts.

- The year has continued to see Airtel’s involvement in the

community across Africa, such as:

- Airtel Kenya participated in the First Lady’s half

marathon aimed at eradicating maternal deaths by

providing better healthcare systems for pregnant

mothers.

- Airtel Chad together with UNICEF launched and

executed a nationwide campaign to fight Malaria,

Ebola and Cancer.

- Airtel led a breast cancer awareness campaign in

partnership with the Think Pink Foundation.

- Airtel Zambia donated various items for the

Malnutrition ward as well as food stuff for the cancer

ward.

- Airtel Kenya reached 43 schools with free internet

connectivity.

- Airtel Ghana helped millions of flood victims by giving

them an opportunity to communicate with their loved

ones and friends for free through an emergency offer,

‘Airtel Too Much Relief‘ Pack.

Key Highlights

- Airtel and Liquid Telecom signed pan-African agreement

to provide fibre connectivity to towers. Airtel’s mobile

broadband subscribers in Africa will soon enjoy faster

Internet access speeds on its 3G and 4G networks.

The framework agreement enables Airtel operations

to leverage Liquid Telecom’s existing 20,000 km-long

fibre network across East, Central and Southern Africa,

as well as enjoy new purpose-built fibre infrastructure,

to connect Airtel’s mobile base stations and enterprise

customers with fibre.

- During the year, sale and lease back of 8,740 towers in

seven countries (Ghana, Uganda, Kenya, Burkina Faso,

Zambia, Nigeria and Congo B) was completed for a total

consideration of USD 1.8 Bn (sale and lease back to Eaton

tower – 2,681 towers for USD 0.54 Bn, IHS towers - 949

towers for USD 0.15 Bn, Helios towers - 393 towers for

USD 0.05 Bn and ATC – 4,717 towers for USD 1.06 Bn).

- Airtel has signed a definitive agreement with Orange to

sell its operations in Burkina Faso and Sierra Leone. The

companies had signed an initial agreement in July 2015

for the acquisition of Airtel’s operations in Burkina Faso,

Sierra Leone, Chad and Congo B. The agreement over

the latter two countries has lapsed.

- The Company’s subsidiary in Tanzania and American

Towers Corporation and its subsidiaries have entered

into an agreement for the sale of over 1,300 telecom

towers in Tanzania.

- Airtel Rwanda in a drive to extend affordable

telecommunications products and services to Rwandans,

has partnered with ITEL to introduce a new trendy and

affordable data enabled phone dubbed KEZA. It now

stands as one of the most affordable data enabled

phones in the Rwandan market.

Awards & Recognition

- Airtel Rwanda received the award of best 4G Mobile

Network Operator for 2015 for exceptional performance

in 4G LTE.

- Airtel Money Malawi was commended for being the

mobile financial services leader in Malawi at 62.2%

market share by Malawi Communications Regulatory

Authority in conjunction with the National Statistical

Office.

- Airtel Money Seychelles won the best innovative product

in the Seychelles chambers of commerce award (SCCI)

in November 2015.

- Airtel Tanzania has lifted awards in a recent Tanzania

Leadership Awards 2015. Airtel emerged winners in two

categories, the best use of social media in marketing

and brand excellence within the telecom sector in the

country.

- Airtel Sierra Leone has received an award in recognition

of the role the Company played in the fight to contain

and eradicate the Ebola Virus Disease (EVD) from the

Office of the President.

- Airtel Ghana was bestowed with four awards at the 2015

Ghana Telecom Awards. The Company has won these

awards for five consecutive years. Airtel Ghana swept

awards in the following categories - Telecom Brand of

the Year; Marketing Campaign of the Year - Talk Chaw;

Innovative Enterprise Product of the Year - One Network

and Special Recognition to the Telecom Industry Award -

Lucy Quist.

- Airtel Nigeria emerges Telecom Company of the Year for

its laudable contributions to the growth of the telecoms

industry in Nigeria. Airtel Nigeria has been named

Africa’s Telecommunications Company of the Year at the

6th African Business Leadership Forum & Awards 2015.

