Credit cards are financial tools that provide convenience, security, and purchasing power. Despite their common usage, many people are unaware of the various elements that make up a credit card. Understanding the anatomy of a credit card can help users better manage their cards, protect their information, and utilise the features effectively.

Here’s a comprehensive look at the different parts of a credit card and their functions.

And, if you are looking to get a new credit card, simply choose the Airtel Axis Bank Credit Card from Airtel Finance and save up to ₹16,000 per year! Apply from the Airtel Thanks app today and get low joining fees, low interest rates, relaxed eligibility criteria and much more.

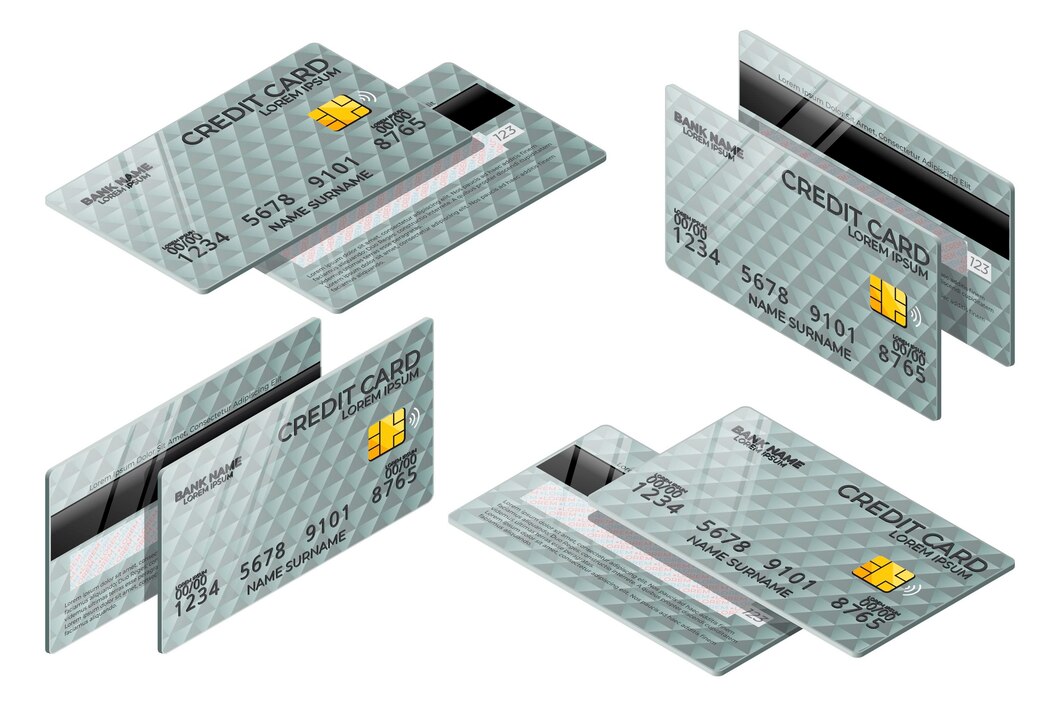

Front of the Credit Card

Card Number

The credit card number is a 16-digit number typically displayed on the front of the card. This number is crucial as it identifies the card issuer and the cardholder’s account. The first digit of the card number indicates the card network (such as MasterCard), while the subsequent digits are used to identify the issuing bank and the individual account. This number is used for transactions and is unique to each card.

Cardholder’s Name

The cardholder’s name is printed on the front of the credit card, usually below the card number. This name indicates who the card is issued to and can be used to verify the identity of the person making transactions. It is essential to ensure that the name on the card matches the name on your identification documents to avoid issues during purchases.

Expiration Date

The expiration date, shown as MM/YY, indicates the month and year when the card expires. After this date, the card is no longer valid for transactions. Credit card issuers usually send a new card with a new expiration date before the old one expires. The expiration date helps ensure the card’s validity and reduces the chances of fraud.

Payment Network Logo

The logo of the payment network is usually displayed on the front of the card. This logo indicates which payment network processes transactions made with the card. It is important because it determines where the card can be used, as not all merchants accept all payment networks.

Read more: Features and benefits of Axis Bank Credit Cards

Back of the Credit Card

Magnetic Stripe

The magnetic stripe, located on the back of the card, contains encoded information about the cardholder’s account. This stripe is swiped through a card reader to process transactions. Although magnetic stripes are being gradually replaced by more secure EMV chips, they are still widely used, especially in older terminals and regions that have not fully transitioned to chip technology.

EMV Chip

The EMV chip, often located on the front of newer credit cards, enhances security by encrypting transaction data. Unlike magnetic stripes, which use static data, EMV chips generate a unique transaction code for each purchase, making it more difficult for fraudsters to replicate the card. This technology is becoming the global standard for credit card transactions.

Security Code (CVV/CVC)

The Card Verification Value (CVV) or Card Verification Code (CVC) is a three- or four-digit number located on the back of the card. This code is used to verify that the cardholder has the physical card during online or phone transactions. It adds an extra layer of security by ensuring that the person making the purchase possesses the card.

Signature Panel

The signature panel is a white strip on the back of the card where the cardholder is required to sign. This signature can be used by merchants to verify the cardholder’s identity. Although not as commonly checked today due to advancements in electronic verification, it is still a recommended security measure.

Read more: How to avoid interest charges on a credit card?

Additional Features

Contactless Payment Symbol

Many modern credit cards feature a contactless payment symbol, indicating that the card supports tap-to-pay technology. This allows cardholders to make quick and secure payments by simply tapping their card on a compatible terminal, without the need to swipe or insert the card.

Issuer Logo

The logo of the issuing bank or financial institution is usually displayed on the front of the card. This helps identify the card issuer and provides a point of contact for customer service and support.

Hologram

Some credit cards feature a hologram, often of a dove or globe, which acts as a security measure to prevent counterfeiting. The hologram is a three-dimensional image that changes appearance when viewed from different angles, making it difficult to replicate.

Read more: How many credit cards should you have?

FAQs

Q: What should I do if my credit card is lost or stolen?

A: If your credit card is lost or stolen, immediately contact your card issuer to report the loss and request a replacement card. Most issuers have 24/7 customer service lines for this purpose. Prompt reporting helps prevent unauthorised transactions and limits your liability for fraudulent charges.

Q: How can I protect my credit card information?

A: Protect your credit card information by keeping your card in a secure place, regularly monitoring your account for suspicious activity, and using secure websites for online transactions. Avoid sharing your card number, CVV, or expiration date with untrusted sources.

Q: What is the difference between the magnetic stripe and the EMV chip?

A: The magnetic stripe stores static data that can be read by swiping the card through a reader, while the EMV chip generates a unique transaction code for each purchase, providing enhanced security. EMV chips are more resistant to fraud than magnetic stripes.

Q: Why does my credit card have an expiration date?

A: The expiration date ensures that the card is periodically updated with new security features and helps prevent fraud. It also provides an opportunity for the card issuer to send a new card in case of wear and tear.

Q: Can I still use my credit card if the magnetic stripe is damaged?

A: If the magnetic stripe is damaged, you may still be able to use your credit card if it has an EMV chip or supports contactless payments. However, it’s advisable to request a replacement card from your issuer to avoid any issues during transactions.

In conclusion, understanding the anatomy of a credit card helps you better appreciate its features, functions, and security measures. By familiarising yourself with the various elements of your credit card, you can use it more effectively and protect yourself from potential fraud. Whether you’re swiping, dipping, or tapping, knowing how your credit card works is an essential part of managing your financial health.

Get App

Get App  Airtel Store

Airtel Store  Login

Login