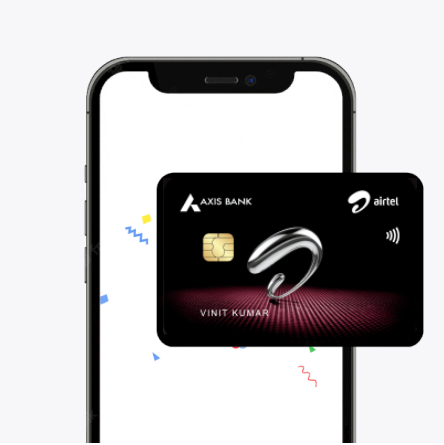

Get Credit Limit up ₹5 Lakhs ✔️₹500 Amazon Voucher

Apply NowTo qualify for the Airtel Axis Bank Credit Card, applicants must meet specific eligibility and documentation requirements. The process is straightforward and clearly defined.

Eligibility Criteria:

This meets the basic Airtel Axis Bank credit card eligibility standards set by the issuer.

Documents Required:

Meeting these conditions guarantees your application aligns with the Airtel Axis Bank credit card eligibility norms.

Multiple parameters influence approval for an Airtel Axis Bank Credit Card. These credit card eligibility factors include:

All these elements are part of the standard credit card eligibility factors evaluated by lenders during application review.

Easily calculate your monthly EMIs for credit card purchases with Airtel Finance. Enter the amount, tenure, and interest rate to get instant estimates.

Submitting accurate credit card documents is essential to complete the application and verification process. Ensure all documents are clear and up-to-date.

Document Categories:

Submission Tips:

The Airtel Axis Bank Credit Card comes with fixed-value benefits across essential spending categories. Below are the key perks:

These fixed features define the overall Airtel Axis Bank credit card benefits that come standard with the card.

The Airtel Axis Bank Credit Card eligibility depends on three factors. You must be between 18 and 70 years of age, a citizen of India, and present your PAN card, current income payslips, residency evidence, and identification proof.

To begin the Airtel Axis Bank credit card application process, follow the steps below using the Airtel Thanks app. The entire flow is digital and requires minimal documentation.

Step-by-Step Guide

This is the direct route to apply without visiting a branch or submitting physical paperwork.

10% cashback on food & groceries, 25% on Airtel bills, and high card limit up to ₹5,00,000. Bonus: Get ₹500 Amazon voucher after first use.