- Airtel Uganda won two awards at the Digital Impact

Awards Africa for its innovations in the Finance and

Entertainment sector. Airtel Uganda’s mobile money

transaction service was recognised and awarded in the

category of Best Financial Inclusion Impact. The talent

search music competition, Airtel Trace Music Star, was

recognised in the category of the Best Digital Marketing

Campaign.

- Airtel Money Tanzania was recognised for the Best

Mobile Money Product Innovation at Kalahari mobile

money awards.

South Asia

Overview

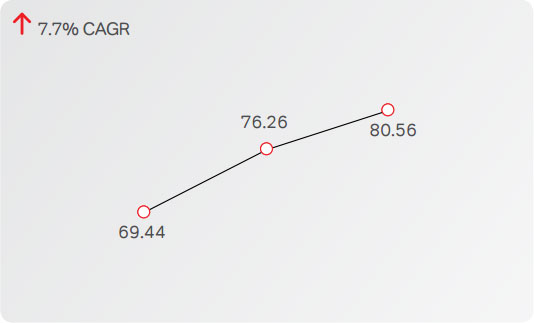

As on March 31, 2016, South Asia had 10.2 Mn mobile

customers on the Company’s network. Data customers

represented 28.7% of the total customer base as on March

2016, compared to 25.5% in the last year (on the basis of

revised definition of ‘data customer’ as one who uses at least

1 MB in last 30 days). As on March 2016, the Company had

7,083 sites on network, compared to 6,867 sites in the last

year. Of the total number, 3G sites were 4,115 (PY: 3,050) in

number, representing 58.1% of the total sites, compared to

44.4% for the previous year.

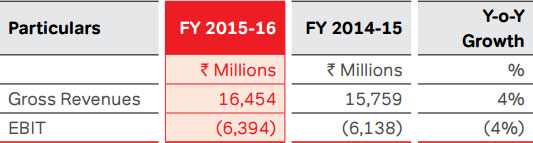

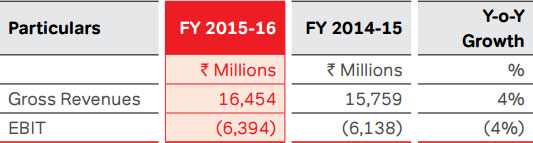

The Company’s full year revenues of South Asia increased

by 4.4% to ` 16,454 Mn, compared to ` 15,759 Mn in the

previous year. EBITDA loss for the year was at ` 801 Mn,

compared to a loss of ` 196 Mn in the previous year. EBIT

losses for the year reported at ` 6,394 Mn, compared to a

loss of ` 6,138 Mn in the previous year. Capex for the year

was ` 3,321 Mn, compared to ` 3,233 Mn in the previous

year

Key Initiatives

- Airtel Sri Lanka commenced 2016 by being the

Principal Sponsor of the Battle of the North (annual

cricketing tournament) for the third consecutive year.

- Airtel Sri Lanka launched Smart Byte facility in order

to facilitate customers to enjoy data usage at

discounted rates.

- Airtel Sri Lanka won a Gold Award for the Best

Multinational Corporations in Sri Lanka and silver award

for Medium Sized Enterprise Category. Airtel Lanka

is the youngest organisation in terms of market

existence in Sri Lanka to receive these prestigious

accolades; and the only telecommunication operator to

be listed on the GPTW (Sri Lanka) Hall of Fame.

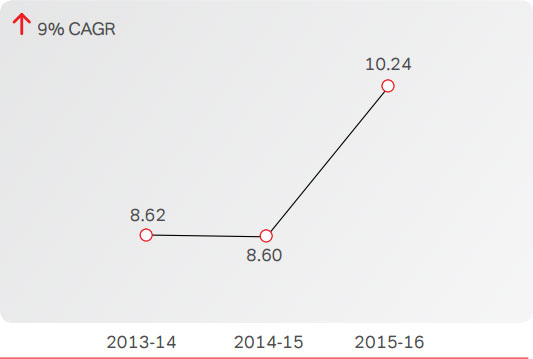

Wireless Subscriber: South Asia (Million)

- Axiata Group Berhad and Bharti Airtel Limited signed

a Definitive Agreement to merge their respective

telecommunication subsidiaries in Bangladesh, namely,

Robi Axiata Limited (Robi) and Airtel Bangladesh

Limited (Airtel). The agreement followed the September

09, 2015 announcement of both parties entering into

an exclusive discussion to explore the possibility of

combining the business operations in Bangladesh.

