Guaranteed Message Delivery is revolutionising BFSI customer engagement in India

-

June 4, 2024

-

3 min read

To this day, SMS remains one of the safest and quickest methods for banks to connect with customers. SMS, essential for sending transactional alerts, and authentication codes ensure fast and one-to-many communications. Despite the rise of email and live chat, its simplicity and effectiveness make it indispensable.

The banking landscape in India is undergoing a transformative shift towards digitalisation, with online transactions becoming the cornerstone of financial interactions. The surge in online transactions, mobile banking, and fintech innovations has necessitated reliable and timely communication channels between financial institutions and their customers. SMS and message delivery systems play a crucial role in this ecosystem, ensuring real-time transaction alerts, OTP verifications for secure logins, and updates on account activities. High message delivery rates are critical to maintaining customer trust and satisfaction, as any delay or failure in message delivery can lead to financial losses, security breaches, and diminished user confidence. In an era where instant communication is paramount, the BFSI sector’s reliance on robust messaging solutions underscores their importance in safeguarding financial operations and enhancing the user experience.

The need of the hour: Communication platforms that ensure seamless and on-time delivery

“According to a recent report by Statista, the number of mobile internet users in India is expected to reach approximately 1.2 billion by 2024, with a significant portion of these users demanding seamless, secure, and real-time digital interactions with their financial service providers.” By adopting newer and innovative omni-channel communication delivery solutions, BFSI institutions can meet this demand, enhance customer experiences, and maintain a competitive edge in the rapidly evolving market.

Why is a new-age omni-channel communication platform required now more than ever?

- Growing Digital User Base:

- The significant increase in BFSI customers and online transactions highlights the need for robust digital communication solutions.

- Customer Expectations:

- Modern customers expect seamless, real-time interactions across various digital channels, which means higher need for modern communication platforms that keep them updated on these transactions in real time.

- Security and Compliance:

- With the rise of digital transactions, ensuring secure and compliant communications is critical.

- Operational Efficiency:

- Auto routing time-sensitive communications and integrating with existing systems can streamline operations and reduce costs.

- Competitive Advantage:

- Early adoption of secure communication platforms can give BFSI players a technological edge and improve customer retention and satisfaction.

Most importantly, it enhances cost efficiency by eliminating the need for complex communication infrastructure and reducing hardware, software, and security expenses.

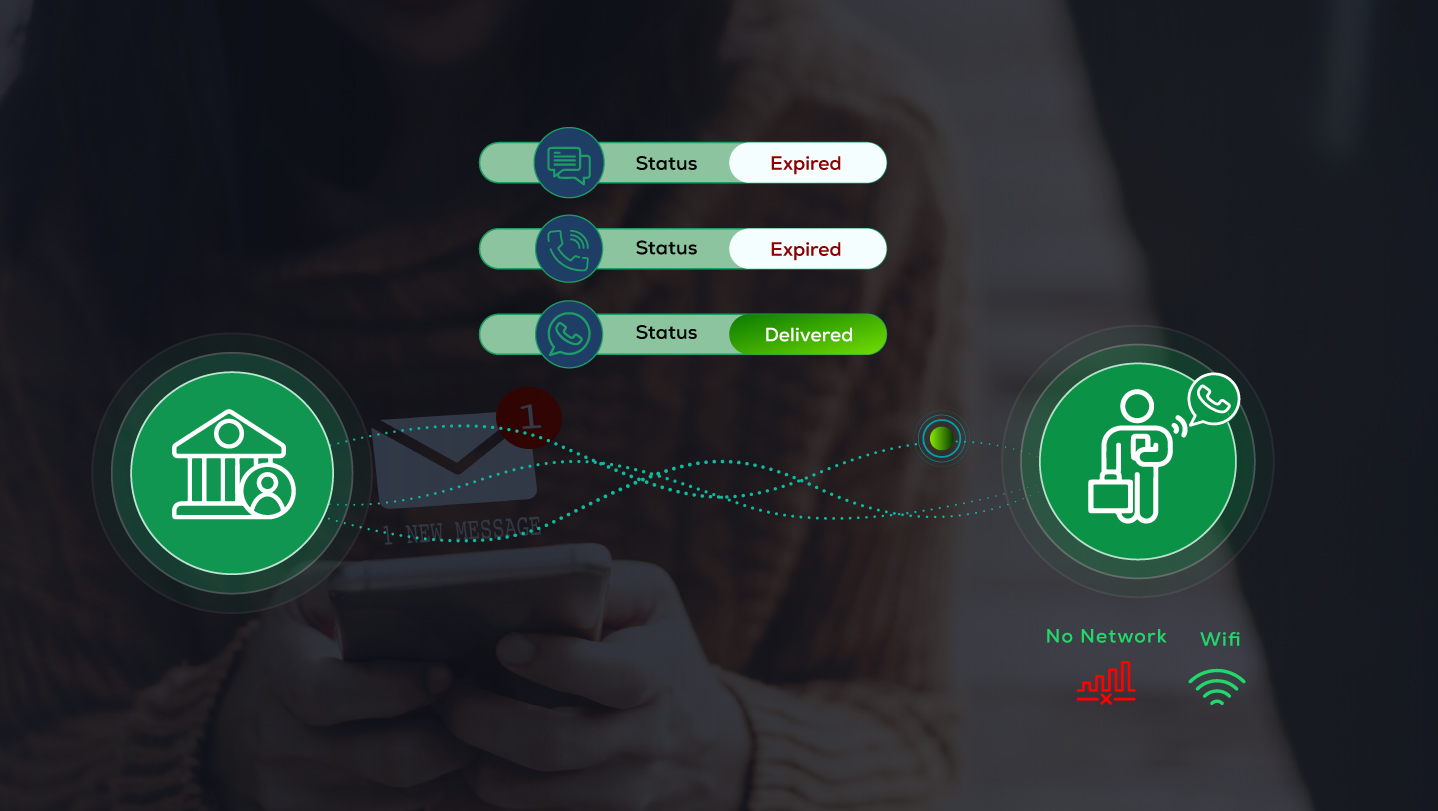

Today, secure, seamless, and guaranteed message delivery is pivotal for India’s BFSI sectors, driven by rapid digitisation. With growing mobile financial users anticipated, Indian consumers expect efficient, omnichannel communication from their financial service providers. New and innovative communication platforms integrate SMS, voice and chat, offering a comprehensive communication strategy. They enhance customer engagement, ensure compliance, streamline operations, and provide critical insights.

As the BFSI landscape in India evolves, adopting cloud-based solutions that guarantee mission-critical message delivery is not just a necessity but a strategic move for staying competitive, improving customer loyalty, and driving business growth in a digital marketplace.

Share

Share