Annual Interest rate as low as 3.6% per month

Charged on monthly overdue on extended credit & cash advances

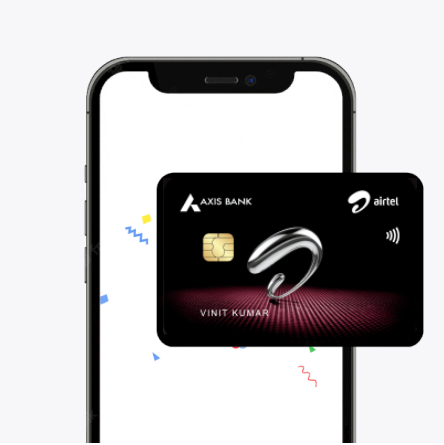

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

Credit card interest rates are the charges you pay when you don’t clear your outstanding balance on time. They represent the cost of borrowing on your card and are usually calculated monthly but shown as an annual percentage rate (APR). Understanding how these rates work is crucial before using a card, as unpaid balances can quickly grow into heavy debt. By knowing the exact cost of carrying forward credit, you can manage payments better, avoid unnecessary financial stress, and use your credit card more responsibly.

A credit card interest rate is the fee charged when you carry forward an unpaid balance beyond the due date. It is displayed as the annual percentage rate credit card (APR), which shows the yearly cost of borrowing on your card.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

Credit cards apply different charges depending on how you use them. Understanding these helps you manage debt better.

Enjoy low interest rates on your Credit Card.

Charged on monthly overdue on extended credit & cash advances

The interest is only charged on cash advances & outstanding credit

Annual Percentage Rate offered lower than most credit cards in the market

Credit card issuers calculate interest using the average daily balance method with daily compounding. Follow these steps:

This is how credit card interest is calculated in practice. The same rule applies when computing interest for cash withdrawal from a credit card, except it starts from the transaction date without a grace period. These steps ensure accuracy when calculating credit card interest.

Big savings and cashback offers, now with Credit Card

Download the app and go to Shop section

You will see the Credit Card button

Now fill up the complete application form

The card will be delivered to you within 5-7 business days.

Several factors determine the rate applied to your credit card:

These factors combined decide the final interest applied to your outstanding balance, making repayment behaviour and credit management crucial.

Interest rate on credit cards is mostly charged using an

average daily interest method. According to this method, the

interest is accumulated and compounded every day, based on the

daily interest rate. The daily interest rate is calculated as

per the Annual Percentage Rate (APR).

Consistent repayment habits and avoiding high-cost transactions are the most effective ways to keep your card usage cost-efficient and interest-free.

Big savings and cashback offers, now with Credit Card

Just ₹500 joining fees

Up to ₹5 lakh credit

Save up to ₹16,000 annually

Just ₹500 as annual fee

Apply on the Thanks app

18-70 years old

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.