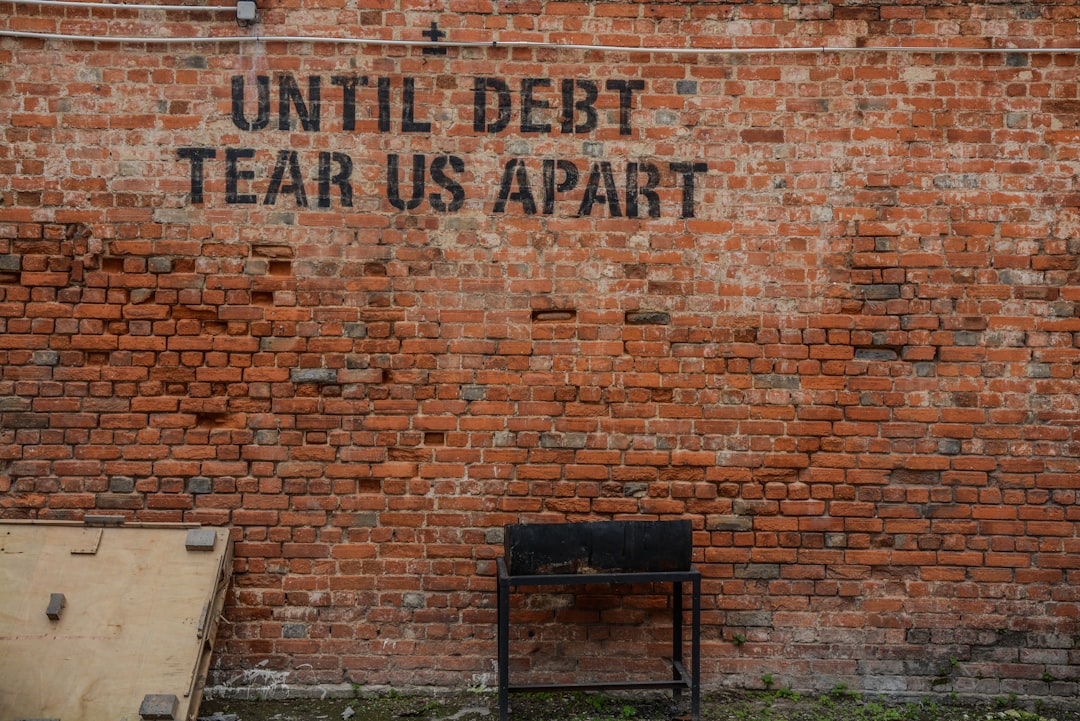

Marriage is a beautiful partnership, but it also means sharing financial responsibilities. One common concern among married couples is whether a spouse’s debt can affect their credit score. Let’s dive into this crucial topic and explore how you can navigate debt as a team while maintaining a healthy credit profile.

Understanding the Basics of Credit Scores

Your credit score is an individual metric that reflects your creditworthiness. It is based on factors such as your payment history, credit utilisation, and length of credit history. When you get married, your credit reports remain separate, and your spouse’s debt before marriage generally does not impact your credit score directly.

However, if you and your spouse decide to take on joint financial obligations, such as co-signing a loan or opening a joint credit card account, both of your credit reports will reflect these accounts. Any late payments or high balances on these joint accounts can negatively affect both of your credit scores. In such situations, spouse debt can affect your credit score.

Navigating Joint Debts and Credit Scores

Let’s consider a scenario: Rahul and Priya recently got married. Rahul has a personal loan from his bachelor days, while Priya has an excellent credit score. Here’s how they can manage their finances so that the effect of spouse debt on credit scores is minimal:

- Keep Individual Debts Separate: Rahul’s pre-marriage personal loan remains his responsibility. As long as he makes timely payments, it shouldn’t impact Priya’s credit score.

- Be Cautious with Joint Accounts: If Rahul and Priya decide to apply for a joint credit card or loan, both their credit scores will be evaluated. Priya’s strong credit score can help them secure better terms, but any missed payments will affect both of their scores.

- Communicate and Plan: Open communication is key. Rahul and Priya should discuss their financial goals, create a budget, and develop a plan to pay off their debts together.

Tips for Managing Joint Debts

|

Strategy |

Explanation |

|

Set a Budget |

Determine how much you can allocate towards debt repayment each month. |

|

Prioritise High-Interest Debts |

Focus on paying off debts with the highest interest rates first. |

|

Consider Balance Transfers |

Moving high-interest debts to a lower-interest credit card can save money. |

|

Make Timely Payments |

Late payments can damage both spouses’ credit scores. |

Building Credit Together

As a married couple, you have the opportunity to build a strong credit profile together to navigate debt and family credit scores. Here are some strategies to consider:

- Become Authorised Users: Adding your spouse as an authorised user on your credit card can help them build a credit history without the legal responsibility of the debt.

- Open Joint Accounts Wisely: When applying for joint credit, make sure both spouses have a good understanding of the terms and repayment obligations.

- Monitor Your Credit: Regularly check your credit reports to ensure accuracy and identify any potential issues early on. You can access your credit score through the Airtel Thanks app.

Seeking Financial Guidance

Navigating the credit score impact of spouse debt can be complex. Don’t hesitate to seek professional advice from financial advisors who can provide personalised guidance based on your unique situation of debt and family credit score.

At Airtel Finance, we understand the importance of financial well-being for families. Our range of products, including personal loans, credit cards, and gold loans, are designed to help you manage your finances effectively. With transparent terms and a user-friendly Airtel Thanks app, we strive to make your financial journey as smooth as possible.

Remember, your spouse’s debt doesn’t have to define your credit score. By communicating openly, managing joint debts responsibly, and seeking guidance when needed, you can build a strong financial foundation together.

FAQs

- Can my spouse’s debt affect my credit score if we keep our finances separate?

If you and your spouse maintain separate financial accounts and do not co-sign any loans or credit cards, your spouse’s debt should not directly impact your credit score.

- What happens to my credit score if my spouse defaults on a joint loan?

If your spouse defaults on a joint loan, it will negatively affect both your credit scores. Late payments and defaults are reported on both borrowers’ credit reports.

- How can I protect my credit score if my spouse has a lot of debt?

To protect your credit score, avoid co-signing loans or opening joint accounts with your spouse if they have a significant amount of debt. Encourage them to seek debt management solutions and maintain separate finances if necessary.

- How does being an authorised user on my spouse’s credit card affect my credit score?

As an authorised user, you are not legally responsible for the debt on the credit card. However, adding a spouse to a credit card can affect your credit score, depending on usage.

- How can I improve my credit score if it has been affected by my spouse’s debt?

To improve your credit score, focus on making timely payments on your individual accounts, keeping credit utilisation low, and disputing any errors on your credit report. Consider becoming an authorised user on a spouse’s account with a positive payment history.

Get App

Get App  Airtel Store

Airtel Store  Login

Login