In the realm of real estate transactions, bridge loans serve as crucial financial instruments bridging the gap between buying and selling properties. For those unfamiliar, navigating the intricacies of bridge loans can seem daunting. This comprehensive guide aims to demystify bridge loans, exploring their mechanisms, applications, advantages, risks, and real-life examples.

Exploring Bridge Loans

Bridge loans, in essence, are short-term loans designed to provide interim financing until permanent financing or the next stage of financing is secured. They are particularly prevalent in the real estate sector, where timing can be critical. There are various types of bridge loans, including open bridge loans, closed bridge loans, first charge bridge loans, and second charge bridge loans. Each type caters to different borrower needs and financial situations.

How Do Bridge Loans Work?

The mechanics of bridge loans are relatively straightforward. These loans offer temporary financing to bridge the gap between the purchase of a new property and the sale of an existing one. Typically, bridge loans come with higher interest rates and shorter repayment terms compared to traditional loans. However, they provide borrowers with the flexibility and liquidity needed to seize opportunities in the real estate market.

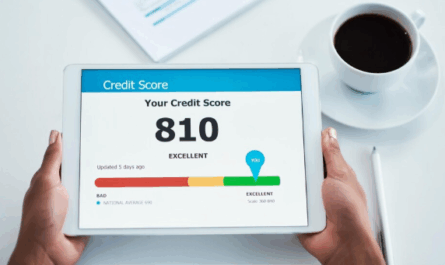

Eligibility criteria for bridge loans may vary among lenders. Generally, lenders consider factors such as credit scores, property valuation, income verification, and loan-to-value ratio when assessing loan applications. Collateral requirements are also significant, with real estate properties often serving as primary collateral. However, other assets may be considered depending on the lender’s policies.

Read more: How to improve your credit score – complete guide

Advantages of Bridge Loans

Bridge loans offer several advantages for borrowers. Firstly, they provide flexibility in timing, allowing borrowers to act quickly on lucrative real estate opportunities. Moreover, bridge loans facilitate property acquisitions without the constraints of contingent offers, giving buyers a competitive edge in the market. Additionally, bridge loans can bridge financing gaps, enabling borrowers to proceed with transactions even when facing liquidity challenges. Furthermore, bridge loans can be used to finance renovation and repair projects, enhancing property value and investment returns.

Risks and Challenges of Bridge Loans

Despite their benefits, bridge loans come with inherent risks and challenges. Primarily, borrowers should be mindful of the higher interest rates associated with bridge loans, which can significantly impact overall borrowing costs. Additionally, the shorter repayment periods of bridge loans may pose challenges for borrowers, necessitating prompt repayment or refinancing. Default risks are also a concern, particularly in volatile market conditions where property values may fluctuate unexpectedly. Moreover, bridge loans can potentially impact borrowers’ credit scores if repayment obligations are not met promptly.

Read more: How to check your credit score using your PAN card?

Real-Life Examples of Bridge Loan Scenarios

To illustrate the practical application of bridge loans, consider the following scenarios:

– Example 1: A homeowner intends to purchase a new property before selling their current home. A bridge loan provides the necessary funds for the down payment, allowing the homeowner to secure the new property while awaiting the sale of their existing home.

– Example 2: A property developer embarks on a new construction project but requires additional financing to cover construction costs. A bridge loan serves as interim financing, providing the developer with the necessary funds until long-term financing can be secured.

– Example 3: An investor identifies a lucrative real estate investment opportunity but lacks the immediate liquidity to capitalize on it. A bridge loan facilitates the acquisition, allowing the investor to seize the opportunity without delay.

– Example 4: A homeowner wishes to renovate and flip a property for profit. A bridge loan finances the renovation costs, enabling the homeowner to enhance the property’s value before selling it for a profit.

In conclusion, bridge loans play a vital role in the real estate market, providing borrowers with the flexibility and liquidity needed to navigate transactions effectively. By understanding the mechanisms, applications, advantages, risks, and real-life examples of bridge loans, borrowers can make informed decisions and leverage these financial instruments to their advantage.

But what if you want a small personal loan instead of a bridge loan? Now you get one, very easily, from the Airtel Thanks mobile wallet app. A completely digital process, very less documents needed, instant credit approval, personal loan up to ₹9 lakhs, and many more benefits – all at Airtel Flexi Credit.

Therefore, check your eligibility criteria, use the personal loan EMI calculator, and apply for your personal loan right away!