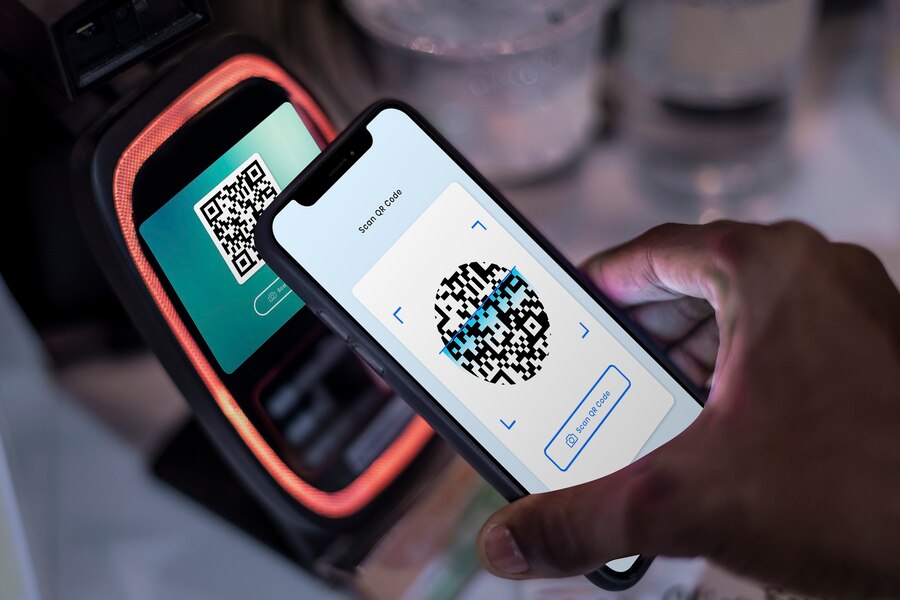

UPI Payment in India has really taken off, with large sections of the population frequently using the payment apps in their daily lives. It helps them to perform multiple cashless transactions throughout the day.

The large number of payment apps available out there, such as Airtel Thanks, have certainly played a key role in ensuring the average Indian citizen reduces their dependency on cash-based transactions. It encourages a shift towards a more digital economy. The Government of India has also been steadily pushing for this change.

However, beneath this amazing success story of UPI payment, lies the unwanted case of UPI based scams and frauds. As UPI payment steadily grows each day, so does the number of these frauds.

How do I recognize that I am in a UPI scam?

UPI frauds are getting more and more elaborate every single day; therefore, you always need to be careful with your transactions and funds. Here are some easy to identify patterns which can tell you that your money can be in danger:

Phishing

There can be instances where you receive an email or an SMS that contains a link from a source or a sender that you did not request for. Once you click on this link, you will be taken straight to your UPI payment app on your smartphone and eventually auto-debit the amount. These links can also install virus or malware into your smartphone and essentially make it unusable.

Screen monitoring apps

There are numerous unverified apps that can screen record your activity on your smartphone. By recording the activity, they can eventually have access to all kinds of personal information and data on your mobile, which includes your bank account details from your UPI payment app.

Fake calls

On a number of instances, you may find people from a certain bank calling you and asking your bank account-based information in the name of verification. If you do what they ask and follow their instructions, you could potentially lose all of your money.

Precautions to take to avoid UPI Payment scams

Some of the ideal precautions that can help you avoid such mishaps are:

Maintain your privacy at all times

Never give out your bank account details, smartphone password, card number and other associated information to unknown or unverified people over the internet. Additionally, you can also put a lock over your UPI Payment apps to ensure greater protection.

Do not download apps from unknown sources

It is always better to download apps that you trust, and use the Apple App Store or Google Play Store to download third party apps. A large number of apps can be downloaded from web browsers too, but you should be wary since they may contain viruses or recording features that can put your data at risk of being stolen

Browse securely to avoid UPI scams

While searching for customer care helplines, always look inside the official verified website and place calls on the numbers mentioned there. Fraudsters often post fake numbers on Google; therefore, you need to be careful.

Verify your contacts

You may receive unverified calls or an SMS from a source that you did not expect, claiming to be an insurance official or provident fund organizations. In such cases, you should try to check if they are trying to get personal information from you. Do not share any personal information until you are completely sure about their identity. The actual officials will never ask for your bank account details.

These are only some of the effective ways that can help you stay safe in the world of UPI payment. Follow these steps while making payments through Airtel Thanks and enjoy making cashless transactions every day

Get App

Get App  Airtel Store

Airtel Store  Login

Login