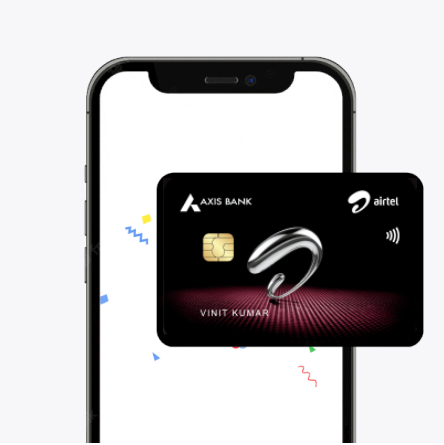

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

Apply for a credit card in India today and unlock instant cashback, exclusive lifestyle offers, and effortless rewards on everyday spends. From bill payments to travel and dining, enjoy maximum value on every transaction. Fast approval, low fees, and a 100% digital process make it simple.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

Before you apply, it’s important to know if you qualify. The card is available only to individuals who are residents of India. Applicants must also meet the age requirement, falling between 18 and 70 years. With a wide eligibility range and simple terms, these credit card criteria make the process accessible while ensuring you meet the basic credit card eligibility requirements hassle-free.

When applying, being prepared with the right paperwork saves time. Here’s what you’ll need:

Keep these documents for credit cards ready to enjoy a quick, seamless application journey.

Getting started is simple when you know the steps. Here’s how to apply for a credit card with Airtel Finance:

This streamlined process makes your credit card application quick and hassle-free. If you’ve ever wondered how to get a credit card without delays, this is the fastest way forward.

Being transparent about costs helps you plan better. Here’s a quick breakdown of what you’ll pay with this card:

|

Type |

Details |

|

Joining Fee |

₹500 for the primary card; add-on card is free |

|

Annual Fee |

₹500, waived off with annual spend above ₹2 lakhs |

|

Fuel Surcharge Waiver |

1% waiver available |

With straightforward credit card fees and no hidden surprises, this card is designed to keep expenses predictable. Affordable credit card charges combined with strong cashback benefits ensure you save more while paying less. It’s a balanced approach—practical costs matched with everyday rewards.

A credit card is more than just a payment tool—it’s a smart way to save, earn, and unlock lifestyle perks. To get the most from your card, you need to be strategic in how you use it. Consider these practical steps to stretch your rewards and savings:

These simple credit card tips ensure you don’t leave money on the table. Think of this as your quick credit card guide—a way to turn everyday expenses into cashback, privileges, and convenience. With disciplined use, your card won’t just make payments easier; it will actively contribute to your financial growth and lifestyle upgrades.

After approval, staying in control is simple. You can easily manage credit card features and keep everything secure through the Airtel Thanks app. Key points to know:

With these tools and protections, managing your card stays convenient, safe, and stress-free.

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.