Enhancing Customer Experience (CX) in Indian BFSI Sector with Guaranteed Message Delivery Platform

-

June 24, 2024

-

4 min read

The Banking, Financial Services, and Insurance (BFSI) sector is undergoing a significant transformation in India, driven by the imperative to enhance Customer Experience (CX). As customer expectations evolve, BFSI institutions increasingly leverage Communications Platforms to ensure guaranteed message delivery and superior CX. Here’s how message delivery platforms will reshape the future of the Indian BFSI sector.

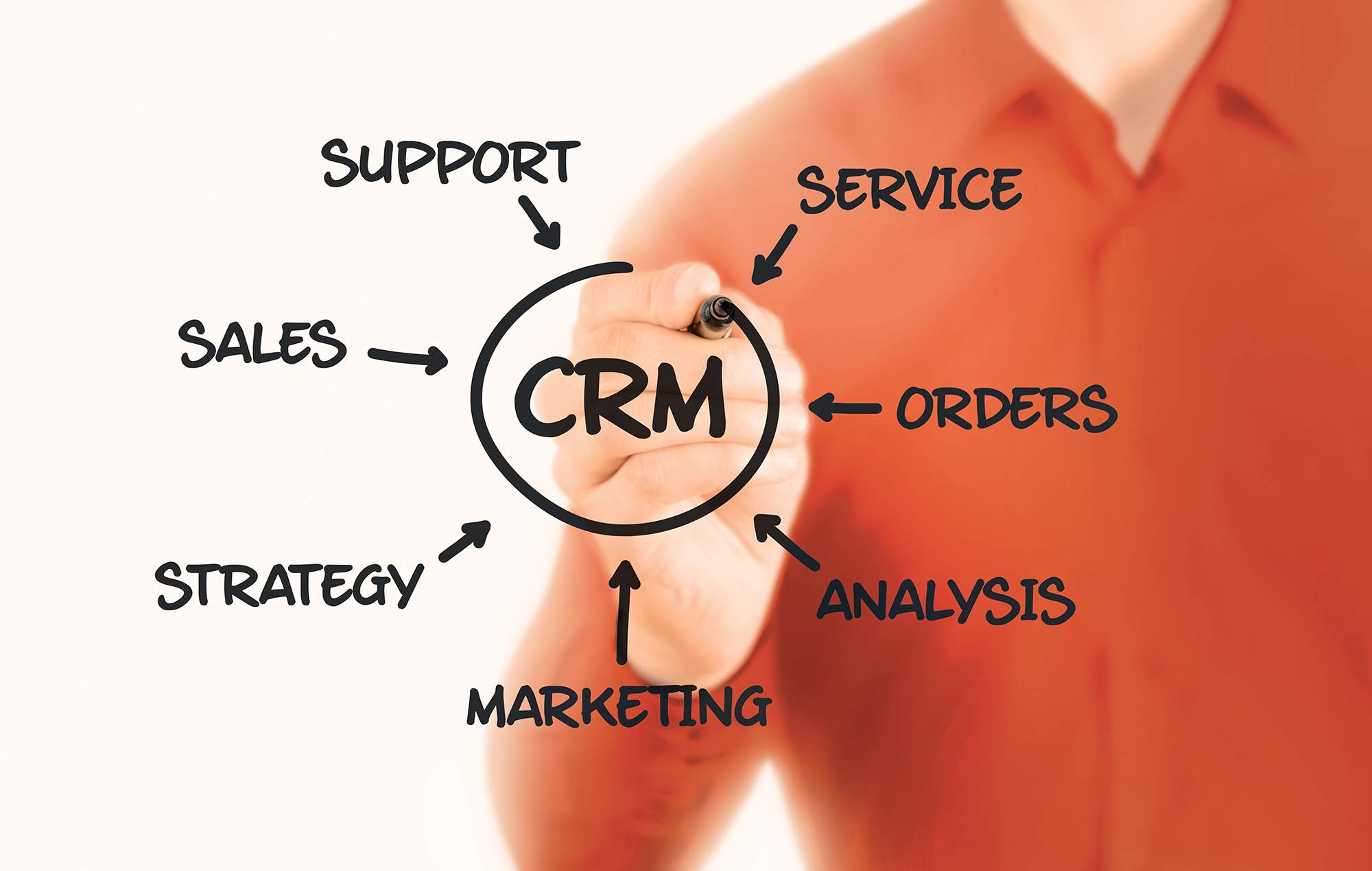

The Growing Importance of Customer Experience in BFSI

Customer experience has become a critical differentiator in the BFSI sector. Modern customers demand seamless, personalised, instant interactions with their financial service providers. A survey by PwC highlights that 73% of consumers point to customer experience as an essential factor in their purchasing decisions, even more so than price and product quality.

