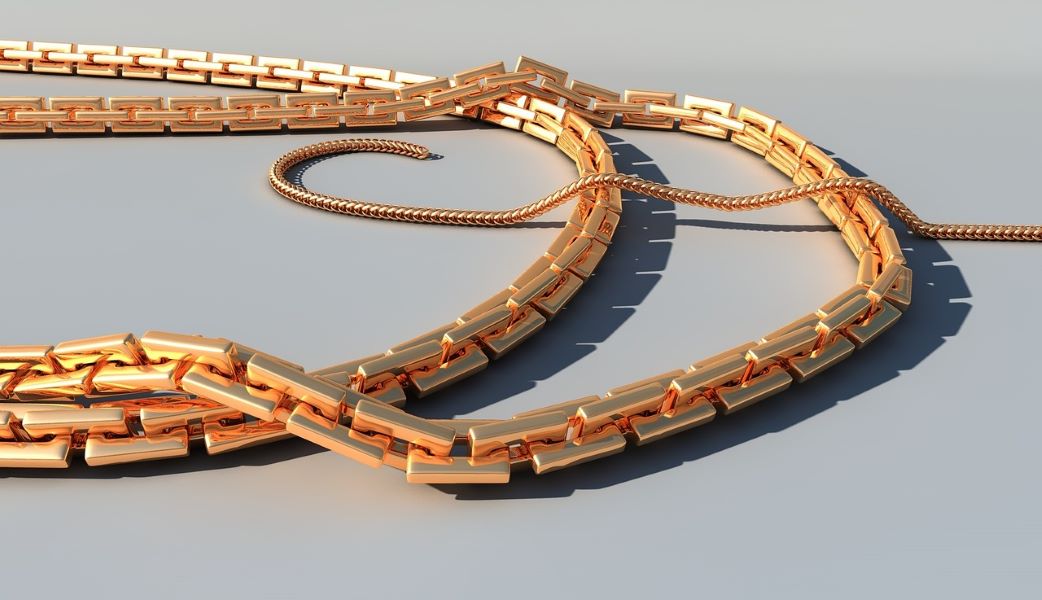

Gold has been valued for centuries, serving as a symbol of wealth and a reliable store of value. Unlike flat currencies, which can be subject to inflation and economic fluctuations, gold offers unique advantages that make it an attractive option for savers.

In this blog, we will explore seven key benefits of saving in gold and understand why this precious metal remains a cornerstone of sound financial planning.

Have gold at home and need a loan? Apply for your gold loan from Airtel Finance today via the Airtel Thanks app! Get the lowest interest rates, secured gold loan lockers, and much more, with just a few documents.

1. Hedge Against Inflation

One of the primary reasons people turn to gold is its ability to act as a hedge against inflation. Inflation erodes the purchasing power of fiat currencies over time, reducing the value of money held in savings accounts or cash. Gold, on the other hand, tends to retain its value during inflationary periods. When the cost of goods and services rises, the price of gold often increases as well, preserving the value of your savings. This makes gold a reliable means of safeguarding your wealth against the erosive effects of inflation.

Read more: Gold loan vs. personal loan

2. Safe Haven in Times of Crisis

Gold has a long history of being considered a safe haven asset, particularly during times of economic or geopolitical turmoil. When stock markets plummet, currencies falter, or political instability arises, investors often flock to gold as a secure store of value. Its tangible nature and universal acceptance make it a trusted asset when confidence in other financial instruments wanes. By saving in gold, you can protect your wealth from the uncertainties and volatilities that characterise modern financial markets.

3. Portfolio Diversification

Diversification is a key principle in prudent financial planning, and gold plays a crucial role in achieving a well-balanced portfolio. Traditional investments like stocks, bonds, and real estate can be subject to market cycles and economic downturns. Gold, however, often moves independently of these assets, providing a counterbalance that can reduce overall portfolio risk. By allocating a portion of your savings to gold, you enhance the resilience of your investment portfolio, ensuring that it can withstand various market conditions.

Read more: Factors that determine your credit score

4. Long-Term Wealth Preservation

Gold has demonstrated its ability to preserve wealth over the long term. Unlike paper currencies, which can be printed in unlimited quantities by central banks, gold’s supply is finite and cannot be easily increased. This inherent scarcity contributes to its enduring value. Historical data shows that gold has maintained its purchasing power over centuries, making it an effective vehicle for transferring wealth from one generation to the next. By saving in gold, you can create a lasting legacy that retains its worth over time.

5. Liquidity and Universality

Gold is a highly liquid asset, meaning it can be easily bought or sold in various forms, such as coins, bars, or exchange-traded funds (ETFs). Its widespread recognition and acceptance make it a globally trusted medium of exchange. Regardless of where you are in the world, gold is universally recognized as a valuable asset. This liquidity and universality provide savers with flexibility and ease of access to their funds whenever needed, without the complexities associated with other investment vehicles.

Read more: Get a personal loan without security

6. Protection Against Currency Devaluation

Currency devaluation occurs when a country’s currency loses value relative to other currencies. This can result from economic mismanagement, political instability, or excessive money printing. Gold serves as a safeguard against such devaluation, as its value is not tied to any single currency. When a currency weakens, the price of gold in that currency typically rises, offsetting the loss in purchasing power. By holding gold, you can shield your savings from the detrimental effects of currency devaluation and maintain your financial stability.

7. Tangible and Timeless Asset

Unlike digital or paper assets, gold is a tangible asset that you can physically hold. This tangibility provides a sense of security and ownership that digital forms of wealth cannot replicate. Additionally, gold’s timeless appeal and cultural significance add to its desirability as a store of value. Throughout history, gold has been cherished for its beauty and intrinsic worth, making it a reliable and enduring asset for savers.

Read more: What are instalment loans? – Types, processes & more

FAQs

Q: How do I start saving in gold?

A: There are several ways to save on gold, including purchasing physical gold (coins or bars), investing in gold ETFs, or buying shares in gold mining companies. Consider your investment goals and risk tolerance when choosing the method that suits you best.

Q: Is saving in gold safe?

A: Gold is considered a safe-haven asset due to its ability to retain value over time and during economic downturns. However, like all investments, it carries risks, including price volatility. It is important to diversify your investments to mitigate risk.

Q: What percentage of my portfolio should be in gold?

A: Financial experts often recommend allocating 5-10% of your investment portfolio to gold. This percentage can vary based on individual risk tolerance and market conditions.

Q: How is the price of gold determined?

A: The price of gold is determined by supply and demand dynamics in the global market. Factors such as economic data, geopolitical events, and central bank policies can influence gold prices.

Saving in gold offers numerous benefits that can enhance your financial security and peace of mind. By understanding these advantages and incorporating gold into your savings strategy, you can build a resilient and diversified portfolio capable of weathering various economic conditions. As with any investment, it is important to conduct thorough research and seek professional advice to ensure that your approach aligns with your financial goals.

Get App

Get App  Airtel Store

Airtel Store  Login

Login