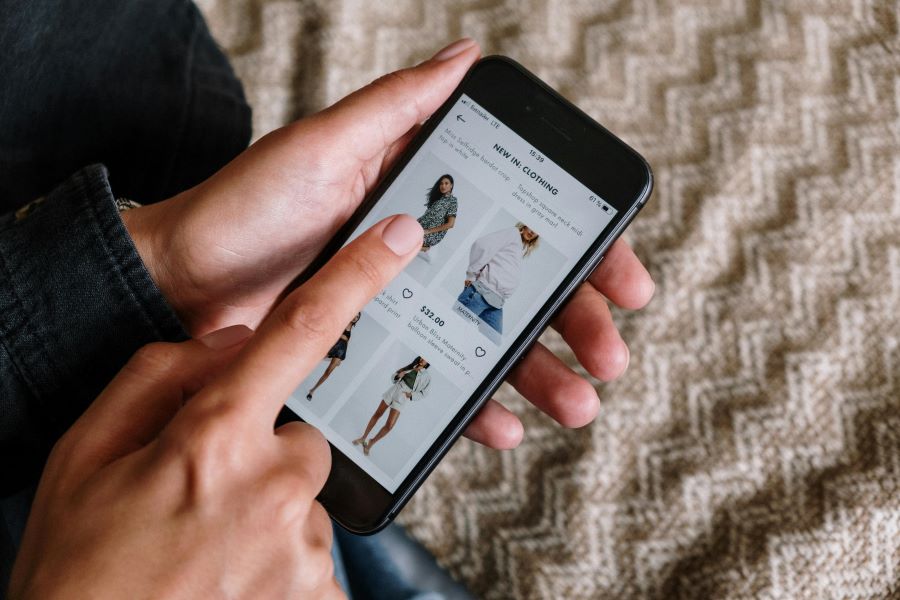

BNPL or Buy Now, Pay Later schemes have recently become very popular. As the name suggests, the scheme is basically a form of credit where you can buy a product now, but you can pay for it later.

In this blog, we will help break down what it actually means to buy now and pay later, and whether it is actually helpful over conventional methods of credit such as a personal loan or credit card.

What is the whole idea behind Buy Now, Pay Later (BNPL) schemes?

Buy Now, Pay Later is a type of short-term financing that allows consumers to buy products immediately and pay for them in instalments over a specified period. BNPL services are typically offered by fintech companies and are integrated into the checkout process of online and, increasingly, brick-and-mortar stores.

Unlike traditional credit cards, BNPL schemes often come with minimal to no interest rates and are designed to provide a hassle-free borrowing experience.

Read more: What is loan moratorium? How does it work?

How does Buy Now, Pay Later work?

The BNPL process is straightforward and typically involves the following steps:

Select that you want to pay via Buy Now, Pay Later

When shopping online or in-store, consumers are presented with the option to use a BNPL service at checkout.

Buy Now, Pay Later approval

Upon selecting the BNPL option, consumers are usually required to undergo a quick approval process. This process is generally less stringent than traditional credit score checks and is completed within seconds. Some BNPL providers also conduct a soft credit check, which does not affect the consumer’s credit score.

Choose the payment plan that you want

Once approved, the consumer chooses a payment plan, with the ideal tenure ranging up to a few months from the actual purchase. The terms and conditions, including any applicable fees, are clearly outlined at this stage.

The first payment on BNPL scheme

The first instalment is typically due at the time of purchase. The remaining payments are automatically deducted from the consumer’s bank account or charged to their debit or credit card as per the agreed schedule.

Read more: What is a promissory note: definition, types & more

What are the benefits of choosing the Buy Now, Pay Later scheme?

Here are some of the benefits of the Buy Now Pay Later scheme:

Adds to your convenience & flexibility

BNPL schemes offer unmatched convenience by allowing consumers to spread the cost of a purchase over time. This flexibility makes it easier to manage cash flow, especially for larger or unexpected expenses.

Interest-free options for Buy Now, Pay Later

Many BNPL services provide interest-free plans, provided payments are made on time. This can make BNPL a cost-effective alternative to traditional credit cards, which often carry high-interest rates. Moreover, if you want a credit card with low APRs, high credit limit and big on savings, then apply for the Airtel Axis Bank Credit Card today!

Get instant approval for Buy Now Pay Later

The approval process for BNPL is typically fast, which makes it an attractive option for consumers with varying credit histories.

Better shopping experience

For retailers, offering BNPL can enhance the shopping experience and increase sales. Consumers are more likely to complete a purchase if they can spread payments over time.

Read more: Loan syndication: definition, how it works and more

How to use the Buy Now, Pay Later scheme better?

To make the most of BNPL services, consumers should follow these best practices:

Ensure your budget before you select Buy Now Pay Later

Before using BNPL, ensure the instalment payments fit within your budget. Avoid making purchases that strain your finances.

Always make timely payments

Set reminders for due dates to avoid late fees and penalties. If possible, link payments to a bank account with sufficient funds.

Have a better understanding of your terms

Read and understand the terms and conditions of the BNPL service, including any fees, interest rates, and the impact of missed payments.

Avoid using multiple BNPL accounts

Make sure that you avoid using multiple BNPL services simultaneously, which can complicate payment schedules and increase the risk of missed payments.

As a result, the Buy Now, Pay Later scheme is very flexible and provides a very convenient way to complete your payments. It is a very popular alternative to the already popular credit cards, especially since you can get these on a debit card as well. However, as with every other form of credit, you need to use it responsibly. Overspending and then accumulating a lot of debt is never a good choice. Make sure to use the Buy Now, Pay Later feature only for purchases that are within your repayment capability.

Get App

Get App  Airtel Store

Airtel Store  Login

Login