We often see commercials on TV, YouTube, and Instagram ads talking about UPI fraud. It has become nearly recurrent today. UPI fraud is getting more widespread in India as the number of digital transactions increases. Fraudsters frequently use strategies like UPI ID fraud, where they fake their identities to con you. Scroll down to read more about UPI related fraud and types of UPI fraud.

What is a UPI Fraud?

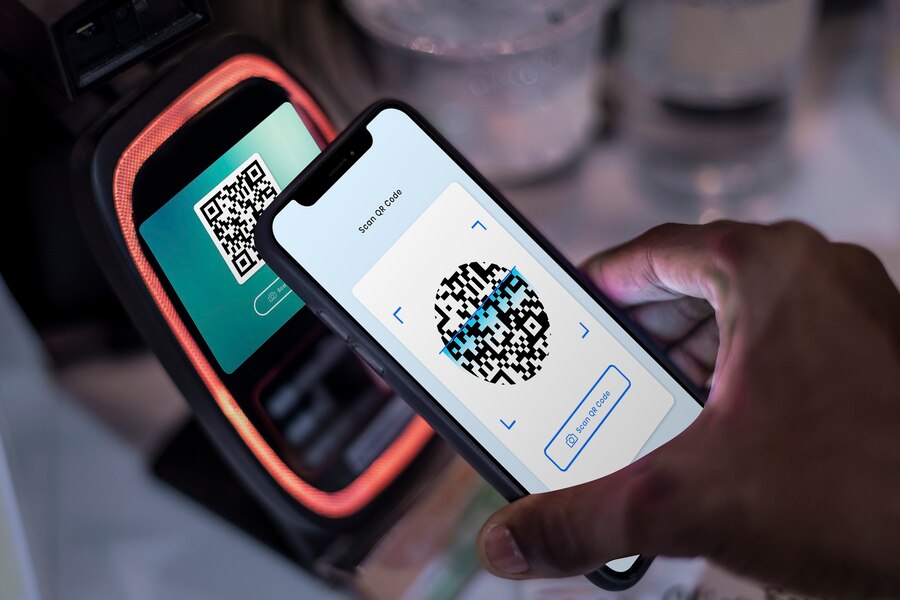

UPI fraud refers to fraudulent acts and frauds that occur inside the Unified Payments Interface (UPI) system in India, specifically about UPI-based digital transactions. Fraudsters try a variety of methods to scam you and exploit flaws in the UPI ecosystem. Fraudsters frequently lure you into disclosing your UPI PIN or personal information. This allows them to access your bank accounts and trap you in a UPI fraud.

Also read: What are the different UPI payment scams and how can you avoid them?

Types of UPI Fraud

Here are some of the regular UPI fraud you need to know about-

Phishing

Phishing is one of the most common forms of UPI transaction fraud. Scammers send false emails to get access to your personal information. Once you enter your password or PIN onto the false site, it is immediately sent to the hacker for misuse. This makes you more vulnerable to UPI fraud.

Fraudulent Sellers

Fraud sellers are common in the digital world. These fraudsters try to trick you by selling false services or processing orders but failing to deliver the product. This causes financial losses and a breach of confidence in the e-commerce website.

Also read: How to find and know what is your UPI ID!

SIM Cloning

SIM cloning is a relatively new phenomenon that emerged following banks’ implementation of the OTP requirement. If a fraudster clones your SIM, they can obtain the OTP on their smartphone and alter your UPI PIN. The thief obtains your bank account information and ID evidence to reset the PIN. Within a minute, you’ll be a victim of a UPI scam.

Malware

Malware is among the most prevalent types of UPI fraud. It might be accessed via a false email attachment or an insecure website. Malware is intended to extract and copy data from compromised devices.

Money Mule

A money mule is a more sophisticated type of fraud. Once your financial information has been stolen, fraud rings shift funds to an intermediate account to store the plunder. This account serves as one of the money mules, storing money gathered from several unwary victims. This form of scam is also prevalent in UPI hacking.

Vishing

Vishing is a scam in which fraudsters pose as bank officials and ask inquiries on their behalf. These people create a web of deceit and ask for personal details to obtain your PIN or password.

Deceiving UPI IDs

Fraudsters frequently construct misleading UPI IDs to scam you. These frauds may occur across a variety of channels, including social media, online markets, and unwanted messaging. Fraudsters may use alluring offers or urgent demands for cash to trick you into transacting using their faulty UPI IDs.

How do hackers execute UPI Fraud?

Now that we know different types of UPI fraud, let’s see how the hackers execute UPI fraud-

- The first step is to make a random call. They frequently pose as a bank representative, contacting you over a minor issue.

- To make the call appear true, they will ask verification questions such as your date of birth, name, or mobile number.

- Hackers use technical issues with the app or website to communicate with you. They frequently use misleading stories to get you to give over your personal information to address your true issue.

- Once the scammer has convinced you, they will urge you to download an app onto your phone. Some of these apps, such as AnyDesk and ScreenShare, are accessible in the Google Play Store.

- Once you download AnyDesk or a similar program, it will ask for privacy permissions, just like any other ordinary software.

- The scammer will then ask for an OTP created by your phone. As soon as you divulge the code, the hacker will request authorisation from your phone.

- After acquiring complete access to your phone, the hacker gets your important credentials and starts using your UPI account.

This is how one gets trapped in a UPI fraud.

How to prevent UPI frauds?

Here are some ways which can help you prevent UPI frauds:

- Always make sure that you verify the UPI ID of the user before your proceed to make the payment

- Ensure that you enter the correct UPI PIN

- Never share your UPI PIN with anyone or on any online platform

- Check your SMS updates are completing a payment. If you receive any SMS that raises a red flag, immediately inform your bank

- For any irregularities while paying with Airtel Thanks app, raise a help request from the app itself or contact Airtel customer care

Contact NPCI customer care for any UPI fraud. NPCI helpline number: 1800-120-1740 (toll free)

Why Airtel UPI is safe for your payment needs

Here are a couple of reasons on why you should start using Airtel UPI more often:

- We deliver top-notch services to the users, fostering a strong sense of trust and reliability.

- We ensure quick and secure payment transactions, safeguarding the interests of customers.

- To further enhance user experience, we provide prompt customer support, addressing concerns and queries with utmost efficiency.

- Additionally, we have incorporated SMS verification as an added layer of security, ensuring the safety and authenticity of each user’s account.

How can you create an UPI ID on the Airtel Thanks app?

Here are the steps to create your UPI ID on the Airtel Thanks app:

- Install and sign into the Airtel Thanks app.

- Head on to the “Pay” section located in the bottom bar

- Next, tap on “UPI Registration.”

- Press “Link Bank Account” and finish the SMS verification process in just a few seconds.

- Choose your desired bank account and connect it to your Airtel UPI ID.

- Your Airtel UPI ID is now ready- initiate your first transaction

Conclusion

Stay extra alert of fake calls or communications from persons posing as bank staff. Check the validity of unknown calls using applications before replying or revealing any personal information!