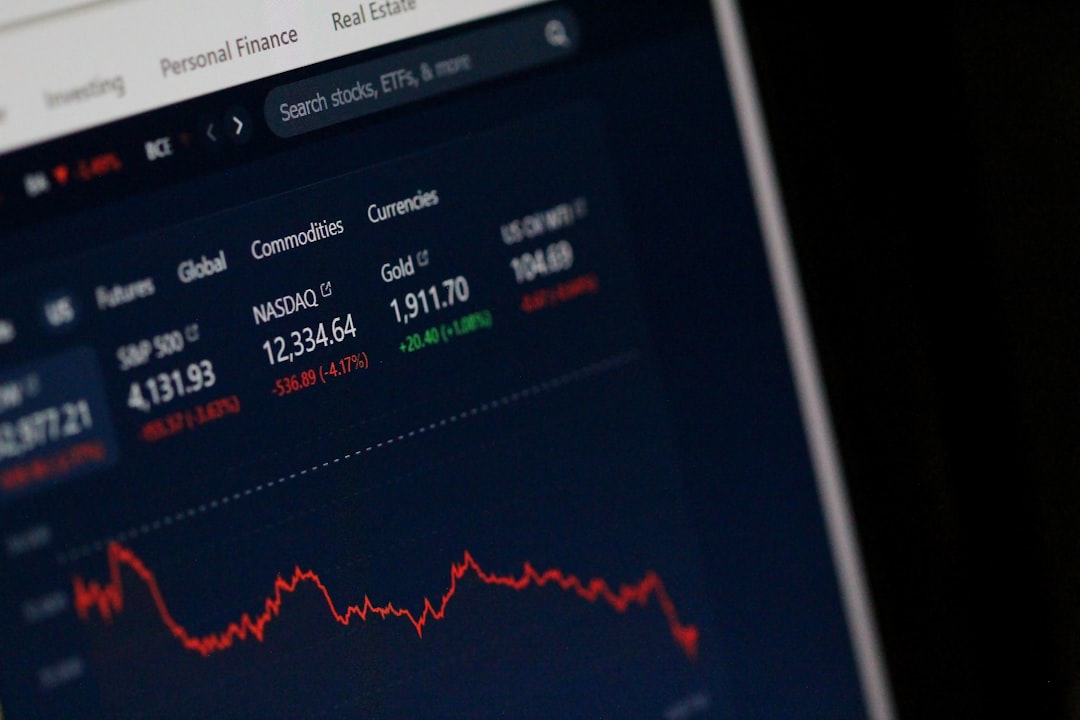

The stock market’s ups and downs can leave investors uncertain and anxious. When major indices start to decline, it’s natural to wonder what’s driving the downward trend. As a key player in India’s telecom sector, Bharti Airtel’s performance often reflects broader market sentiments. In this article, we’ll explore why the market is falling and how Airtel news can provide valuable insights into market trends.

Buy Airtel Broadband with exciting benefits!

Understanding the Current Market Scenario

Several factors contribute to the current stock market decline:

-

Economic Indicators: Inflation rates, interest rates, and geopolitical tensions can impact investor confidence and increase selling pressure across sectors, including telecommunications.

-

Sector-Specific Challenges: The telecom industry faces regulatory pressures and competitive pricing strategies, which can affect the performance of individual stocks like Bharti Airtel.

-

Market Volatility: Airtel’s stock has experienced an average daily volatility of 3.45% over the past three months, highlighting its susceptibility to market fluctuations.

Bharti Airtel’s Stock Performance

Current Trends

As of October 25, 2024, Bharti Airtel’s share price closed at Rs 1,697.90, a slight decline from the previous day. Despite this short-term dip, the stock has delivered impressive returns over various periods:

|

Period |

Return |

|---|---|

|

1 Month |

2.6% |

|

3 Months |

14.44% |

|

1 Year |

78.19% |

|

5 Years |

342.72% |

Source: The Economic Times[3]

Technical Analysis

Recent technical indicators suggest potential short-term weakness for Bharti Airtel’s stock:

-

The stock has fallen below its 20-day Exponential Moving Average (EMA), which can signal a bearish trend.

-

Airtel news about bearish moving average crossovers has historically led to average price declines.

However, the stock’s long-term performance remains robust, with a 3-year return of 148.05% compared to the Nifty 100’s return of 40.02%.

Implications for Investors

Investment Strategy

Under current market conditions, investors should closely monitor Bharti Airtel’s performance metrics and market trends. While the stock has shown impressive long-term growth, recent declines may prompt a reevaluation of investment positions.

Future Prospects

Despite short-term challenges, Airtel’s long-term potential remains significant due to its extensive customer base and ongoing innovations in service delivery. The company’s focus on improving margins and expanding offerings could provide opportunities for recovery in the future.

Staying Informed with Airtel

As an investor, staying updated on Airtel news and broader market developments is crucial for making informed decisions. Airtel’s proactive approach to enhancing customer experience, such as using AI technology to combat spam, demonstrates its commitment to navigating sector-specific challenges.

Moreover, with Airtel’s reliable and high-speed broadband services, investors can easily access real-time market data and analysis. Airtel Xstream Fiber offers speeds up to 1 Gbps, ensuring seamless connectivity for tracking market trends and managing your portfolio.

Why the market is falling is a complex question influenced by various economic, sector-specific, and company-specific factors. While Bharti Airtel’s recent performance reflects the broader market decline, its long-term growth prospects remain promising.

As an investor, staying informed is key to navigating market volatility. By closely following Airtel news and leveraging the company’s robust broadband services, you can stay ahead of the curve and make well-informed investment decisions.

Remember, while short-term fluctuations can be unsettling, maintaining a long-term perspective and a diversified portfolio can help weather market downturns and capitalize on future growth opportunities.

Get App

Get App  Airtel Store

Airtel Store  Login

Login