Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply Now

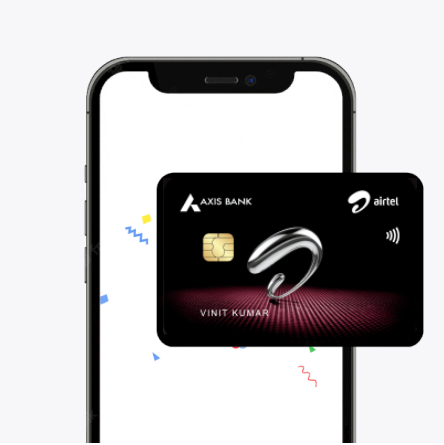

An instant credit card is designed for quick approval and immediate access to credit. Unlike traditional cards that may take weeks to process, this card offers confirmation within minutes and can be used instantly for digital transactions. With Airtel Finance, you benefit from a seamless online application process and a physical card delivered within 7–10 working days.

Key features include a credit limit of up to ₹5,00,000, cashback rewards on everyday expenses, low annual fees, and complimentary airport lounge access. The entire process is digital via the Airtel Thanks App designed for convenience and speed.

If you are ready to apply for credit card services with Airtel Finance, simply download the Airtel Thanks App and complete the KYC steps online. Start enjoying cashback, savings, and a higher credit limit today.

Choosing an instant credit card ensures fast access to credit with added value on everyday spending. Look at the instant card benefits designed for convenience and savings:

To enjoy these advantages, simply apply for a credit card through the Airtel Thanks App and activate your benefits without delay.

The Airtel Finance Instant Credit Card combines flexibility, savings, and lifestyle advantages in a fully digital format. Customers can rely on a straightforward application process and valuable rewards on everyday expenses.

Instant credit card benefits include:

Enjoy these credit card perks while managing payments with speed and convenience.

For a smooth application process, applicants must meet the following instant card eligibility requirements:

Meeting these criteria allows applicants to complete a fully digital application and receive approval quickly through the Airtel Thanks app.

The application process is designed to be fast and fully digital. Follow these steps to apply for instant credit card services:

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.