Low Joining Fees

Just ₹500 joining fees

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

Apply for your feature-rich Credit Card in Delhi using the Airtel Thanks app! Now you have a chance to save big every time you use the credit card and make annual savings worth up to Rs 16,000. Get loads of added benefits such as airport lounge benefits, cashback offers and discounts on bill payments, a greater credit limit, and much more.

Managing your daily expenses becomes much easier with

a Credit Card in New Delhi. Keep a clear track of where

you spend, and how much you spend, and get

additional rewards too. A Credit Card will also help you get

extra benefits such as airport lounge access, cashback offers,

and multiple discounts.

Big savings and cashback offers, now with credit card

Just ₹500 joining fees

Up to ₹5 lakh credit

Save up to ₹16,000 annually

Just ₹500 as annual fee

Apply on the Thanks app

18-70 years old

Applying for a credit card is very easy. Follow the steps below:

Download the app and go to Shop section

You will see the Credit Card button

Now fill up the complete application form

The card will be delivered to you within 5-7 business days.

Fulfill these eligibility criteria to get the credit card!

Individual should be a Resident of India

The age of the primary cardholder should range between 18 and 70 years.

PAN card or Form 60, Residential, Identity, and Income proof, Colour Photograph

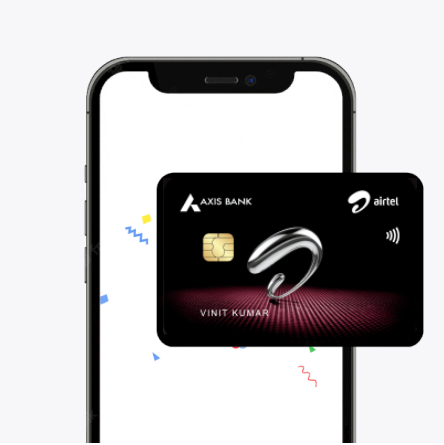

There are many popular credit cards available in New Delhi such as the Airtel Axis Bank Credit card that offers several benefits like 25% cashback on Airtel Postpaid bills, DTH, etc., 10% cashback on utility bill payments, domestic airport lounge access up to 4 times a year, and lots more.

You can apply for your Credit Card in New Delhi using the Airtel Thanks app.

Here are the documents you need to provide: a PAN card or Form 60, residential proof, identity proof, income proof, and a color photograph.

If you are looking for a credit card with low interest rates, a high credit limit, and multiple benefits, then apply for one using the Airtel Thanks app.

There are no special credit card offers for New Delhi residents.

You can check your credit score in New Delhi using the Airtel Thanks app.

Once you apply for your credit card and all the documents are correct, you will get your credit card very soon. Apply now on the Airtel Thanks app.

You can get the Airtel Axis Bank Credit Card with a low annual fee on the Airtel Thanks app.

You can get multiple sets of benefits such as airport lounge access, cashback offers, discounts on food delivery/grocery apps, fuel surcharge cashback, and many more on the right Credit Card in New Delhi.

If you have lost your credit card in New Delhi, immediately inform your credit card issuing bank. You can call their customer support and ask them to block the credit card, as soon as possible.

Apply on the Airtel Thanks app to get a credit card with a credit limit of ₹5 lakhs.

You can check the credit card reward page for any credit card that you have.

Check with your credit card provider to get a credit card tailored for travel benefits.

No, there is no such facility where you can upgrade or downgrade your credit card in New Delhi.

Getting your brand new feature-rich credit card in New Delhi is now extremely simple. Just apply for Credit Card from the Airtel Thanks app and make big savings, whenever you pay using your credit card. What is even more lucrative is that you stand the chance to save up to ₹16,000 each year, by using this credit card.

Added features of the Credit Card in New Delhi include airport lounge benefits, cashback offers on recharges done via the Airtel Thanks app, discounts at partner restaurants, fuel surcharge waiver and a lot more.