This philosophy is in line with the Governmentís vision of a digitally empowered and inclusive India, with a less-cash dependent economy and enhanced transparency. Conventional brick-andmortar banking is passť, welcome to a smarter way to bank.

Airtel Payments Bank, Indiaís first payments bank, commenced nationwide operations on January 12, 2017 and is a completely digital and paperless bank.

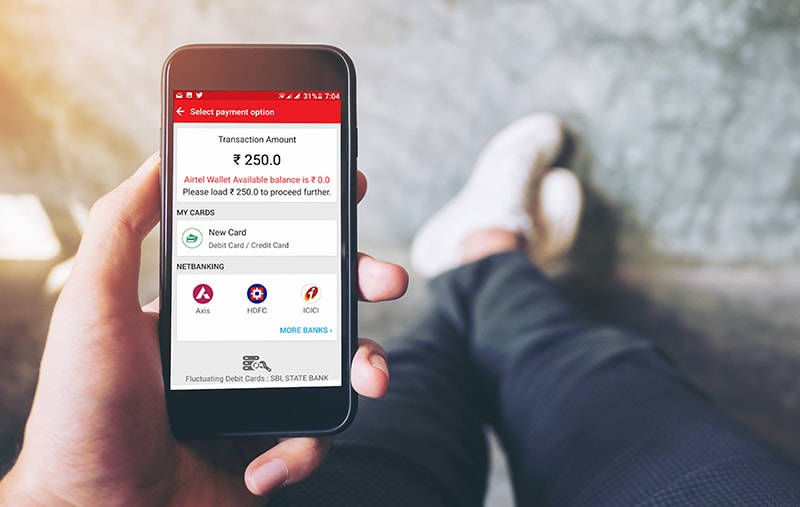

The bank aims to take basic banking services to the doorstep of every Indian by leveraging Airtelís vast retail network in a quick and efficient manner. Over 500,000 Airtel retail outlets act as Banking Points and offer basic banking services such as account opening, cash deposit and cash withdrawal, at a neighbourhood location for every Indian. Majority of these banking points across states are in rural areas, helping in extending the reach of services to unbanked regions.

Airtel Payments Bank is a joint venture between Bharti Airtel and Kotak Mahindra Bank with each holding 80.1% and 19.9% stake respectively. Kotak Mahindra Bankís expertise in banking products and technology will help Airtel Payments Bank define its products and processes well.

Being integrated with Bharti Airtel allows Airtel Payments Bank to gain scale, distribution and differential benefits, compared to other wallets or telecom companies. Airtel believes that there is a massive opportunity to serve the unbanked and contribute to the growth of digital payments and transactions as envisioned by the government of India. Given Airtelís vast distribution and brand trust, we believe we are strongly positioned to provide convenient banking to customers and hence, are committed to offer its services to the entire customer base.

500,000

Current network Airtel retail stores, which also function as banking points.

More than the total number of ATMs in the country.

2 million+

Merchants have already been onboarded across India.

We plan to build a digital payments ecosystem with over 3 million merchants.

70%

Accounts opened in rural/unbanked areas, contributing to financial inclusion