- Airtel Bangladesh has won the prestigious Asia

Communication Award 2015 in the Category of

‘Customer Experience Initiative’ for ‘Online Airtel

Experience Centre’.

Risks and Concerns

At Bharti Airtel (the Company), we have thrived globally

by building a culture of innovation and high performance.

We explore new markets and business models across

the world; evolve new ways of customer and stakeholder

engagement; enter into new strategic partnerships; adopt

new technologies; and build exponential efficiencies in

existing systems. While these initiatives unveil a universe

of possibilities, potential risks and uncertainties arise in a

volatile business environment. The distress signals need to

be addressed with urgency for smooth operations. Therefore,

we have created a robust risk management framework

in our operating landscape. We have a sound practice to

identify key risks across the Group and prioritise relevant

action plans for mitigation.

At the Board Governance level, the Risk Management

Framework is reviewed bi-annually by the Company’s Risk

Management Committee. The Board of Directors performs

an annual review. These apex reviews include: discussing the

management submissions on risks, prioritising key risks and

approving action plans to mitigate such risks. The Internal

Audit function is responsible to assist the Risk Management

Committee on an independent basis with a full status of

risk assessments and management. Every quarter, the Risk

Management Committee also obtains periodic updates on

certain identified risks, depending upon the nature, quantum

and likely impact on the business.

At the Management level, the respective CEOs for the

Management Boards (AMB and Africa Exco) are accountable

for managing risks across their respective businesses,

viz., India and South Asia, and Africa. The strategic risk

registers capture the risks identified by the operating teams

(Circles or Operating Companies) as well as the functional

leadership teams at the national level. The AMB / Africa Exco

ensure that the environment – both external and internal – is

scanned for all possible risks. Internal Audit reports are also

considered for identification of key risks.

The two CEOs, for India & South Asia and Africa, are responsible for the implementation of the agreed risk

framework, including the detailed processes of:

At the operating level, the Executive Committees (EC) of

Circles in India and Operating Companies in the international

operations are entrusted with responsibilities of managing

the risks at the ground level. Every EC has local representation

from all functions, including many centrally driven functions

like IT, Legal & Regulatory, Finance and SCM, besides

customer-facing functions, such as Customer Service, Sales

& Distribution and Networks. It is the responsibility of the

Circle CEO or Country MD to pull together various functions

and partners to manage the risks. They are also responsible

for identification of risks, and escalating it to the Centre for

agreeing mitigation plans. Operating level risk assessments

(RACM) have been concluded at Function / OpCo risk

assessment and mitigation plans agreed and kicked off.

Internal Audit Plans are being drawn up to ensure scope and

coverage of these critical risks during the course of next year.

The key risks that may impact the Company and the

mitigating actions undertaken by the Company comprise:

1. Regulatory and Political Uncertainties (Legal &

Compliance)

Risk Statement

The Company operates in India, Bangladesh, Sri Lanka and

17 African countries. Some of these countries (or regions

within countries) are affected by political instability, civil

unrest and other social tensions. The political systems in a few

countries are also fragile, resulting in regime uncertainties;

hence, the risk of arbitrary action. Such conditions tend to

affect the overall business scenario. In addition regulatory

uncertainties, like escalating spectrum prices, call drops /

EMF penalties, among others are potential risks facing the

business.

Mitigation

- As a responsible corporate citizen, we engage

proactively with key stakeholders in the countries in

which we operate; and continuously assess the impact

of the changing political scenario. We contribute to the

socio-economic growth of the countries in which we

operate through high-quality services to our customers,

improved connectivity, providing direct and indirect

employment, and contributions to the exchequer. Our

annual Sustainability Report is a document, which

highlights to the larger external environment the role

we are playing in the countries we are operating in.