In the BFSI sector, this means providing timely updates, personalised services, and secure communication channels. With the advent of digital banking and fintech innovations, customers now expect real-time responses and proactive engagement from their banks and financial institutions.

Guaranteed Message Delivery: The Catalyst for Superior CX

Communications platforms focus on guaranteed message deliveries, mostly a cloud-based solution that enables businesses to integrate real-time communication features such as SMS, voice, email, and chat into their applications. For BFSI companies, communication solutions offer a robust platform to enhance customer interactions and ensure message delivery across multiple channels. Here’s how communication platforms are driving the improvement of CX in the BFSI sector:

Omnichannel Communication

- Seamless Integration: Communication platforms enable BFSI companies to integrate various communication channels, providing a unified and consistent customer experience. Customers can choose their preferred communication method, SMS, voice calls, or chat, and receive consistent service across all channels. Example: A customer can start a loan application via chat on a bank’s website, receive updates via SMS, and finalise the process through a voice call with a representative, all managed through the platform.

Personalisation and Automation

- AI and Machine Learning (ML): Communication platforms leverage AI and machine learning to analyse customer data and deliver personalised communications. For instance, banks can send personalised financial advice, transaction alerts, and product recommendations based on a customer’s financial behaviour.

- Automation: Automated responses and chatbots powered by the communication platform ensure that customers receive immediate responses to their queries, improving satisfaction and reducing wait times.

Guaranteed Message Delivery

- Reliability: Communication platforms ensure high reliability and guaranteed message delivery, which is crucial for the BFSI sector, where timely communication can impact financial decisions and compliance. Whether it’s a transaction alert, a fraud notification, or a policy update, customers receive messages without delay.

- Security: Enhanced security features in newer platforms, such as end-to-end encryption and secure APIs, protect sensitive financial information during transmission.

Enhanced Customer Support

- 24/7 Availability: With guaranteed message delivery platforms, BFSI institutions can offer round-the-clock customer support. AI-powered chatbots handle routine inquiries, while more complex issues are escalated to human agents, ensuring that customers always have access to support when they need it. For example, a notable Indian bank’s use of AI chatbots for customer support has resulted in a 20% increased customer satisfaction scores.

Regulatory Compliance

- Adherence to Regulations: Communication platforms help BFSI institutions comply with regulatory requirements by providing secure and auditable communication channels. This is particularly important for adhering to data protection regulations such as GDPR and local Indian laws.

- Audit Trails: Guaranteed message delivery solutions often include features for maintaining audit trails of all communications, which are essential for compliance and dispute resolution.

The Future of Communication Platforms in BFSI: Trends for 2024

- Integration with 5G: The expansion of the 5G network in India will significantly enhance the capabilities of communication platforms, providing faster and more reliable communication channels. This will improve real-time interactions and enable new services like high-definition video banking.

- Blockchain for Security – BFSI institutions are exploring using blockchain integrated with communication platforms to ensure secure and transparent communication. Blockchain can provide an immutable record of all interactions, enhancing trust and security.

- Advanced Analytics – Communication platforms incorporate advanced analytics to provide deeper insights into customer behaviour and preferences. Enabling BFSI companies to fine-tune their communication strategies and deliver even more personalised and effective customer interactions.

- Voice and Video Communications – The demand for voice and video communications is growing, with customers seeking more personal and interactive ways to connect with their financial service providers. New and inventive communication platforms are evolving to support seamless voice and video integration.

It is time to explore the ideal communication platform that ensures guaranteed message delivery.

As the BFSI sector in India continues to evolve, enhancing customer experience through reliable and secure communication will remain a top priority. Communication platforms offer the tools and capabilities to meet and exceed customer expectations, ensuring that BFSI institutions can provide the seamless, personalised, and secure interactions that modern customers demand. By leveraging this, the BFSI sector in India is well-positioned to lead the way in customer experience innovation in 2024 and beyond.

Share

Share