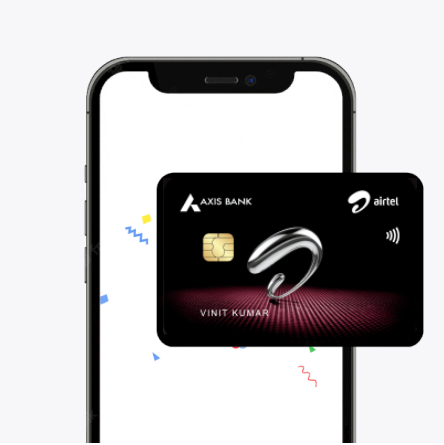

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply NowTo qualify for a credit card, applicants must meet specific eligibility criteria and submit standard documents. Review the requirements below before starting your application.

Eligibility Criteria:

Documents Required:

Meeting these conditions ensures your credit card eligibility can be assessed without delays. Always provide accurate and up-to-date documentation for a smooth verification process.

Your credit card approval depends on several important factors. Below are the key elements that impact your eligibility:

These are essential credit card eligibility criteria that determine your application outcome.

When applying for a credit card, ensure you have the following documents ready for submission:

Ensure all credit card documents are valid and clearly visible to avoid delays in your application process.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

Credit cards offer several valuable features and perks. Some of the key credit card benefits include:

The Credit Card has set eligibility criteria for applicants. If you fulfil those parameters, you can also enjoy unlimited cashback, rewards, and more. An Indian resident aged between 18 to 70 is eligible for this super-saver credit card! This credit card in your pocket makes it easier for all kinds of purchases and shopping needs.

Follow these simple steps to apply for a credit card online using the Airtel Thanks app:

Once submitted, your application will be processed, and your credit card will be delivered within 5-7 business days.

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.