We maintain cordial relationships with governments

and other stakeholders in every country where we

operate. The Country MDs and Circle CEOs carry direct

accountability for maintaining neutral Government

relations. Through our CSR initiatives (Bharti Foundation

etc.), we contribute to the social and economic

development, especially in the field of education.

- We actively work with industry bodies like COAI, CII, and

FICCI on espousing industry issues e.g. penalties, right

of way, tower sealing, and so on.

2. Economic Uncertainties (Operational)

Risk Statement

The Company’s strategy is to focus on growth opportunities

in the emerging and developing markets. These markets

are characterised by low to medium mobile penetration, low

internet penetration and relatively lower per capita incomes,

thus offering more growth potential. However, these

countries are also more prone to economic uncertainties,

such as capital controls, inflation, interest rates and currency

fluctuations. Since the Company has borrowed in foreign

currencies, and many loans are carrying floating interest

terms, we are exposed to market risks, which impact our

earnings, cash flow and balance sheet. These countries

are also affected by economic downturns, primarily due to

commodity price fluctuations, reduced aid, capital inflows

and remittances. Slowing down of economic growth tends

to affect consumer spending, including telecom.

Mitigation

- As a global player with presence across 20 countries,

we have diversified our risks and opportunities across

markets.

- Through a variety of services including voice, data,

Airtel Money and value added services, we have also

spread our portfolio.

- To mitigate currency risks, we follow a prudent risk

management policy, including hedging mechanisms

to protect our cash flow. No speculative positions

are created; all foreign currency hedges are taken on

the back of operational exposures. A prudent cash

management policy ensures that surplus cash is upstreamed

regularly to minimise the risks of blockages

at times of capital controls. We have specifically

renegotiated many operating expenditure / capex

Fx contracts in Africa and converted them to local

currency, thereby reducing Fx exposure.

- To mitigate interest rate risks, the Company is further

spreading its debt profile across local and overseas

sources of funds and to create natural hedges.

- Finally, the Company adopts a pricing strategy that is

based on twin principles of mark to market, profitability

and affordability, which ensures that we protect margins

at times of inflation, and market shares at times of

market contraction.

3. Poor Quality of Networks and Information

Technology Including Redundancies and Disaster

Recoveries (Operational)

Risk Statement

The Company’s operations and assets are spread across

wide geographies. Our telecom networks are subject to risks

of technical failures, partner failures, human errors, or wilful

acts or natural disasters. Equipment delays and failures,

spare shortages, energy or fuel shortages, software errors,

fibre cuts, lack of redundancy paths, weak disaster recovery

fall-back, and partner staff absenteeism, among others are

few examples of how network failures happen. Repeated

outages and / or poor quality of networks cause disruption

of services, resulting in revenue losses, customer attrition,

market share losses and damage to brand image and

Company reputation. Regulators are now also levying stiff

monetary penalties for poor quality of services.

The Company’s IT systems are critical to run the customerfacing

and market-facing operations, besides running

internal systems. In many geographies or states, the quality

of IT connectivity is sometimes erratic or unreliable, which

affect the delivery of services e.g. recharges, customer

query, distributor servicing, customer activation, billing, etc.

In several developing countries, the quality of IT staff is

rudimentary, leading to instances of failures of IT systems

and / or delays in recoveries. The systems landscape is ever

changing due to newer versions, upgrades and ‘patches’ for

innovations, price changes, among others; the dependence

on IT staff for turnaround of such projects and changes is

huge. Unauthorised access to network and IT systems can

result in wrong configurations, poor quality of service, frauds

and regulatory non-compliances.

Mitigation

- Network Planning is increasingly being done in-house,

to ensure that intellectual control on architecture is

retained within the Company. The recently announced

` 600,000 Mn Leap Programme in India continuously

seeks to address issues (congestion, indoor coverage,

call drops, modernisation and upgrade of data speeds,

among others) to ensure better quality of network.

Recent efforts also include transformation of the

microwave transmission, fibre networks, secondary

rings / links and submarine cable networks. The

Company consistently eliminates systemic congestion